Orefinders Resources Inc

Gold Juniors in 2020: Orefinders Anticipates What Lay Ahead

Gold’s $200 increase in 2019 marked the beginning of a rebirth of the juniors, but this increase alone was

not enough to revitalise them. We argue that a higher gold price is the tip of the spear and the first of a

sequence of events that will bring renewed investment to the sector.

Miners recorded the impact of a higher gold price on their bottom line in Q3 2019. With this new cash

came the debate about how this capital is allocated. Fund managers called for dividends and internal

investment, while leadership within the miners centred in on supply scarcity within a depletion business.

Inevitably the necessity of securing supply will supersede to ensure operational sustainability and current

circumstances will lead to history repeating itself with the gold miners consolidating their reserves via

mergers and acquisitions. With the limited number of quality projects available and an industry that tends

to operate in sync, the fear of missing out will be too large to overcome. Capital providers will be forced

to follow or exit a sector which appears ripe for growth. Accordingly, we anticipate long term thinking to

prevail and gold mining mergers and acquisitions to become a dominant theme in 2020 and beyond. A

recent wave of M&A implies the wheels are already in motion.

Recent M&A Transactions

• Newmont sells interests in KCGM to Northern Star for $800M - December 16, 2019

• Equinox and Leagold Merger at Market Value - December 16, 2019

• Endeavour Mining bids $2.5 billion for Centamin - December 3, 2019

• Zijin Mining to acquire Continental Gold in $1 billion deal - December 2, 2019

• Newmont Goldcorp to Sell Red Lake to Evolution Mining Limited - November 25, 2019

• Kirkland Lake Gold to acquire Detour Gold - November 25, 2019

• St. Barbara to acquire Atlantic Gold - May 15, 2019

• Barrick and Newmont Nevada Joint Venture Agreement - March 11, 2019

• Imperial to Joint Venture with Newcrest - March 10, 2019

• Newmont and Goldcorp merger - January 14, 2019

• Barrick to acquire Randgold - September 24, 2018

Simple Math: Inevitability of Mergers & Acquisitions

Newmont Goldcorp forecasts 35 million ounces of gold production over the next five years from stated

gold reserves of 65 million ounces. This implies the world’s largest gold miner will be out of business in

less than ten years. How does Newmont plan to sustain their production rate? Exploration? Unlikely.

Significant gold discoveries have declined substantially over the past decade. The discovery of +10 million

ounce deposits, while not uncommon between 1980-2010, have not materialized since. The potential for

mega discoveries exists but they are deeper, harder to find, more expensive to extract and take longer to

permit. For miners to meet their production rates and sustain their business, the most likely solution is

Mergers and Acquisitions. This occurrence is nothing new, it is how the mining industry operates.

Not All Ounces are Created Equal

Compounding reserve depletions is the vast difference between ounces—not just their profitability but

also their timeframe of extraction. For example, the Detour Lake Mine has 15.4 million ounces in reserve.

At a 600,000-ounce annual production rate, its final ounces are payable in 25 years. What is the present

value of a low-grade ounce recoverable in 25 years? Our Excel model computes a near-zero value.

The Juniors Lag: Everything Has its Order

As gold surpassed the $1,400 level in June we forecasted its effects would take time to trickle up the risk

curve towards the juniors. Since June, the gold price has increased another 7% to $1500, while the equity

of the major producers as indexed by the GDX have increased 24%. Yet the juniors, as indexed by the

TSXV, are down over 10% with their access to capital being severely limited. The primary reason for this

is that capital flowed towards the producers and their increased cash flows. However, as producers’

returns rationalize and the M&A trend continues, we expect investment to flow to the juniors. The timing

of this trickle up effect paired with the decline in competition for speculative investment from the

cannabis and crypto market could set the stage for an aggressive rebound to a much depressed junior

market.

Price will Track Costs: Discoveries, Grades and Tonnages are on the Decline

The decline in major discoveries is paired with most new discoveries having lower grades and tonnages

resulting in higher exploration and extraction costs. This is a systemic issue facing the mining industry.

We are not believers in ‘Peak Gold’, whose mitigating variable is price, but we are unwavering in the

concept of ‘Peak Discovery’ whose crescendo appears to be behind us. Gold in the context of its current

price is not discoverable as it was in previous eras, which inevitably has price equilibrium consequences.

New Entrants to the Canadian Market

Canadian companies, and more so Canadian assets, deserve premium multiples relative to lesser

jurisdictions, and the Chinese and Australians have taken note. The formerseeks the end product (physical

gold or copper), while the Australians are using their arbitrage advantage with their higher Net Asset

Valuations. Recent foreign entrants in the Canadian market include Newcrest, St. Barbara, Evolution

Mining and Zijin. We expect this trend to increase with the Chinese being at the forefront in their pursuit

of raw materials and metals.

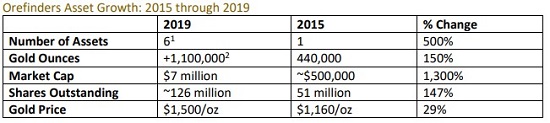

Orefinders in 2020: A Pivot Towards Exploration

In 2020 Orefinders is prepared to pivot towards developing its portfolio of assets via the drill bit. Our

acquisition strategy, which has been in place from 2015, enabled us to accumulate an enviable portfolio

of advanced stage Abitibi gold assets at attractive prices. We anticipate fewer accretive acquisitions will

be available and that investors will provide suitable returns for high quality exploration results. Orefinders

is well positioned to deliver with its assets in the world class Abitibi district, each within major gold systems

that provide opportunities for game changing discoveries.

Orefinders’ assets are permitted to be drilled, each having series of priority targets. Our data analysis and

models, often paired with new interpretations of mineralization, have generated high-quality drill targets

such as the potential mineralized breccia pipes on the Knight project, and the large geophysical anomaly

at Porphyry Lake, which could be the source of gold mineralization on the Knight Project.

Orefinders Exploration Plans in 2020

Orefinders has outlined three distinct targets on its Knight Gold Project which it plans to drill. Each has

distinct geological styles and none of them having been drill tested in the past. Orefinders views the

Knight Project as having highly prospective geology within a large mineralized system with gold having

been deposited over a protracted period. The geology of the Knight Project is complex and has similar

features to those found in the Kirkland Lake-Larder Lake camp, 110 km to the northeast. Priority targets

include:

1. Porphyry Lake

• Large Near Surface IP Anomaly delineating potential source of mineralization at Porphyry Lake

• Never been drill tested

2. Tyranite Mine

• Brand New 3D modelling of gold mineralization along the North-South trending Tyranite fault.

• This interpretation of this geologic model has never been drill tested

3. More Minto Pipe-like Targets

• New targets with geophysical characteristics like the Minto Mineralized Breccia Pipe.

• Never been drill tested

The above shows that Orefinders’ has built its asset base at an exceptionally low cost during the gold

downturn, but our value has yet to be realized. There have been exceptions to the rule, however

Orefinders’ thesis has held true in that exploration drilling has destroyed value for gold juniors even when

excellent results were delivered. It is our view that in 2020, given the fundamentals discussed above that

the market is set to once again provide a return on investment for successful exploration results.

Source: http://www.orefinders.ca/wp-content/uploads/2019/12/Orefinders-The-Juniors-in-2020_2019.12.29_Final.pdf

|

Geologist

If you are a geologist and interested in working with a dynamic team in the Kirkland Lake area, please send your resume and cover letter to careers@oregroup.ca