Pan American Silver reports Q1 2021 results

- A large inventory build impacted revenue, cash flows, and Silver Segment Cash Costs and All-in Sustaining Costs ("AISC"). The inventory primarily related to a three-month build-up of concentrate production at La Colorada due to extended negotiations with a transport supplier and changes to smelting contracts. That inventory is expected to be sold and recognized in revenue over Q2 2021 and Q3 2021. In addition, a build-up in inventory occurred at Dolores from leach pad kinetics, which delayed production later into 2021.

- Protocols to protect health and safety during the COVID-19 pandemic reduce throughput rates across Pan American's operations, and have had a disproportionate impact on its La Colorada and Manantial Espejo operations, which contribute a significant portion of the Company's silver production. This is due to COVID-19 related shortfalls in workforce deployments at these operations.

- Consolidated silver production of 4.6 million ounces primarily reflects reduced production at La Colorada and Dolores. In addition to the COVID-19 related impact, noted above, at La Colorada, the bottom 42 metres of the new ventilation raise from surface to the 345 metre level became blocked from sloughing of the raise wall during shotcreting and commissioning in Q1 2021, restricting mining rates. Pan American is currently working to bypass the blockage through drifting from a nearby ramp and additional raise boring. This work is expected to be completed in Q3 2021, enabling mining rates to improve later this year. At Dolores, lower silver production reflects mine sequencing into higher gold grades and lower silver grades, as expected.

- Consolidated gold production of 137.6 thousand ounces reflects reduced production at Timmins where we adjusted mining to address geotechnical conditions in a section of the Bell Creek mine, and at Shahuindo from lower tonnes placed, grades and extraction rates due to mine sequencing. As expected, Dolores benefited from mine sequencing into higher gold grades, albeit at a lower ratio of ounces recovered to stacked due to temporary leach constraints during the current stage of pad construction.

- Revenue of $368.1 million was impacted by the $39.9 million inventory increase noted above.

- A Net loss of $7.6 million ($0.04 basic loss per share) was recorded, impacted by an investment loss of $39.0 million, primarily related to the mark-to-market fair-value adjustment of the Company's investment in New Pacific Metals.

- Adjusted earnings were $37.4 million ($0.18 basic adjusted earnings per share). The primary adjustment was removing the $39.0 million investment loss. Commencing in Q1 2021, the Company will no longer include in adjusted earnings the gains and losses recognized in relation to certain equity investments owned by the Company.

- Net cash generated from operations of $29.9 million includes $61.3 million in income taxes paid and $47.4 million use of cash from working capital changes, driven mainly by the inventory build-ups noted above.

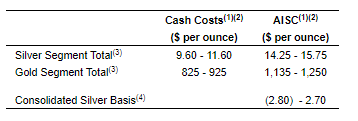

- Silver Segment Cash Costs were $12.30 per ounce, reflecting lower gold by-product credits from the move of Dolores into the Gold Segment, reduced throughput and grades at La Colorada from the temporary ventilation constraints, the inventory build-up at La Colorada, an increase in operating costs at Manantial Espejo due to the ramp-up of mining activities at COSE and Joaquin, and greater COVID-19 related costs. Costs benefited from strong by-product base metal production and prices at Huaron.

- Silver Segment AISC were $16.99, including net realizable value ("NRV") inventory adjustments that increased Silver Segment AISC by $0.51 per ounce. Silver Segment AISC was significantly distorted by the ventilation constraints and inventory build-up at La Colorada, and is expected to normalize over 2021.

- Gold Segment Cash Costs of $846 per ounce benefited from the move of Dolores to the Gold Segment and strong production at La Arena, while costs were negatively impacted by the lower throughput and grades at Timmins and Shahuindo.

- Gold Segment AISC were $1,058 per ounce, including NRV inventory adjustments at Dolores that reduced Gold Segment AISC by $75 per ounce.

- Consolidated AISC, including gold by-product credits from the Gold Segment mines, were $(5.23) per silver ounce sold.

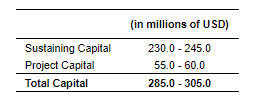

- Capital expenditures totaled $51.0 million, comprised of $45.2 million of sustaining capital and $5.7 million of non-sustaining capital, the majority of which was directed to project capital for exploration drilling activities at the La Colorada skarn project and the Wetmore project at Timmins.

- The Company's liquidity and capital position at March 31, 2021, was comprised of cash and short-term investment balances of $206.4 million, an equity investment in Maverix Metals Inc. with a market value of $134.3 million, working capital of $513.0 million, and $500.0 million available on its revolving credit facility (the "Credit Facility"). Total debt of $30.8 million was related to lease liabilities.

- The Board of Directors has approved a cash dividend of $0.07 per common share, or approximately $14.7 million in aggregate cash dividends, payable on or about June 7, 2021, to holders of record of Pan American's common shares as of the close on May 25, 2021. Pan American's dividends are designated as eligible dividends for the purposes of the Income Tax Act (Canada). As is standard practice, the amounts and specific distribution dates of any future dividends will be evaluated and determined by the Board of Directors on an ongoing basis.

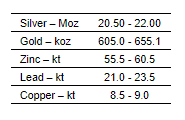

- Pan American is revising Guidance for 2021 annual silver production to between 20.50 to 22.00 million ounces and Silver Segment Cash Costs to a range of $9.60 to $11.60 per ounce and Silver Segment AISC to a range of $14.25 to $15.75 per ounce. The revisions reflect extended ventilation constraints at La Colorada while completing the by-pass of the blockage in the new ventilation raise, as well as greater than originally anticipated COVID-19 related production impacts at Manantial Espejo. There are no changes to estimated 2021 annual gold production of 605.0 to 655.1 thousand ounces and estimated Gold Segment Cash Costs or AISC. The estimated range for consolidated sustaining capital has been reduced to between $230.0 million and $245.0 million while estimated project capital is unchanged at $55.0 million to $60.0 million. Further details are provided in the "Guidance" section of this news release.

Source: https://www.panamericansilver.com/news/news-releases/detail/169/2021-05-12-pan-american-silver-reports-q1-2021-results

|

In this role, you will work with the operations team to consolidate the annual budget, accounting process and preparing short term forecasts.

The role of the IT System Administrator will be responsible for assisting staff with technical support of desktop computers, applications, networks, and related technologies.

In this position, you will be responsible for supervising all mine engineering staff and managing all mine functions at the Timmins West Mine to maximize the operation’s performance in a safe manner.

The role of the Geotechnical Engineer will be to work closely with the engineering and operational teams on site to provide and implement sound engineering and rock mechanics principles that will ensure stability of stopes and excavations with minimal dilution and ground failure.