Pacific North West - River Valley

About the Company

• 100% owned by PFN

• River Valley Measured + Indicated resources: 91 million tonnes @ 0.58 g/t* palladium, 0.22 g/t platinum, 0.04 g/t gold at a cut-off grade of 0.8 g/t PdEq** for 2,463,000 ounces PGM*** plus gold

• River Valley Inferred resources: 36 million tonnes @ 0.36 g/t palladium, 0.14 g/t platinum, 0.03 g/t gold at a cut-off grade of 0.8 g/t PdEq for 614,000 ounces PGM plus gold

• On a PdEq basis, the Measured + Indicated resources contain 3,944,000 ounces PdEq and the Inferred resources contain 1,201,000 ounces PdEq

• River Valley PGM-copper-nickel sulphide mineralized zones remain open to expansion with continued exploration

Location and Access

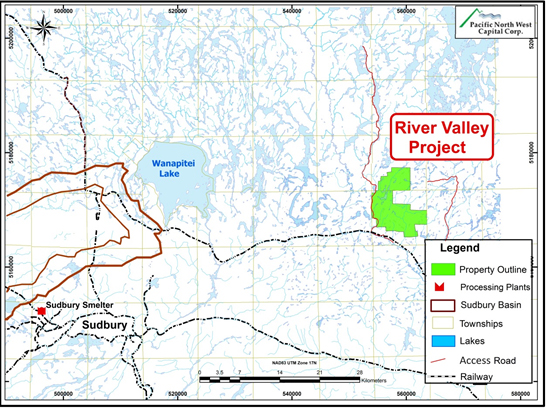

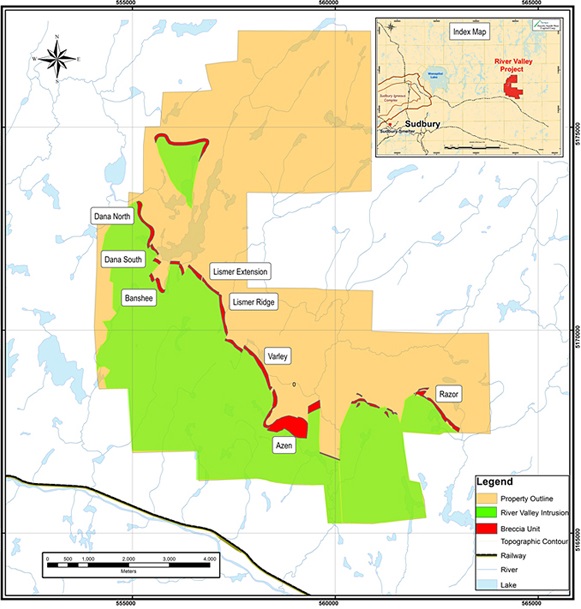

The River valley project is located in the Dana and Pardo townships of Northern Ontario, approximately 60km east of Sudbury, Ontario. The project is road accessible in Canada's premier Ni-Cu-PGM mining and smelting district which boasts perfect infrastructure and community support for mining activities.

Figure 1- Location Map of River Valley Project

Property and ownership:

River Valley PGM Project is 100% owned by Pacific North West Capital. The project is under two Mining leases. The Mining Leases cover an area of 5381.1 hectares, including 4,756.2 hectares of Surface and Mining Rights and an additional 624.9 hectares of Mining Rights. The Mining Leases cover all of the NI43-101 mineral resources of the River Valley PGM Project.

The River Valley PGM project was acquired in 1998 by PFN through a number of transactions. PFN discovered significant PGM occurrences on the property and entered into a joint venture agreement with Anglo Platinum in 1999. PFN remained operator of the joint venture.

In January 2011, Pacific North West Capital Corp. successfully negotiated the 100% acquisition of the Project from Anglo Platinum Limited.

Regional Geology:

The East Bull Lake Intrusive Suite comprises a series of ~2.5 Ga mafic plutons that occur along the boundary of the Archean Superior Province and the Proterozoic Southern Province (East Bull Lake intrusion and Agnew Lake intrusion) and along the boundary of the Southern Province and the Grenville Province, within the Grenville Front Tectonic Zone (River Valley intrusion) . These intrusions are eroded remnants of layered sills that formed from tholeiitic, plagioclase-rich magmas that were emplaced during a Paleoproterozoic rifting event that lasted for several million years .

River Valley Property Geology:

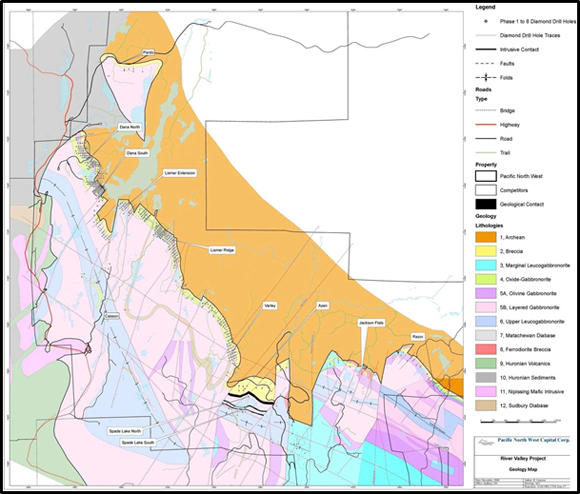

The River Valley intrusion (RVI) is shallow-dipping, layered, and approximately 900 m thick. There is an increase in metamorphic grade from the northwest part of the intrusion (middle greenschist facies) to the southeast part (lower amphibolite). The dominant rock types are leucogabbronorite and leucogabbro with gabbros and anorthosites . Along the Grenville Front, the RVI is either in thrust contact with quartzite of the Huronian Mississagi Formation or is in contact with mafic and felsic metavolcanic rocks of the lower Huronian Supergroup where the nature of the contact is unknown .

Exploration History (1999-2008):

Between 1999 and 2008, Pacific North West Capital Corp as operator of the project, in conjunction with joint venture partner Anglo American Platinum Corporation Limited, carried out several phases of trenching, surface sampling and mapping, and completed 8 diamond-drilling programs. During this period of time $ 22 MM exploration programs were financed by Anglo Platinum.

2011 Exploration Program:

After Pacific North West Capital (PFN) acquired 100% of the project, the company announced that it commenced a five million Dollars, 15,500 metre exploration program for its 100% owned River Valley PGM Project. During 2011 exploration, PFN completed more than 15,500 m of drilling and more than 140 line km of 3D IP geophysics survey. Following is a summary of the program achievements;

Resource Drilling, 13,500 metres

• Focused in the Dana North and Dana South zones

• Infill drilling to advance inferred to indicated resources, increase grade and close gaps

• Proximal targets drilled along strike and down-dip to expand current (2006) mineral resources

Exploration Drilling, 2,000 metres

• Commenced on completion of the resource drilling

• Drill one new 3D IP chargeability target

• Drill two under explored targets identified from surface mineralization internally within the intrusion not drilled previously

Figure 2- Geology Map of River Valley Project

Geophysical Surveys

During resource drilling, 130 line km of ground 3D IP surveys completed to generate new targets

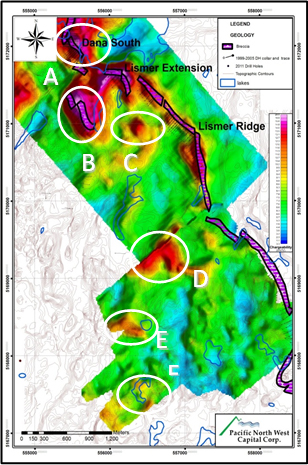

New targets identified, ranked and prioritized for drill testing ( Figure 3)

Other Activities

Environmental baseline studies

Discussion

Work to date at River Valley suggests that the best potential for economic accumulations of PGM‐Cu‐Ni sulphide mineralization is within the Breccia Zone. This zone includes the main mineralized zone. The main zone occurs within about 20 m of the intrusive contact with country rocks. This contact zone extends for over 9 km of prospective strike length and hosts the currently defined resource.

Figure 3- Target areas on IP map

Main Zone of the breccia‐hosted PGM mineralization averages 20‐50 m in thickness, continues to depths of greater than 200 m, and is for the most part open along strike and downdip. In addition, the drilling demonstrates predictable grade to depth with significant high grade intersections (5‐10 gpt 3E over 1‐5 m & 3‐5 gpt 3E over 5‐10 m) enveloped by broader (commonly >20 m and sometimes >100 m) lower grade (1.0‐1.5 gpt 3E) intersections.

The continuity of mineralization and the remarkable consistency in the geology and stratigraphy along strike and at depth, suggests that there is significant potential to increase resources on the property through further extensional drilling away from the currently defined mineralized zones. Deeper holes confirmed the presence of mineralization at depths greater than 350 m (down dip and down plunge). There is a general correlation between three dimensional induced‐polarization (3D‐IP) geophysical survey anomalies and PGM sulphide intersections.

The intersections for most of the holes correlate with relatively high chargeability, an indication of disseminated sulphide.

2012 Mineral Resource Estimate (NI 43-101 compliant):

The detailed results of the new mineral resources estimate for the River Valley PGM Project are presented in Table 1. This NI43‐101 compliant mineral resource estimate was completed by Tetra Tech, Sudbury. The new estimate incorporates the 13,140 metres in 46 holes drilled in the Dana North and Dana South Zones since the May 2006 estimate. This NI43‐101 compliant mineral resource estimate was completed by Tetra Tech, Sudbury. The new estimate incorporates the 13,140 metres in 46 holes drilled in the Dana North and Dana South Zones since the May 2006 estimate. All 462 holes were drilled at a nominal drill section spacing of 25 metres to 100 metres on the eight separate mineralized zones shown in Figure 4.

The estimated NI43‐101 compliant Measured and Indicated mineral resources at a cut‐off grade of 0.80 g/t PdEq have increased by 470% from the previous mineral resource estimate (Filed on SEDAR, May 2006) to 91,339,500 tonnes grading 0.84 g/t Pd+Pt+Au, 0.06% copper, 0.02% nickel and 0.002% cobalt. The compliant Inferred mineral resources have increased by >1000% to 35,911,000 Mt grading 0.53 g/t Pd+Pt+Au, 0.06% copper, 0.03% nickel and 0.002% cobalt.

The mineral resources were estimated using Datamine Studio3(c) software and are reported at a cut‐off grade of 0.8 PdEq (Table 1). The 0.8 g/t PdEq cut‐off was used pending future assessment of the economics and development potential of River Valley as an open pit mining project. The Company considers the 0.8 g/t cut‐off value to be appropriate because: 1) the PdEq grade is 1.38 g/t for Measured and Indicated and 1.07 g/t for Inferred resources; and 2) rhodium and silver are not included in the PdEq calculation.

Comparisons are made above to the previous NI43‐101 compliant River Valley mineral resource estimate of May 2006 (Technical Report by GeoSIMS available on PFN's SEDAR profile at http://sedar.com and on the Company's website).

The large increase in the mineral resources reported herein is explained by the combined effects of:

The large increase in the mineral resources reported herein is explained by the combined effects of:

• incorporation of the 2011 resource drilling results;

• inclusion of three mineralized zones that were previously overlooked;

• use of PdEq rather than Pd+Pt cut‐off grades; and

• use of a length‐weighted average Specific Gravity value of 2.94 measured for River Valley rather than the previous value of 2.89.

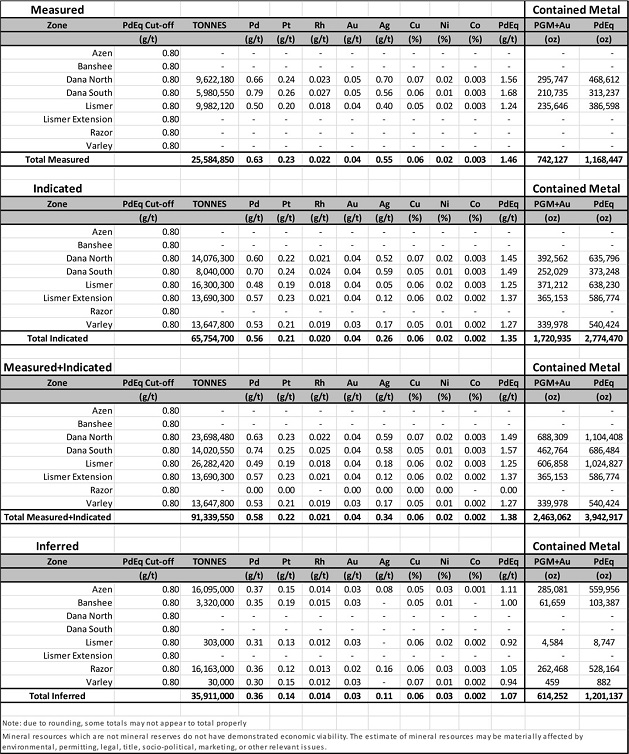

Table 1- NI43‐101 Compliant Mineral Resources for the River Valley PGM Project, Sudbury, Ontario

Notes to Mineral Resources in Table 1

1. The mineral resource estimates in this press release use the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by CIM Standing Committee on Reserve Definitions and adopted by CIM Council on November 27, 2010. The mineral resource estimates provided in this report are classified as "measured", indicated", or "inferred" as defined by CIM. According to the CIM definitions, a Mineral Resource must be potentially economic in that it must be "in such form and quantity and of such grade or quality that it has reasonable prospects for economic extraction".

2. For the River Valley project, a palladium equivalent (PdEq) cut‐off grade was assigned based on economic assumptions from comparisons to other projects, and was used in the resource estimations. Resources reported in this press release use a cut‐off of 0.80 g/t PdEq. Grades have assumed 100% recoveries. The parameters used to generate the PdEq value are provided below:

PdEq=( (Au grade*$Au*Factor1)+(Pt grade*$Pt*Factor1)+(Pd grade*$Pd*Factor1)+(Ni grade*$Ni*Factor2)+(Cu grade*$Cu*Factor2)+(Co grade*$Co*Factor3))/($Pd*Factor1)

$Au = US$1271 per oz.

$Pt = US$1885 per oz.

$Pd = US$896 per oz.

$Ni = US$ 9.74 per lb.

$Cu = US$3.00 per lb.

$Co = US$15.90 per lb.

Factor1 = 0.0321508 (converts ounce per tonne to grams per tonne)

Factor2 = 22.04622 (converts pounds to grade percent)

Factor3 = 0.002205 (converts pounds to ppm)

3. The mineral resources were estimated using a block model with parent blocks of 10m x 10m x 5m and using ordinary kriging (OK) methods for grade estimation. A total of eight individual mineralized domains were identified. The determination technique of the mineral resource is based on the combination of geological modelling, geostatistics and conventional block modelling using the OK method of grade interpolation. The block model resource estimate prepared by the Tetra Tech, was based on more than 96,980 metres of diamond drilling in 462 diamond drill holes. The assay data was reviewed and a composite interval of 2.0 metres was used.

Statistical and Variogram analyses were performed to determine the "nugget effect".

4. Rhodium grades were not estimated by the OK methodology. Rhodium values were determined using a regression formula based on the platinum and palladium grades. Rhodium values are not incorporated into the PdEq value. The PdEq value also does not include silver.

5. The QAQC protocols and corresponding sample preparation and shipment procedures for the River Valley Project have been reviewed and approved by Tetra Tech.

6. An NI43‐101 compliant technical report will be filed on SEDAR within 45 days.

Initiatives

The Company intends to continue exploration at River Valley in order to further expand the PGM resources and to discover new resources and delineate sufficient resources to establish a multi‐million tonne open pit PGM mine.

2012 Exploration Program will include but not limited to; Metallurgical study, drilling, channel sampling and geophysical programs designed to ultimately expand the current mineral resources at River Valley.

Figure 4- Location of the mineralized zones in the Breccia Unit at the base of the River Valley Intrusion, Sudbury area, Ontario.

Qualified Person Statement : Technical information provided on this report has been reviewed and approved for technical content by Dr. William Stone, President & COO of PFN, a Qualified Person under the provisions of National Instrument 43‐101

|