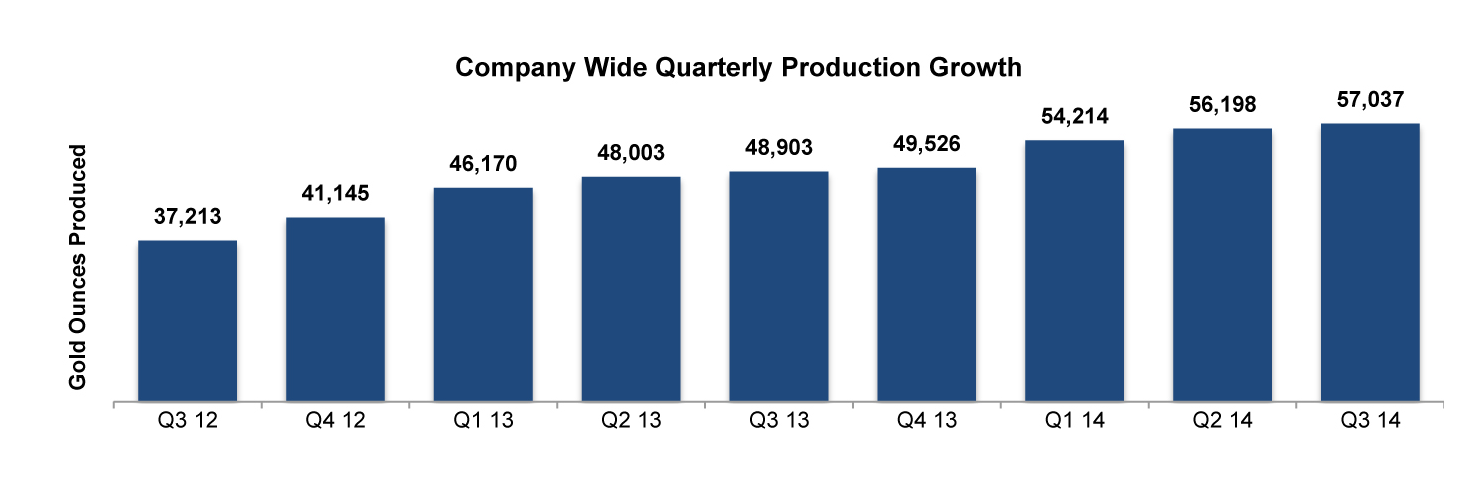

AuRico Gold Announces its Ninth Consecutive Quarter of Record Production

Young-Davidson Reports Underground Cash Costs of $656 per oz.

AuRico Gold announced preliminary third quarter production results. All amounts are in U.S. dollars unless otherwise indicated. (Results for the third quarter 2014 are estimates only and are subject to change.)

Estimated production at the company's Young-Davidson mine in Matachewan, totalled 40,538 oz. in the 3rd quarter 2014 compared to 40,166 oz. in the 2nd quarter. When combined with the 16,449 oz.. mined at AuRico's El Chanate gold mine in Mexico the company produced a total of 57,037 oz. in 3rd quarter compared to 56,198 in the 2nd quarter.

At Young-Davidson, the company closed its short-lived open pit operation at the end of the 2nd quarter and concentrated its 3rd quarter production on their undergournd mine. The underground operation had considerably lower cash costs $650 compared to $923 at the open pit mine. El Chanate is an open pit mine. It's 3rd Quarter cash cost amounted to $663 per oz.

AuRico is reporting its ninth consecutive quarter of record company-wide gold production driven by record production from the cornerstone Young-Davidson mine. Period-over-period production growth is expected to continue going forward, underpinned by the ongoing ramp-up in production at the Young-Davidson mine located in northern Ontario.

Preliminary 2014 Third Quarter Operational Results

| Q1/13 | Q2/13 | Q3/13 | Q4/13 | Q1/14 | Q2/14 | Q3/141 | ||

| Young-Davidson | ||||||||

| Gold ounces produced2 | 28,281 | 29,252 | 30,099 | 33,106 | 35,104 | 40,166 | 40,538 | |

| Underground cash costs per gold ounce | - | - | - | $663 | $808 | $803 | $656 | |

| Open pit cash costs per gold ounce | $694 | $716 | $666 | $983 | $1,350 | $974 | $923 | |

| Total cash costs per gold ounce3 | $694 | $716 | $666 | $850 | $1,009 | $871 | $723 | |

| Underground mine | ||||||||

| Tonnes mined per day | 1,130 | 1,611 | 1,417 | 2,590 | 2,611 | 3,595 | 3,752 | |

| Grades (g/t) | 2.7 | 2.5 | 2.8 | 3.1 | 2.8 | 3.3 | 3.1 | |

| Development metres | 1,941 | 2,445 | 2,620 | 2,986 | 3,772 | 3,545 | 3,269 | |

| Mill processing facility | ||||||||

| Tonnes processed per day | 6,466 | 7,017 | 6,747 | 6,969 | 7,163 | 8,230 | 7,670 | |

| Grades (incl. open pit stockpile) | 1.8 | 1.7 | 1.7 | 2.0 | 1.8 | 2.2 | 1.9 | |

| Recoveries (%) | 86% | 85% | 89% | 88% | 87% | 88% | 90% | |

| El Chanate | ||||||||

| Gold ounces produced | 17,889 | 18,751 | 18,804 | 16,420 | 19,110 | 16,032 | 16,499 | |

| Total cash costs per gold ounce3 | $563 | $602 | $588 | $615 | $586 | $618 | $663 | |

| Open pit tonnes mined per day | 106,319 | 98,928 | 87,336 | 98,487 | 95,402 | 93,808 | 94,643 | |

| Consolidated Results | ||||||||

| Gold ounces produced2 | 46,170 | 48,003 | 48,903 | 49,526 | 54,214 | 56,198 | 57,037 | |

| Total cash costs per gold ounce3 | $635 | $655 | $628 | $771 | $870 | $801 | $706 | |

|

1. Data provided for the third quarter 2014 are estimates only and subject to change. 2. Includes pre-production gold ounces from the Young-Davidson underground mine prior to the declaration of commercial production in the underground mine on October 31, 2013. 3. Represents a non-GAAP measure. See page 18 of the Company's Q2 2014 Management's Discussion & Analysis for further information. Cash costs are prior to inventory net realizable value adjustments & reversals. For Young-Davidson, gold ounces for cash costs purposes include ounces produced for 2013, and ounces sold for 2014. For El Chanate and on a consolidated basis, gold ounces for cash cost purposes include ounces sold. Pre-production ounces produced at Young-Davidson are excluded from ounces produced as these ounces were credited against capitalized project costs when sold. |

||||||||

"The Company is pleased to report its ninth consecutive quarter of record company-wide gold production, which builds on the successes achieved in prior quarters. We are particularly encouraged that our operation teams have delivered another strong quarter of production and demonstrated that their focus remains on quality production that drives margins, with Young-Davidson reporting a significant 17% decrease in cash costs", stated Scott Perry , President and Chief Executive Officer. He continued, "The disciplined approach to our business underpins our growing production profile, which combined with our decreasing cost profile, positions the Company for long-term, sustainable performance. We remain optimistic that in the current gold price environment, the Young-Davidson mine will be generating positive free cash flow by the end of this year."

Young-Davidson Update

- At the end of the quarter, the Young-Davidson mine achieved 557 days of lost time incident free operations.

- Production of 40,538 gold ounces for the quarter represented the ninth consecutive quarter of record gold production with the operation expected to deliver additional period-over-period production increases going forward as the underground mine ramps-up to targeted levels.

- Underground cash costs for the quarter decreased to $656 per gold ounce, an 18% decline over the prior quarter, primarily driven by increased production, lower unit processing costs and lower underground unit mining costs. Total cash costs for the quarter, which includes the low-grade open pit stockpile, decreased by 17% to $723 per gold ounce.

- During the quarter, underground mine productivity exceeded planned levels and averaged approximately 3,752 tonnes per day at grades in-line with reserve grade estimates. With underground productivity at approximately 94% of the year-end target, the operation is well positioned to achieve the year-end target of 4,000 tonnes per day and an ultimate productivity level of 8,000 tonnes per day at the end of 2016.

- For the third full quarter of underground commercial production, unit mining costs declined to approximately $41 per tonne, in-line with the year-end target of $40 per tonne.

- During the quarter, underground development advance continued at planned levels with approximately 3,269 metres completed, an average of 36 metres per day. The Company will continue to focus on advancing underground development to best position the mine for sustainable, period-over-period, productivity increases in the fourth quarter and beyond.

- During the quarter, the mill facility averaged 7,670 tonnes per day, including 4-days of downtime for scheduled mill reline activities. Recoveries increased over prior periods to a record 90%, which is expected to be sustained going forward.

- As planned, the short life open pit mine was fully depleted in early June and as a result, during the quarter higher grade underground mill feed was supplemented with low grade open pit stockpiled ore to ensure the mill processing facility was operating at peak capacity. The open pit stockpile will continue to supplement underground ore feed to the mill processing facility as the underground mine ramps up to targeted levels and the remaining stockpile will be processed at the end of the mine life.

- Currently, approximately 2.6 million tonnes of open pit ore, at an average grade of approximately 0.80 grams per tonne, is stockpiled ahead of the mill facility for future processing. As the related mining costs associated with the stockpile were expended in prior periods, the processing of this ore will favourably augment the mine's free cash flow profile going forward.

El Chanate Update

- During the quarter, the open pit mining rate averaged 94,643 tonnes per day with mined grades being in-line with plan.

- Mining operations in the third quarter reflected a transition from the sequencing of lower grade mining areas to higher grade mining areas during the latter part of the quarter.

- Production increased over the prior quarter while cash costs for the quarter were $663 per ounce, which is in-line with guidance levels.

About AuRico Gold

AuRico Gold is a leading Canadian gold producer with mines and projects in North America that have significant production growth and exploration potential. The Company is focused on its core operations including the Young-Davidson gold mine in northern Ontario, and the El Chanate mine in Sonora State, Mexico. AuRico's project pipeline also includes advanced development opportunities in Mexico and Canada. AuRico's head office is located in Toronto, Ontario, Canada.

For further information please visit the AuRico Gold website at www.auricogold.com or contact:

Scott Perry

President and Chief Executive Officer

AuRico Gold Inc.

1-647-260-8880

|