Treasury Resources - Goliath Project

About the Goliath Project

Treasury Metals (TSX: TML) is a Canadian gold exploration and development company focused on its 100% owned high-grade Goliath Gold Project, which currently demonstrates an Indicated and Inferred resource of 1.7 Moz. The Project, which is located in the Kenora/Dryden district in northwestern Ontario, is slated for near-term Canadian gold production.

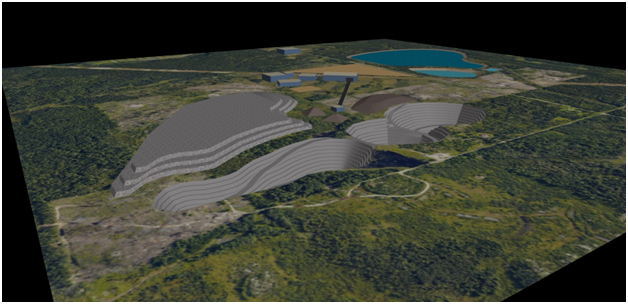

Treasury Metals is advancing through the Canadian permitting process to begin production at its open-pit gold mine and 2,500 tpd processing facility by 2015. Subsequent underground operations will be developed in the latter years of mine life and will be funded from the project's initial cash flow.

• 100%-owned high-grade, flagship Goliath Gold Project demonstrating an indicated and inferred resource of 1.7 Moz

• Results of 2013 drilling program have defined high-grade near-surface intersections, indicating significant upside potential for both resource and project economics

• Low initial start-up CAPEX of $92M with cash-flows from initial 3 years of open-pit production funding underground development

• Stable, mining-friendly jurisdiction of Northwestern Ontario

• Strong leadership team with successful capital markets, mine and operations expertise

Location: 20 km east of Dryden, Northwestern Ontario

Resource: 1.7 Million ounces with upside potential

Host to: Gold, Silver

Stage: Advancing to bankable feasibility study

Infrastructure: Mining-related Infrastructure & skilled local workforce readily available

3D View of Goliath Gold Project Mine Infrastructure

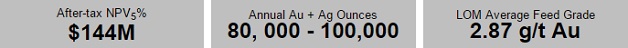

In August 2012, Treasury Metals completed an updated preliminary economic assessment on its Goliath Project. Key Highlights include:

• After-tax NPV 5% of $144M and 32.4% IRR

• Producing 80,000 -- 100,000 oz annually over 10+ years of mine life

• Payback Period of 2.8 years

• Low initial start-up CAPEX of $92M

• LOM average feed grade of 2.87 g/t Au and 9.30 g/t Ag

The preliminary economic assessment is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Exploration Focus: Treasury Metals has completed more than 100,000 metres of diamond core drilling since 2008 (in addition to Teck Resources' historical drilling). The Company's current exploration and drilling program has been principally focused on targets located in the northeast and east of the Goliath Gold deposit, within its >49 km2 property block. Significant gold values intercepted in previous drilling campaigns, as well as re-interpreted airborne EM and aeromag geophysics, are being used to guide the current drilling program. Treasury Metals is currently undertaking a gap analysis to determine the scope and size of the Company's final in-fill and expansion drill program, to be completed in 2014.

Resource Estimate

Indicated Resource OP & UG: 9.14Mt @ 2.6 g/t Au and 10.4 g/t Ag for 760,000oz Au and 3,070,000oz Ag

Inferred Resource OP & UG: 15.9Mt @ 1.7 g/t Au and 3.9 g/t Ag for 870,000oz Au and 1,990,000oz Ag

| Resource Category | Block Cut-off Grade (g/t) | Tonnes | Average Grade (g/t) | Contained AU (oz) | Average Ag Grade (g/t) | Contained Ag (oz) | Silver Equivalent Ounces of Au | Total Au Equivalent Ounces (Au+Ag) |

|---|---|---|---|---|---|---|---|---|

| Indicated | ||||||||

| Surface | 0.3 | 6,002,000 | 1.8 | 326,000 | 7.1 | 1,257,000 | 22,000 | 348,000 |

| Underground | 1.5 | 3,136,000 | 4.3 | 433,000 | 18.0 | 1,812,000 | 32,000 | 465,000 |

| Total | 9,140,000 | 2.6 | 760,000 | 10.4 | 3,070,000 | 54,000 | 810,000 | |

| Inferred | ||||||||

| Surface | 0.3 | 11,093,000 | 1.0 | 352,000 | 3.3 | 1,184,000 | 21,000 | 374,000 |

| Underground | 1.5 | 4,789,000 | 3.3 | 514,000 | 5.2 | 807,000 | 14,000 | 528,000 |

| Total | 15,900,000 | 1.7 | 870,000 | 3.9 | 1,990,000 | 35,000 | 900,000 | |

Indicated Resource OP & UG: 9.14Mt @ 2.6 g/t Au and 10.4 g/t Ag for 760,000oz Au and 3,070,000oz Ag

Inferred Resource OP & UG: 15.9Mt @ 1.7 g/t Au and 3.9 g/t Ag for 870,000oz Au and 1,990,000oz Ag

|