Demand for Clean Energy and High Tech Products Boost Mining for REE

Rare earth elements (REE) are not top of mind when one thinks about mining, but their increasing importance in today’s economy and a number of supply-side issues are making REE mining a priority in Canada.

The development of a secure Canadian supply of REE is so important that commencing in November 2013 the House of Commons Standing Committee on Natural Resources conducted hearings into the REE Industry in Canada. A report summarizing the evidence presented by experts appearing at the hearings was released in June, 2014.

At the moment Canada does not yet produced REE nor is there refining capacity. But Canada has enormous potential with more than 200 exploration projects across the country.

The attention at present focuses on five REE – The attention at present focuses on five REE – neodymium (Nd), Europium (Eu), Terbium (Tb), Dysprosium (Dy) and Yttrium (Y).

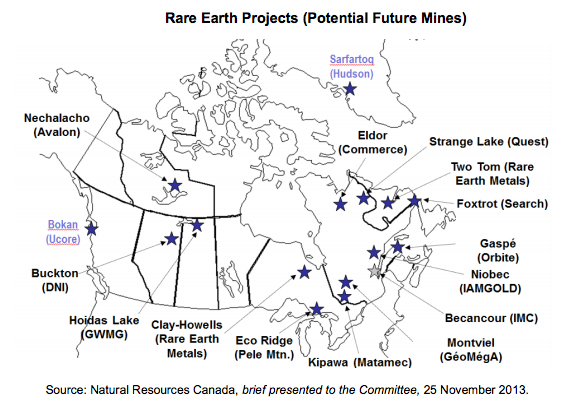

Advanced REE Exploration Projects in Canada

Natural Resources Canada has identified 11 REE projects in their advanced exploration stage, all of which are Canadian owned. Of the eleven 5 are located in Quebec: GéoMéga Resources Montview Project; Commerce Resources’ Eldor Project; Orbite Aluminae’s Grand Vallee Project; Quest Rare Minerals’, Strange Lake Project; Matamec Exploration’s Zeus-Kipawa Project.

Two are located in Ontario: Canadian Rare Earth’s Clay Howells Project and Pele Mountain Eco-Ridge Project.

The remaining four advanced projects are:Search Minerals’, Foxtrot Project, Labrador; Avalon Rare Metals’, Nechalacho Project, North West Territories; Canadian Rare Earth’s Two Tom Project, Labrador; Great Western Minerals’, Hoidas Lake Project, Saskatchewan.

Five of these projects are expected to be in production in the next four to five years. They are Avalon, Quest, Matamec, Pele Mountain and Orbit.

.

.

REE are used in the manufacture of everything from smartphones, hybrid vehicles, rechargeable batteries, LCD screens, laptops, wind turbines, medical imaging equipment, radar systems, catalytic converters and alloys that are more corrosion-resistant.

In addition REE are used in producing high-performance iron-baron magnets. These magnets then are used in a wide range of products. 15% are used to manufacture traction motors and wind turbines. The rest go into products ranging anywhere from magnetic resonance imaging to air conditioners, loudspeakers, hard drives and compact drives.

The unique properties of REE means that there are few substitutes.

Plentiful…But Expensive to Extract

REE are a group of 17 metals that include scandium and yttrium, which exhibit similar properties and occur in many of the same mineral deposits. Testifying before the Standing Committee, Christine Villemure, the Director General of Natural Resources Canada, explained that despite the name, REE are not that rare. In fact, they are plentiful but in low-level concentrations, that are often combined together and require expensive separation technology to extract the desirable element.

REE Supports a Trillion Dollar Manufacturing Sector

Evidence presented before the Standing Committee indicated global production of REE is approximately 130,000 tonnes per year, which is estimated to be worth around US$4 billion, annually. But though this figure appears small compared to the value from gold or diamond mining experts informed the Committee the REE support a manufacturing sector worth between US $ 2 trillion to US $ 4.8 trillion.

Statistics supplied by NRCan show that over the last 10 to 15 years, the world consumption of rare earth elements has increased at 8% to 12% per annum, a trend that experts agree will continue, and may increase. A recent study by MIT suggests demand may shoot up by as much 2600 per cent by 2025.

Increased Future Demand-Problems Meeting Supply

Market analysts expect supply shortages for five REE – neodymium (Nd), Europium (Eu), Terbium (Tb), Dysprosium (Dy) and Yttrium (Y) – in the short to medium term. As a result these REE “have been defined as critical by the United States Department of Energy, Japan, and the European Community.”

China Dominates REE Supplies

In addition to the increasing industrial demand for REE, China’s overwhelming control of global REE supplies is another major factor for the sudden interest in developing a Canadian REE mining industry. A cause for worry is that China accounts for 95 % of global REE production and has significant control over aspects of the REE supply chain. Since 2005 China has been restricting REE exports resulting in price increases. Underlining the vulnerable situation Canada and other western nations find themselves was China’s decision to cut REE exports by 40 % in 2010.

“Not only is China the leader in production, it is also unequivocally the leading expert in downstream processing including all economic spinoffs from secondary processing…tertiary processing.” said, André Gauthier, President and Chief Executive Officer of Matamec Explorations Inc. Since 2005, China has placed restrictions on its rare earths exports. This has resulted in resulted in significant REE price increases. For example, the price of lanthanum peaked at $250/kg in 2011 compared to $2/kg in 2007.

Pele Mountain Resources Inc. is Toronto-based company that is developing its Eco Ridge REE project potential near the Elliot Lake among the lands once used for uranium mining. Al Shefsky, President of Pele Mountain Resources Inc., testifying before the Standing Committee explained that: “China restricts the export of rare earths in order to use much of its domestic production in manufacturing value-added products within its borders. China’s rare earth national strategy has played an important role in its achievement of extraordinary economic growth and high levels of domestic employment. [It] leads the world in the manufacture and export of many strategically important products made with rare earths. It has effectively leveraged its control of rare earth resources to dominate many clean energy and high technology value chains.”

Canada has Great Potential for REE Production

Witnesses appearing before the Standing Committee said REE are not yet being produced in Canada nor is there refining capacity. But Canada has enormous potential with more than 200 exploration projects across the country.

There are 56 rare earth projects that are in the advanced exploration and development stage around world. According to Steven Wilson, Senior Vice-President at the SGS Canada and a member of the Canadian Rare Earth Elements Network (CREEN) said of these 56 projects, 19 are located in Canada, 9 are in Australia, 5 are in the U.S. and 23 are spread across the rest of the world. Canada has 40 per cent to 50 per cent of known REE reserves according to Wilson.

Canada is well positioned with its world class deposits to produce REE, create a supply chain and create billions of dollars in economic growth including thousands of high-paying jobs.

The evidence presented to the Standing Committee indicated that the 20 most currently active exploration projects in Canada amount to some 38 million tonnes of contained total rare earth oxides or roughly 30% of the global total.

Cost of Developing Rare Earth Mine in Canada

Developing a rare earth mine in Canada ranges between $106 million and $2.5 billion and have higher costs than those associated with mining a more traditional metal, such as copper. Developing a REE mine may take between 7 to 10 years and like other mining projects involves several stages of development including prefeasibility studies and environmental assessment.

Some companies expect annual revenue of approximately $1 billion; however, this may depend on the quantity and quality of the supply.

|