IAMGOLD to Proceed with Construction of the Côté Gold Project in Ontario, Canada

- 2020: 10% or $77 million (previously $45 million);

- 2021: 45%;

- 2022: 35%;

- 2023: 10%.

- Signed Impacts and Benefits Agreement ("IBA") with First Nations partners at Mattagami First Nation and Flying Post First Nation;

- Received approval for the Environmental Assessment ("EA") and Closure Plan;

- Received approval under the Federal Fisheries Act - Section 36, Schedule 2, a key milestone in attaining permits related to impacts on fish habitats and tailings management;

- Subsequent to the receipt of the Schedule 2, we received approval under the Federal Fisheries Act - Section 35.

- Permits underway: Lakes and Rivers Improvement Act (fish collection), Permit to Take Water, Lakes and Rivers Improvement Act (access roads) and Canadian Navigable Waters Act (for major works including dams and reconnections), permits for industrial sewage (Environmental Compliance Approval - construction phase) and aggregate sourcing (Aggregate Resource Act).

- Construction start: Q3 2020 with activities ramping up into Q4 2020

- Earthwork & mining contractors start : Q2 2021

- Process building enclosed: Q1 2022

- Tailings Management Facility phase 1 completed: Q4 2022

- Commissioning completed: Q3 2023

- Commercial production: H2 2023

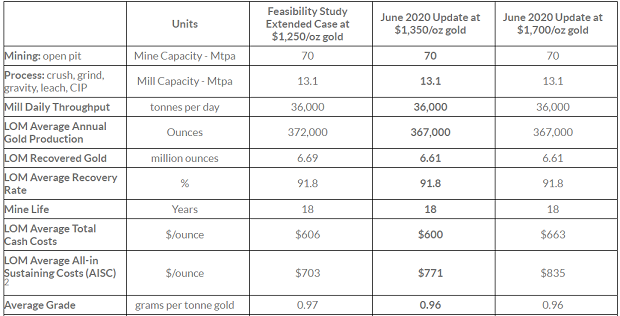

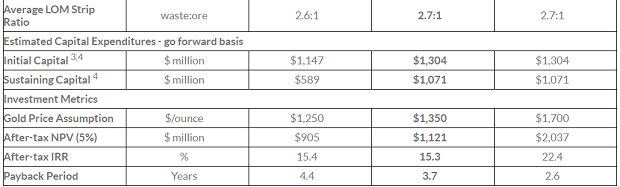

- The metrics provided in Table 1 under the "Feasibility Study" column are based on the Extended Case cited in the 2018 feasibility study ("FS") (see news release dated November 1, 2018). The metrics provided in Table 1 under the "Update" columns are based on: the Extended Case cited in the 2018 FS, recent non-material updates, a long term U.S. $ / Canadian $ exchange rate of $1.30 and go-forward capital (exclusive of sunk costs). The FS Extended Case includes 233 million tonnes over the life of mine compared to the FS Base Case of 203 million tonnes. The FS carries an accuracy basis of +15%/-10%. Figures may not add due to rounding. Please see Cautionary Statement below.

- Royalties (included in AISC) vary with the gold price. In addition, the updates reflect higher AISC relative to the 2018 FS due to more conservative assumptions.

- Amount shown is net of equipment financing of $115 million (100% basis) and does not include credits from pre-commercial production sales.

- Amount shown is based on the FS Extended Case, which is subject to receipt of permitting. The initial capital period is the same for the Base and Extended Cases. The Extended Case mine plan adds two additional years to the Base Case mine life without expanding the footprint of the project. The Extended Mine Plan is supported by exploitation of the total Mineral Reserve, and recognizes that permit amendments may be required to raise the height of the Mine Rock Area and Tailings Management Facility. Sustaining capital variance between the FS Extended Case and the Updates primarily reflects the shift of capitalized waste stripping from operating to sustaining capital.

Source: https://www.iamgold.com/English/investors/news-releases/news-releases-details/2020/IAMGOLD-to-Proceed-with-Construction-of-the-Ct-Gold-Project-in-Ontario-Canada/default.aspx

|

- Design and supervision of construction of geotechnical and hydrological structures such as foundations, slopes, excavations, diversion ditch, and dams;

- Investigation of ground instabilities and recommending and designing mitigation measures

To purchase materials, goods, and services for all operations, maintenance, and support functions.

To provide safe and cost-effective survey services, by way of design, plans, and measurement data that communicate critical mining instructions to operators and development results to engineers.

To provide administrative support and ensure the efficient and effective functioning of the mill office and related activities.

The purpose of the Mine Road Supervisor is to ensure all site service roads are maintained year round.

The purpose of the Supervisor Mine is to supervise the mine crew and ensure production targets and schedules are met as forecast.

The Senior Mining Engineer takes part in the development of economic studies of mining projects (approach, prefeasibility, feasibility).

To ensure optimization of the Mill process is maintained through effective management and technical support to the Operations group as well as external support groups including Mine Technical Services and Mine Operations.

As a member of the Global Supply Chain (GSC), the analyst will utilize your abilities to provide actionable recommendations to the leaders of the organization.

This position is responsible to manage all maintenance activities including; safety, execution, personnel, budget, planning and continuous improvement.