Barrick Gold Makes Big Changes to Become a Smaller Company

It’s quiet at the headquarters of Barrick Gold in Toronto. On a Wednesday afternoon in May, all that can be heard is the soft hum of the ventilation system. A few years ago, around 500 people filled the office, overseeing mining operations that spanned the globe. Today, there are just 140 employees responsible for a much smaller geographical footprint. And that footprint might shrink over the coming year.

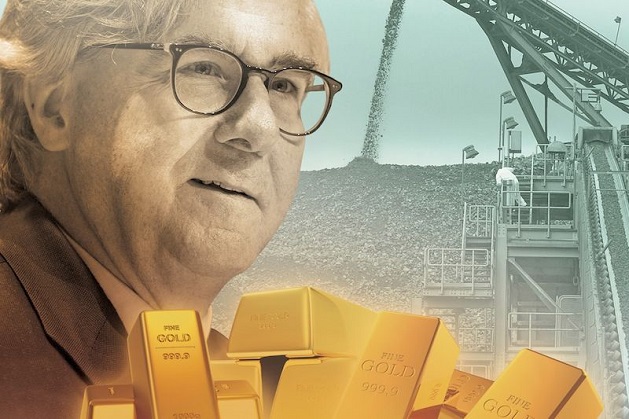

For long-suffering Barrick shareholders, this is welcome news. “We’re taking Barrick back to the way it was 15 years ago,” says Kelvin Dushnisky, the company’s co-president. Back then, Barrick was not a bloated organization that had lost investor confidence, nor was it facing a mountainous $13-billion debt in a depressed gold market. Since 2012, Barrick’s share price has fallen by roughly 70%. While gold prices are a long way from where they were at the height of the 2000s commodities boom—a reality that’s hurt many miners—Barrick’s wounds are mostly self-inflicted. In 2011, founder and chairman Peter Munk pushed the company to spend billions on an underperforming copper mine in Zambia. Barrick also botched the development of what was to be a monster gold mine on the border of Chile and Argentina called Pascua-Lama. These two headaches have cost Barrick about $15.9 billion over the past few years, according to an analyst at Macquarie Group.

Munk retired in 2014 at the age of 86, and it’s now up to John Thornton, Barrick’s executive chairman, to clean up the mess. He has been in the position for just over a year, and he’s already ushered in a host of changes. He has overhauled the entire senior executive ranks. Dushnisky, who joined Barrick in 2002, is the only C-level exec to remain from Munk’s time. Half of the board members have been replaced; Thornton hired a former British military officer to serve as chief of staff and eliminated the CEO role entirely. Thornton sits at the top of the hierarchy, and Dushnisky and colleague Jim Gowans (also a newcomer) serve as co-presidents. Layers of middle management have been axed.

Thornton is not trying to fulfil Munk’s vision of turning Barrick into a diversified, empire-building mining giant with operations around the world. Instead, Barrick wants to be lean, nimble and focused on the commodity it knows best: gold. Barrick will also concentrate on just a few key mines in the geographies it’s most familiar with, primarily Nevada and South America. The company is committed to cutting its debt, and it is selling assets and forming partnerships to ease the burden. It might seem like a less ambitious goal, but Thornton believes it’s one that delivers better shareholder value.

Some investors are confident Thornton can carry out his plan. “John Thornton is a vast improvement over several past Barrick leaders,” says Seymour Schulich, the prominent mining investor who owns 15 million shares of Barrick. “The company is still a gem, underneath all the crap that’s been piled onto it.”

Still, the stock is down 15% in the past year, and the broader market hasn’t yet been won over. Of the 29 analysts who cover Barrick, 16 have Hold or Neutral ratings on the stock. Five rate it as Sell or Underperform. “It’s a show-me story right now,” says Phil Russo, an analyst with Raymond James. The fate of Barrick has always depended on the price of gold, but there is more at stake today. If gold prices stay depressed or sink lower, Barrick’s debt burden leaves the company with little flexibility.

Barrick’s problems started back in 2011 with the $7.3 billion acquisition of copper miner Equinox Minerals. It was the company’s first foray into copper, and the move puzzled investors who had bought Barrick specifically because it was a pure gold play. Barrick later revealed to shareholders that it would take longer than expected to bring down costs at the flagship copper mine, Lumwana, and improve performance. The company wrote down the value of Lumwana by $3.8 billion just two years after the acquisition. Meanwhile, the Pascua-Lama gold mine in South America was experiencing its own problems. Instead of outsourcing the engineering and construction of Pascua-Lama, as Barrick has done in the past, the company handled it in-house—with terrible results. Costs ballooned and timelines stretched out. Barrick halted work in October 2013 and is currently mired in legal and regulatory issues with the Chilean government. Shareholders have launched a class-action suit accusing Barrick of hiding problems at the mine, which the company denies.

The turmoil extended to head office, too. CEO Aaron Regent was turfed in 2012, just a few months after the board gave him a stellar review in Barrick’s annual proxy circular. Investors and analysts grew concerned that Munk was making decisions based on cementing his own legacy. There were also concerns that he wielded undue influence. Although he founded Barrick, Munk owned fewer than 1% of the shares. Several board members were longtime friends and associates of his. Munk recruited Thornton in 2012 to serve as co-chairman, indicating some kind of succession planning was underway, but some investors still called for a board overhaul. Munk retired in 2014, leaving Thornton to run the show.

Thornton was an interesting choice, owing to his lack of mining industry experience. Up until 2003, he had served as president for Goldman Sachs. Throughout his career, he’s developed deep ties with China, serving as a board member at both China Unicom, and Industrial and Commercial Bank of China, and has taught at the Tsinghua University School of Economics and Management in Beijing. These ties were said to be an advantage, and the hope was that Thornton could develop partnerships with Chinese companies and secure access to capital. His outsider status may have raised eyebrows initially, but Dushnisky sees it as an advantage. “John’s open to new ideas for whatever is best for Barrick.”

Thornton is said to be a big thinker. He eschews interviews and has expressed frustration over the media’s tendency to boil down his cerebral expositions to sound bites. For the first year of his tenure, Thornton and his intentions were a bit of a mystery to investors and analysts. He didn’t participate in conference calls and would meet with select investors privately. “Senior leaders of the company had a difficult time answering questions about where Thornton stood on issues,” says Ron Stewart, an analyst with Macquarie Group. The market wasn’t even sure if copper would remain a priority for Barrick, or if the company would revert back to exclusively gold. His exorbitant compensation has twice raised the ire of shareholders—first with an $11.9-million signing bonus in 2013 and, most recently, with his $12.9-million package for 2014, even though Barrick shares posted a double-digit decline. (Three-quarters of votes cast at the company’s annual meeting in April went against Barrick’s pay practices, and the company has vowed reform.)

Thornton finally spoke up in a conference call in February, when he laid out his vision to turn Barrick into a slimmed-down gold producer. At the top of the list of priorities is reducing the company’s debt. Barrick plans to eliminate $3 billion in debt by the end of the year through asset sales and partnerships, and by using its free cash flow. The company has already put at least $850 million toward debt reduction from the sale of a gold mine in Australia, and a portion of its stake in the Porgera mine in Papua New Guinea to Chinese company Zijin Mining Group. The partnership with Zijin could be important over the long term and fulfils the hope that Thornton would put his connections to use. Analysts are now speculating that the two could partner to restart the Pascua-Lama development.

In addition to the one-time hit an asset sale can provide, Barrick is trying to maximize cash flow from its existing mines to pay down debt. Even skeptical analysts concede the company has an impressive roster of mines. “They’ve got a tremendous portfolio of new projects they’re working to bring forward,” says Stewart, who has an Underperform rating on the stock. That includes Turquoise Ridge in Nevada, which is estimated to hold 4.5 million ounces in reserves. Schulich is impressed, too, dismissing discoveries by other Canadian gold miners as “one-gram wonders.”

Source: http://www.canadianbusiness.com/lists-and-rankings/best-stocks/investor-500-2015-barrick/

|