The Co-Operators

Co-operators General Insurance Company Reports First Quarter 2021 Results

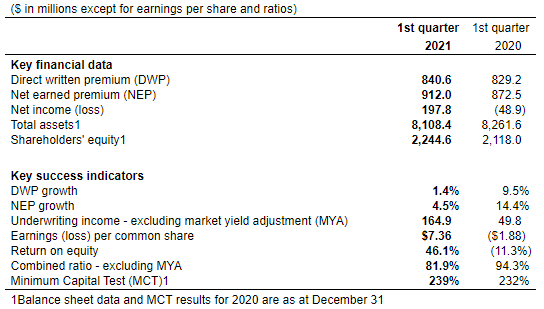

GUELPH, ON, April 29, 2021 /CNW/ - Co-operators General Insurance Company (Co-operators General) today released consolidated financial results for the three months ended March 31, 2021. The consolidated net income was $197.8 million compared to a net loss of $48.9 million for the same quarter in 2020. This resulted in earnings per common share of $7.36 for the quarter, compared to a loss per share of $1.88 in the same period last year.

"In the first quarter of 2021, our financial performance remained strong, driven by a trend of improved underwriting performance coupled with continued favourable investment results," said Rob Wesseling, President and CEO of The Co-operators Group Ltd. "Over the long term, our position of financial strength will help ensure we can navigate increasing risks in our midst, including ongoing market uncertainty and climate risk, while also providing financial security for our clients and investing in the resilience of our communities."

CO-OPERATORS GENERAL'S FIRST QUARTER FINANCIAL HIGHLIGHTS

FIRST QUARTER REVIEW

The first quarter of the year saw DWP increase by 1.4% or $11.4 million to $840.6 million compared to the comparative quarter of 2020. The increase in DWP was primarily driven by higher average premiums in the home and auto lines of business and was partially offset by a decrease in premiums in the travel and other line of business as a result of COVID-19 travel restrictions. NEP increased during the first quarter by 4.5% or $39.5 million compared to the same quarter last year primarily attributable to the auto and home lines of business.

Undiscounted net claims and adjustment expenses decreased by $89.6 million compared to the same quarter of 2020. This led to an improvement in our loss ratio by 12.6 percentage points to 50.6% and was primarily the result of a decrease in current accident year claims in auto from ongoing COVID-19 restrictions, coupled with fewer major events across all lines of business except farm. Our expense ratio remained flat at 31.3% compared to the first quarter of 2020, with premium growth being offset by an increase in operating expenditures. Consequently, our combined ratio excluding MYA decreased to 81.9% in the quarter, down 12.4 percentage points compared to the same period last year. A decrease in the discount rate used to measure our claims liabilities resulted in a $32.7 million favourable MYA in the quarter.

During the first quarter, economic recovery and vaccine rollouts, supported by accommodative fiscal and monetary policies, have resulted in continued gains in equity markets while rising interest rates drove lower bond valuations. Net investment income and gains of $64.5 million was recognized in the first quarter and was primarily driven by realized gains in our preferred share portfolio and gains on foreign exchange contracts.

Our balance sheet, liquidity and capital positions remain strong and enable us to continue to serve and meet the needs of our clients while also supporting our strategic areas of focus. Our investment portfolio is comprised of high quality and well diversified assets. The credit quality of our portfolio remains high with 96.5% of our portfolio considered investment grade and 84.8% rated A or higher. Our equity portfolio is 85.9% weighted to Canadian stocks.

CAPITAL

Co-operators General's capital position remains strong, as the Minimum Capital Test for Co-operators General was 239% at March 31, 2021, well above internal and regulatory minimum requirements. We continue to closely monitor capital levels in response to the changing economic environment as it relates to the COVID-19 pandemic.

ABOUT CO-OPERATORS GENERAL INSURANCE COMPANY

With assets of more than $8.1 billion, Co-operators General is a leading Canadian multi-product insurance company. Co-operators General is part of The Co-operators Group Limited, a Canadian co–operative. Through its group of companies, it offers home, auto, life, group, travel, commercial and farm insurance, as well as investment products. The Co-operators is well known for its community involvement and its commitment to sustainability. The Co-operators is ranked as one of the Corporate Knights' Best 50 Corporate Citizens in Canada and is listed among the Best Employers in Canada by Kincentric (formerly AON).

Source: https://newsreleases.cooperators.ca/2021-04-29-Co-operators-General-Insurance-Company-Reports-First-Quarter-2021-Results

Magazine

No information