Cadillac Ventures Inc.

Thierry Project

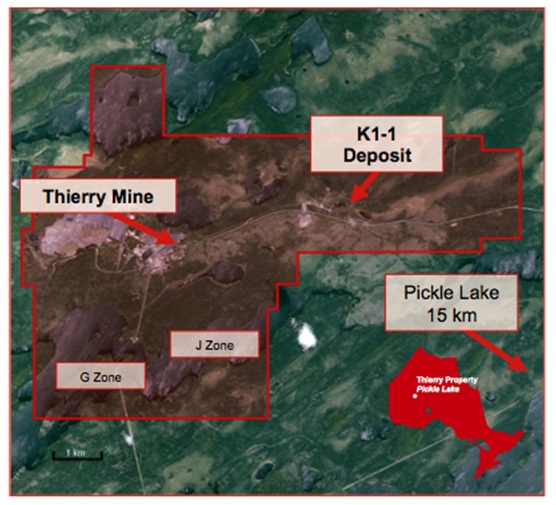

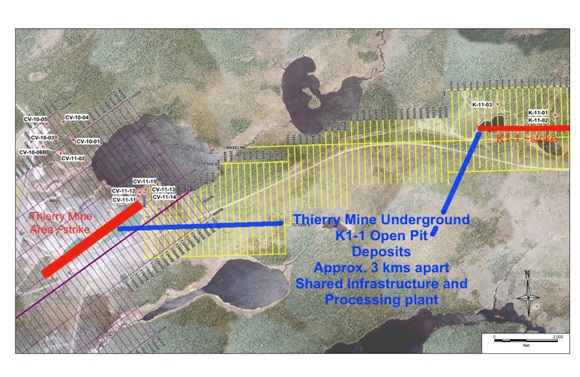

The wholly owned Thierry Project covers over 11,000 acres located outside of the Town of Pickle Lake, in Northwestern Ontario. The Thierry Project, depicted below, hosting 4 known deposit areas; (1) The Thierry Mine (formerly operated as the UMEX Mine), (2) K1-1 Open Pit, (3) G Zone (historic UMEX identified deposit) and (4) J Zone (historic UMEX identified deposit.

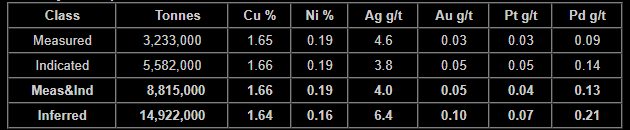

Presently Cadillac has delineated NI 43-101 compliant Resources at the Thierry Mine and the K1-1 Deposit as detailed below. The current Resources are based upon the assumption that the two deposits will be mined together, thereby lowering certain of the mining costs due to efficiencies which it is assumed can be attained.

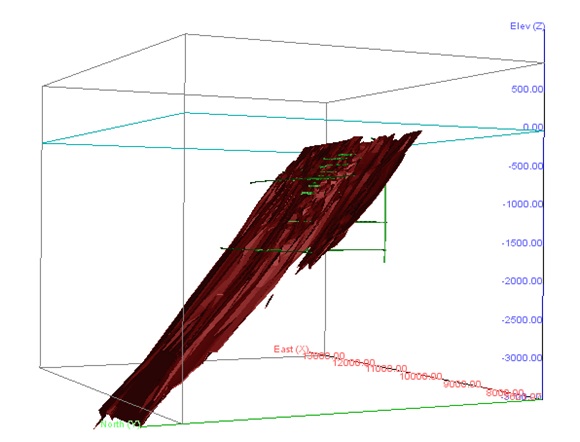

Thierry Mine (Underground)

February 2012 Updated Resource Estimate at a C$41/tonne NSR cut-off

(1) Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

(2) The quantity and grade of reported Inferred resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred resources as an Indicated or Measured mineral resource and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured mineral resource category.

(3) The mineral resources in this press release were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council

(4) The January 31, 2012 two year trailing average US metal prices used in this estimate were $3.72/lb Cu, $10.15/lb Ni, $28.18/oz Ag, $1,419/oz Au, $1,663/oz Pt and $639/oz Pd. The C$US$ Exchange rate was 0.99.

(5 ) Overall payable metal in the NSR calculation were 84% Cu, 13% Ni and 37% for Ag, Au, Pt & Pd.

(6) Costs used to determine the C$41/tonne NSR cut-off value are as follows: mining C$30/tonne, processing C$9.50/tonne and G&A C$1.50/tone (Processing and G&A costs were developed on a shared basis with K1-1)

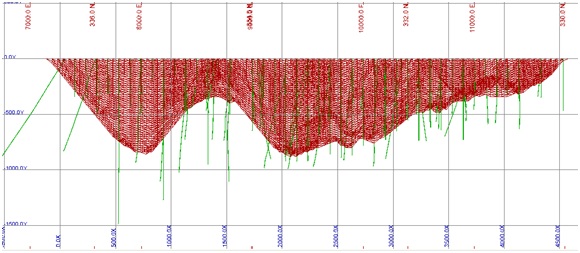

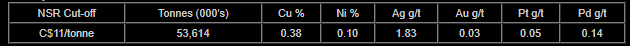

K1-1 Deposit (Open Pit)

K1-1 Updated Inferred Mineral Resource Table

(1) Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

(2) The quantity and grade of reported inferred resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred resources as an Indicated or Measured mineral resource and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured mineral resource category.

(3) The mineral resources in this press release were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council.

(4) Metal prices for the estimate are: US$3.72/lb Cu, US$10.15/lb Ni, US$1,663/oz Pt, US$639/oz Pd, US$1,419/oz Au, US$28.18/oz Ag, based on a Jan 31, 2012 two-year trailing average..

(5) Overall payable metal (process recovery x smelter payable) in the NSR calculation were 84% Cu, 13% Ni and 37% for Ag, Au, Pt & Pd.

(6) Mineral resources were determined within a Whittle pit shell with 50 degree slopes utilizing mining costs of C$1.85/tonne for mineralized material, $1.65/tonne for waste rock, and C$1.250/tonne for overburden.

(7) Costs used to determine the C$11/tonne NSR resource cut-off value were processing at C$9.50/tonne and G&A C$1.500/tonne.

(8) The K1-1 Mineral Resource Estimate were undertaken by Rick Routledge, P.Geo and Eugene Puritch, P.Eng. of P&E Mining Consultants Inc.

These Resources contain 875 million lbs of Cu in the Thierry Mine deposit and 449 million lbs of Cu in the K1-1 deposit.

Further Exploration

Presently the Thierry Mine and K1-1 Deposits are separated by approximately 3 kms., with no exploration program yet carried out to identify any relationship between the 2 deposits.

In addition to this Cadillac has not explored the historically identified G or J deposits, or any other known showings on the property, only a portion of which is occupied by the Thierry Mine and the K1-1 Open Pit deposits.

While occupied with increasing the Resources on the property Cadillac also commenced initial dewatering activities, commissioning environmental engineers to design a dewatering strategy which meets the requirements set out in the permits which Cadillac has in place to dewater Thierry, and drafting tender documents which will be made public to interested bidders at the appropriate time.

Source: http://www.cadillacventures.com/s/Ontario.asp

|