RJK Explorations Ltd.

Investment Highlight Fact Sheet

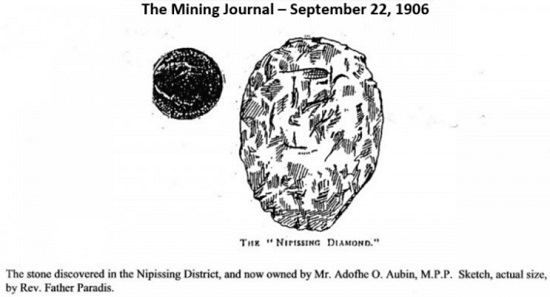

1. Evidence suggests the 700-800 Carat Nipissing Diamond may have been found on or near RJK’s Bishop diamond exploration claims. Where there was one large diamond discovered, the probability increases that more could be located underground in its source. Advancements in exploration knowledge and technology have made 2019 the best time in history for RJK to reopen the search.

2. RJK has confirmed the historical Nipissing Diamond discovery by obtaining articles dating back to 1906, one of which gave a clue to its location when it stated Tiffany and Co. sent a team of diamond experts and geologists to an area “west of Temiskaming,” after they cut and polished the Nipissing Diamond. In addition, the company has confirmed the decedents of the original owner, Adolphe O. Aubin, still own pieces cut from the original Nipissing Diamond.

3. De Beers, the world’s most successful diamond company historically, has invested heavily in the area over the past two years. They have used mag and electro mag technology to map out geophysical signatures from Elk lake, to Temagami, and from South Temiskaming to Larder Lake. In the centre of this flight area is RJK’s properties in Cobalt. De Beers has started to strike deals with nearby companies and have begun to drill targets they have identified as potential kimberlite pipes in close proximity to RJK’s Bishop claims.

4. On Feb 5, 2020, RJK drilled its first kimberlite pipe, the Kon 1 Kimberlite. Kon 1 was the 1st target of 45+ within the optioned and staked diamond exploration claims. 100m of hypabyssal kimberlite was encountered on a vertical hole, beginning only 12m from surface, and 79m was encountered on a diagonal hole, facing west, starting from the centre of the magnetic low anomaly. A kimberlite dike was also drilled, encountering 21m of hypabyssal kimberlite.

5. RJK’s Bishop Claims are located in a geologically ideal setting for not only kimberlite discoveries, but pipes from deep-seated subduction zones where it is believed Type IIa diamonds, the most valued and purest type of diamonds, originate.

6. Kimberlites exist in clusters. There are already 46 discoveries and showings in the geological area, 29 of which have contained diamonds, it’s just that none have proven to be economic, yet. Very few have ever been tested properly. The odds of finding more kimberlites nearby, that could be economic, increase with the existence of past diamondiferous kimberlite discoveries in close proximity.

7. RJK has begun to expand on 5 years of kimberlite indicator mineral data and mapping from Tony Bishop and his family. The results suggest new potential kimberlites nearby, waiting to be discovered.

8. A G10D chrome pyrope garnet was found in a till sample. G10Ds are statistically considered to be derived from diamond-bearing kimberlite pipes.

9. Large grain G9 purple chrome pyropes were found >2mm in multiple locations. These likely would’ve pulverized into smaller sizes if moved by a glacier far from their kimberlite sources. Below is a 2.3mm G9 brecciated Chrome Pyrope with kimberlite attached down-ice from Lightning Lake.

10. Green Chrome diopsides have been found. These are the same indicator minerals, which lead to the discovery of the Ekati Diamond mine in the Northwest Territories.

11. In an area down-ice from Little Grassy Lake, thousands of indicators minerals were discovered. Generally, when over 100 indicator minerals are found in a sample, you know you’re very close to a kimberlite source.

12. Many circular-shaped lakes and swamps with vegetation anomalies are located within the Bishop claims. These are often classic indications of kimberlite pipes below.

13. There are many clear, geophysical magnetic high, and low signatures, that are deep-seated within a granite and diabase batholith. Some mag signatures coincide with the locations of the lakes and swamps, and also the kimberlite indicator mineral sampling trails.

14. RJK has up to 15 more targets surrounding its Kon 1 kimberlite discovery.

15. RJK’s Board of Advisors have voluntarily signed up to the deal and each have extensive experience in diamond exploration. This is invaluable to a junior diamond exploration company, shortening the learning curve for management.

16. RJK’s diamond exploration claims have incredible infrastructure relative to most diamond exploration zones in other parts of Canada, i.e. the remote Northwest Territories and Quebec. Therefore, the cost of potential diamond mine construction would be greatly reduced compared to many of RJK’s peers.

17. Global diamond jewellery demand in 2018 was $83 billion USD, with rough diamond sales of 147 million carats.

18. There are very few investments that in historical percentage terms, are more explosive than when new diamond mines are found. Details of these historical returns can be found in RJK’s Interactive Timeline, under the section, Diamond Rush 1.0. Diamond mine profitability is illustrated in the section Diamond Rush 2.0 in Canada, where it highlights De Beers paid back its entire billion dollar investment in the Victor diamond mine in year one, and experienced high profit margins for 11 years thereafter.

Source: https://www.rjkexplorations.com/investors/

|