Globex Mining Enterprises Inc.

TTM - Timmins Talc-Magnesite Deposit

Note: Globex has made significant progress since publishing the PEA. In particular, among many things, we have an alternate plan for the MgO which is projected to significantly reduce the capital cost, shorten the time periods to reach specific goals and eliminate project metallurgical risks. These changes are a work in progress and may be provided to potential project investors, subject to signature of a Confidentiality and Standstill Agreement.

Property Description and Location

The property consists of seven (8) unpatented mining claims (totaling 36 claim units), covering approximately 576 hectares (‘ha’) in Adams and Deloro townships, and one (1) mining lease (CLM 490) covering 413 ha, located in Deloro Township, Porcupine Mining District, Ontario. The property also includes approximately 485 ha of “severed” or surface-rights–only mining patents, all of which are located in the south half of Deloro Township, 13 km southeast of the City of Timmins, Ontario. Mining lease CLM 490 was received December 18, 2013 and is deemed by the Corporation to mark a significant milestone in its aim to bring this project to production.

Globex purchased the original 19 claims in Deloro Township in 2000 and has staked or purchased the remaining mining claims since that time. The property is owned 100% by Globex.

Access to the claim group is provided by road from the City of Timmins via Pine Street South and subsequently the Naybob Road to kilometer post 10, at which point the Mount Joy River Road is followed eastward for 3 km to the Wishbone power line and then northward for 3 km along a series of seasonal trails and mining roads to the centre of the property.

Geological Setting

The area is underlain by Archean aged intrusive, volcanic and sedimentary rocks including large masses of altered ultramafic volcanic lithologies and at least one east-trending diabase dyke. Strike directions of units are generally east-west, with near vertical dips. The magnesite-talc-quartz rock unit is exposed on surface as large areas of outcrop rising 3 to 6 metres (‘m’) above a sand plain floor.

History

Work in the 1940’s by Porcupine Southgate ML included the completion of 29 diamond drill holes totaling 8,108 m of diamond drilling which focused on gold exploration. Subsequently, in 1962 Canadian Magnesite Mines Ltd. carried out surface sampling and 1,209 m of diamond drilling in 8 holes in an effort to delineate a resource of refractory magnesia (MgO) from magnesite mineralization. This company completed various studies and in 1974, Canadian Magnesite Mines Ltd. prepared a positive preliminary feasibility study on the property with a proposed production rate of 50,000 tpy for MgO and 16,400 tpy for talc (ref. Preliminary Feasibility Study prepared for Canadian Magnesite Mines Ltd. on the magnesite/talc property, Timmins, Ontario, by Scrivener Engineering Ltd., Toronto, Ontario, 1974).

The property was then acquired by Pamorex and then re-staked by Royal Oak Mines Ltd. in 1984-85. The latter carried out limited diamond drilling (8 holes, totaling 591 metres) and in-situ blasting for bulk sampling (15,000 tons) purposes. The magnesite property was later optioned to Magnesium Refractories Ltd. who worked the Pamorex/Royal Oak Mines property from 1989 to 1994.

Magnesium Refractories carried out numerous economic studies and mineral processing, engineering and financial studies including a 1991 Prefeasibility Study with the objective of developing a magnesite-talc operation to produce MgO and high quality talc from a deposit estimated to host a global resource of 110Mt grading 54% magnesite (MgCO3), 28% talc, 16% quartz and 3% iron oxides (ref: Magnesium Refractories Ltd, Pre-Feasibility Report, R.A. Elliot, April, 1991). This resource estimate was not prepared by a Qualified Person under National Instrument (NI) 43-101 and as such, the validity of this estimate cannot be relied upon. In 1999, Pentland Firth Ventures completed 2 shallow closely spaced diamond drill holes totaling 151 m on the “Deloro Magnesite Deposit” where they report intersecting “magnesite altered ultramafic intrusive rock”.

Subsequent to Royal Oak Mines Inc. going into receivership, Globex purchased the Deloro Magnesite Property in 2000.

Test work by previous owners of the property attempted to produce magnesium refractories by conventional processes available at that time. For the most part, this test work showed that magnesium products could be generated from this deposit, albeit with elevated iron contents that are not necessarily suitable to obtain for the optimum markets for MgO.

Exploration and Development

The reader is referred to Globex’s 2012 Annual Information Form for details regarding the company’s exploration activities spanning the period 2000 to 2008 inclusively.

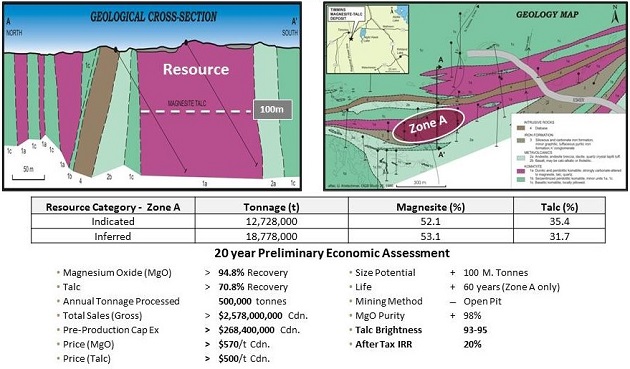

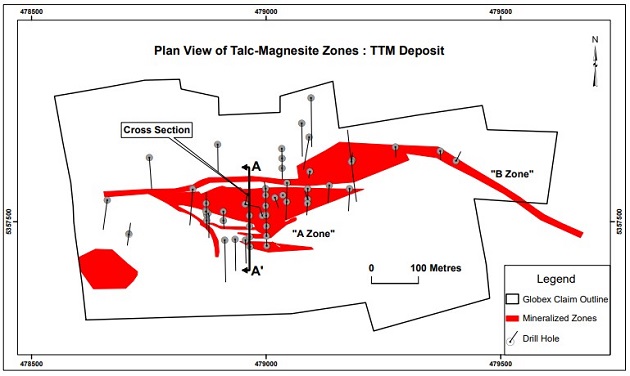

In 2009 and 2010, Globex carried out geological mapping on the Deloro township portion of the property in conjunction with induced polarization, resistivity and ground magnetometer surveys. Micon International Ltd. completed a NI 43-101 technical report, estimating an initial mineral resource on the A Zone as detailed below. The resource was estimated using diamond drilling information from surface down to a depth of 100 m. At the time of this appraisal, the A Zone was known to be exposed at surface and open to depth and along strike and that there are other magnesite zones identified on the property.

The following resource tonnages and grades from the 2010 Micon Technical Report are all estimated within a limited portion of the A Zone geological extent:

*Note: Additional information is available in the Globex press release and in the complete report both of which were filed on (www.sedar.com), March 2, 2010 and on the Globex web page at www.globexmining.com/TechReports.htm.

Also in 2010, a micro-pilot plant study was completed at Drinkard Metalox Incorporated (DMI) to confirm engineering criteria for the production of high-grade magnesia. This program used tailings material generated from a pilot plant scale talc flotation study.

In 2011, deposit appraisal activities at TTM included the following activities:

a) Jacobs Minerals Canada Inc. was retained to design and engineer a preliminary plant layout that would treat the primary material and produce high-grade talc and magnesia.

b) Mineral industry consultants Micon International Ltd, were originally tasked to deliver a Pre-Feasibility Study (PFS) in 2011, but were subsequently directed by Globex to convert the PFS study into a Preliminary Economic Assessment (PEA).

c) Contractor Blue Heron Environmental continued with base line environmental studies while Golder Associates Ltd. was retained to study waste stream storage requirements and to issue a conceptual pit slope design.

d) Globex increased the size of the project by staking an additional 448 hectares to the west and south of the original property perimeter. Globex also presented an application to the provincial government to bring part of the property claims group in Deloro Township to lease.

In 2012, the newly acquired western claims in the Deloro and Adams townships underwent preliminary exploration work consisting of line cutting, 29.7 km of combined ground magnetometer and VLF-EM geophysical surveys and geological mapping. Work on the talc-magnesite “A Zone” consisted of investigating an alternative talc processing method for the magnesite-rich ore.

Globex purchased 12 “surface-rights-only” (SRO) mining patents totaling approximately 167 ha (412.5 acres) from the City of Timmins. These patents are contiguous with a surface rights package purchased by Globex in 2000 and increase the area of SRO mining patents to about 485 ha. The purchase of the lands was done in order to facilitate construction and mine site infrastructure and any possible mill site that might be considered for TTM.

Micon International Ltd. completed a Preliminary Economic Assessment of the Timmins Talc-magnesite deposit. This PEA, as detailed in a press release dated March 2, 2012, indicated a positive after-tax NPV of $258 M at a discount rate of 8%, an after-tax internal rate of return (IRR) of approximately 20% and a payback period of 5.8 years on the discount cash flow. This technical report is posted on SEDAR (www.sedar.com) and on Globex’s website (www.globexmining.com). The results of the PEA support the conclusion that further work is justified on the project, with an ultimate objective of completing a Feasibility Study. To this end, an infill-surface program of 6,900 m of diamond drilling was initiated in December with a view to improving and updating the 2010 resource estimate.

The aforementioned drill program was completed in March 2013. This program was ultimately comprised of a total of 7,543 m of drilling in 53 holes consisting of 51 new holes and the extension of 2 existing Globex holes. Within this drill program, 7 of the holes totaling 1,178 m were utilized as part of a geotechnical investigation carried out by Golder Associates. These holes were logged by Globex personnel, but were not sampled.

In 2013, a talc variability study was initiated in which a total of 35 samples of quartered core, representing 1,680 m of drilling in mineralized material, were collected to cover the extent of the A Zone. Individual in-hole sample lengths for ranged from 26 m to 70 m (average length of 48 m) based on an initial nominal collection target of 60 m of representative talc-magnesite for a particular target depth. The talc variability study looked to establish the potential variations throughout the deposit as well as assess the chemical and physical qualities of the high-grade talc material. It was also meant to determine the final projected steady-state talc concentrate grade and recovery factors from ore composites using locked cycle testing. This information will be used to inform further engineering and economic modelling. CTMP in Thetford Mines was selected to undertake the variability study, having the necessary research facilities and having demonstrated experience to make the required talc quality determinations. SGS-Lakefield and Activation Laboratories provided QEMSCAN mineralogical and chemical analyses. The test work program to produce talc flotation concentrate samples for quality measurements was completed in mid-2013 including talc product micronization and preliminary brightness measurements.

In 2014, limited renewed funding for the TTM project was used to advance test work on talc quality and production, including an expanded CTMP testing program, locked cycle tests and Bond Work Index determination. Additionally, an enhanced range of physical quality assessments was conducted on compounded talc-polypropylene formulations produced in a CTMP plastics research facility. Results for these tests are pending at the end of 2014. Based on budget constraints, Globex has deferred consideration of additional detailed engineering or pre-feasibility studies until 2015. Globex continues to seek senior level financing to advance development of the TTM project.

During 2015, work continued to develop a range of project scenarios and alternate structures which could allow partners to participate in, or acquire, the project. A dedicated consultant has been recently engaged to identify potential parties with related industry knowledge. Discussions at this time are challenging considering the uncertainties in the financial markets and economic outlook.

Renewed metallurgical test work and an updated resource estimate have been budgeted for 2016.

Note: Globex has made significant progress since publishing the PEA. In particular, among many things, we have an alternate plan for the MgO which is projected to significantly reduce the capital cost, shorten the time periods to reach specific goals and eliminate project metallurgical risks. These changes are a work in progress and may be provided to potential project investors, subject to signature of a Confidentiality and Standstill Agreement.

Source: https://www.globexmining.com/property.php?id=20

|