Boart Longyear Announces 2013 Half Year Financial Results and Progress on Cost Restructuring

Salt Lake City, Utah, USA — August 25, 2013— Boart Longyear Limited (ASX: BLY), the world’s leading supplier of drilling services, drilling equipment and performance tooling for mining and drilling companies, today announces its financial results for the half-year period ended 30 June 2013 and progress on initiatives to reduce costs and improve financial flexibility.

Summary:

• Additional cost reductions of approximately US$90 million on an annual “run-rate” basis underway

• US$315 million of restructuring charges and asset impairments (of which US$297 million were non-cash) taken as a result of continuing weakness in core markets

• Covenant compliant at 30 June 2013

• Pursuing debt restructuring and alternate financing options to provide additional flexibility and reduce risk.

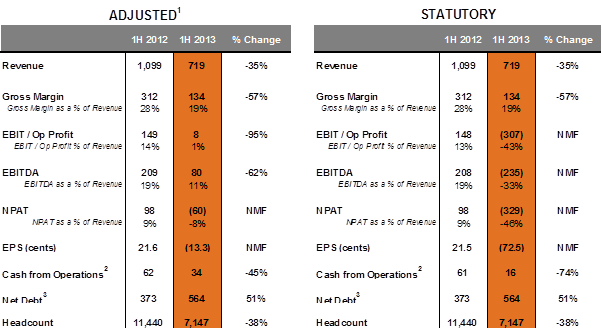

2013 Half Year results:

• Revenue of US$719 million, down from US$1,099 million in the first-half 2012

○ Adjusted 1 EBITDA of US$80 million, down from US$209 million in the first-half 2012

○ Statutory EBITDA of (US$235 million loss), down from US$208 million in the first-half 2012

○ Adjusted1 NPAT of (US$60 million loss), down from US$98 million in the first-half 2012

○ Statutory net profit after taxes (NPAT) of (US$329 million loss), down from US$98 million in the first-half 2012

○ Adjusted1 losses per share of US$0.133, down from earnings per share of US$0.216 in the first-half 2012

○ Statutory losses per share of US$0.725, down from earnings per share of US$0.215 in the first-half 2012

○ No interim dividend to be paid

Financial Overview

Boart Longyear’s first-half 2013 results reflect substantially different market and operating conditions compared to the same period in 2012. Commodity price weakness and slowing growth in China affected the mining industry negatively throughout the first half of 2013. The Company’s key customers responded to the market’s volatility by significantly reducing their capital budgets and, as a result, their demand for the Company’s drilling services and products. With revenue down 35% from the record first-half of 2012, the Company has focused its efforts on cost reductions, working capital management and its capital structure to mitigate the risk of non-compliance with its lending agreements and ensure access to liquidity for future needs.

During the period, the Company undertook several major restructuring initiatives to reduce overheads and operating costs, including:

• Reduction of over 2,800 personnel since 1 January 2013, including approximately 25% of general and administrative positions across the business;

• Consolidation of Drilling Services zones into larger territories;

• Rationalisation of manufacturing, inventory and administrative facilities;

○ Consolidation of the Products division’s aftermarket services group with the Drilling Services maintenance group and the supply chain groups for both divisions; and

○ Sale of its non-core environmental and infrastructure drilling services operations.

Costs linked to restructuring activities, including costs associated with employee separations, exiting onerous leases, and impairments of inventory and capital equipment related to relocating certain manufacturing activities and resizing the business, totaled US$98 million. The Company estimates that such actions, and others it has more recently initiated, will reduce annual run-rate costs by approximately US$90 million. The benefits of these savings are expected to be realised during the course of 2013 and 2014. These cost reductions are in addition to the cost reductions announced in December 2012.

The Company’s results for the half-year were also impacted by impairment charges in the carrying value of certain assets, including goodwill, intangibles and plant and equipment following the Company’s mid-year review of asset carrying values. These impairments include a $175 million write-down of goodwill and intangible assets and a $42 million write-down of rigs and ancillary equipment in the Drilling Services segment.

In total, the Company incurred US$315 million of charges related to restructuring and impairments during the period. A significant portion of the impairment of goodwill, a non-cash item, is attributable to prior acquisitions in Australia and does not reflect a change in the Company’s commitment to continue to operate in Australia.

Operations

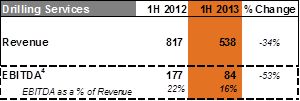

The Company’s Drilling Services division recorded revenue of US$538 million for the first half of 2013, down 34% from the same period last year. Market deterioration and lower rig utilisation contributed to a 53% decline in Drilling Services EBITDA4 to US$84 million. This result also reflects the timing lag between declining Drilling Service revenues and the take-out of costs. The Company expects to see the positive impact of prior cost actions flow through to margins, as cost reduction initiatives continue to be implemented and completed.

Overall, the demand for exploration drilling remains slow, although demand for certain services, such as underground drilling, continues to be strong. The Company’s drill rig utilisation averaged approximately 55% during the first half of 2013, compared to approximately 70% in the same period last year.

Overall, the demand for exploration drilling remains slow, although demand for certain services, such as underground drilling, continues to be strong. The Company’s drill rig utilisation averaged approximately 55% during the first half of 2013, compared to approximately 70% in the same period last year.

The Company also completed the divestiture of its non-core US-based environmental and infrastructure drilling services operations on 15 July 2013. The divestiture will allow the Company to focus resources and efforts on its core mining markets and on higher margin drilling services segments.

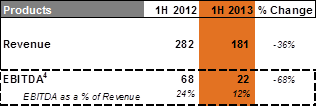

The performance of Boart Longyear’s Products division was also impacted by low global drill rig utilisation rates, particularly in South America and the Asia-Pacific region. With many of the division’s key customers de-stocking and holding historically low levels of inventory, revenues decreased by 36%, to US$181 million, compared to the same period in 2012, while EBITDA4 declined 68% to US$22 million.

As a result of the market’s contraction, the Company’s slow-moving inventory reserve is increasing. Based on current estimates, the Company expects to incur an additional US$10 million to US$15 million of non-cash expense related to its slow moving inventory policy in the second half of 2013. More recently, the business has seen slightly increased purchasing activity from some of its key accounts, and its production tooling business remains stable.

As a result of the market’s contraction, the Company’s slow-moving inventory reserve is increasing. Based on current estimates, the Company expects to incur an additional US$10 million to US$15 million of non-cash expense related to its slow moving inventory policy in the second half of 2013. More recently, the business has seen slightly increased purchasing activity from some of its key accounts, and its production tooling business remains stable.

Financing and Liquidity

The Company is proactively taking steps to ensure it has adequate liquidity to manage the business while market conditions remain challenging and to meet capital needs when conditions improve. Certain of the Company’s financial projections show that, absent a refinancing or recapitalisation, the Company may breach the gross-debt-to-EBITDA leverage covenant of its bank credit agreement at the December 2013 and June 2014 compliance testing dates.

The Company has requested and is evaluating detailed refinancing and recapitalisation proposals and timelines that present as credible and achievable in current market conditions. It has chosen the restructuring of its debt as its preferred approach and does not intend, at this time, to issue additional equity. The Company will move expeditiously into the debt capital markets to complete a refinancing.

The Company believes it will manage its business risks successfully despite the current economic outlook and challenging market environment. Those risks include the volatility of the Company’s core mining markets and the continued challenging outlook for those markets. Additionally, the Company has considered other material risks to liquidity, including the potential for further significant tax assessments from the Canadian Revenue Agency and the possibility of additional collateral being required to appeal those assessments. The Company has factored these contingencies into its evaluation of refinancing alternatives and believes it can adequately address such risks via the available refinancing options and an ongoing ability to reduce costs associated with potentially declining business conditions.

Dividend

In light of market conditions and the need to preserve liquidity, the Company will not pay an interim dividend for the first half of 2013. The Board will continue to evaluate the Company’s financial position and key performance indicators on a regular basis and intends to resume payment of dividends when conditions allow.

Outlook

The Company reports the following key performance indicators, which show that activity levels declined during a seasonal period historically marked by increasing activity. Rig utilisation dropped to approximately 50% in August from approximately 60% in May. The current backlog in the Company’s Products business has also decreased from May levels, consistent with declines in utilisation rates of drilling services contractors.

Operating conditions and key performance indicators have continued to deteriorate early in the second half of the year and are similar to levels experienced during the previous market downturn in 2009. As a consequence, the Company expects its second-half 2013 result to be lower than the adjusted result for the first half despite the benefit of restructuring initiatives. The Company believes market expectations may not adequately reflect the risk of price erosion in the second half and may assume larger benefits in 2013 from the Company’s cost reduction efforts than are likely to be achieved. Current analyst EBITDA expectations for 2013 range from US$116 million to US$159 million. Analyst estimates at the low end of the range appear to be consistent with the Company’s current view for the full year, but significant industry volatility in the second half could materially impact performance.

Richard O’Brien, the Company’s President and Chief Executive Officer, commented on the first-half 2013 results, stating, “Our operating performance and the restructuring and impairment charges we took during the first half reflect the very challenging conditions in our markets since the beginning of 2013. The magnitude and velocity of the market’s contraction during the year has surprised many people in the industry. While we continue to be challenged in implementing cost reductions quickly enough to keep pace with the market’s decline, we are taking aggressive steps to control costs. Our latest cost reduction initiatives should lead to approximately US$90 million of reductions, on a run-rate basis, by the end of 2014 in addition to the US$70 million of reductions announced in late-2012 and already being realized in 2013.

The net impact of these changes will be a US$75 million reduction in 2013 SG&A expenses from 2012 levels. Substantially all of these actions will be realized in 2014, resulting in an additional US$40 million reduction to SG&A expenses from 2013 levels.

Mr O’Brien added, “Management and the Board also have been focused on ensuring the Company has adequate flexibility in its capital structure over the next several years, not only to withstand additional weakness in the market but also to fund new opportunities. We believe we have identified an executable path forward in current market conditions and implementing a more flexible capital structure remains one of our top priorities.

“Historically, the Company has experienced significant fluctuations in its enterprise value driven by the cyclicality of the markets it serves, as well as the resulting risk aversion and near-term uncertainty this creates for shareholders. The Board and management believe that the current market enterprise value is significantly below the fundamental value of the Company, and we are committed to closing this gap by improving our capital structure, running our business more efficiently, reducing costs and prudently managing the risks in our business.”

About Boart Longyear

With over 120 years of expertise, Boart Longyear is the world’s leading provider of drilling services, drilling equipment, and performance tooling for mining and drilling companies globally. It also has a substantial presence in aftermarket parts and service, energy, mine de-watering, oil sands exploration, and production drilling.

The Global Drilling Services division operates in over 40 countries for a diverse mining customer base spanning a wide range of commodities, including copper, gold, nickel, zinc, uranium, and other metals and minerals. The Global Products division designs, manufactures and sells drilling equipment, performance tooling, and aftermarket parts and services to customers in over 100 countries.

1. Adjusted EBITDA and Adjusted NPAT are non-IFRS measures and are used internally by management to assess the performance of the business and have been derived from the Company’s financial statements by adding back $315 million (or $269 million after-tax) of restructuring charges and impairments.

2. Before interest and tax payments.

3. Excludes contingent liabilities relevant to determining bank covenant compliance. See footnote #1and #15 in Financial Report.

4. Does not include restructuring and impairment charges

5. Excludes contingent liabilities relevant to determining bank covenant compliance. See footnotes #1 and #15 in the financial statements.

Source: http://www.boartlongyear.com/boart-longyear-announces-2013-half-year-financial-results-and-progress-on-cost-restructuring/

|

Boart Longyear is accepting resumes for the role of Stockroom Labourer based in North Bay, Ontario.

Boart Longyear is accepting resumes for the role of a Maintenance Supervisor in our North Bay, Ontario Manufacturing facility.

Heavy-duty equipment mechanics repair, troubleshoot, adjust, overhaul and maintain heavy duty mobile drilling equipment and mobile support equipment used within the scope of Boart Longyear Drilling operations.