Harte Gold Corp.

Harte Gold Reports First Quarter 2021 Results, Provides Updated Guidance for 2021 and Initiates Strategic Review

Toronto – May 13, 2021 – HARTE GOLD CORP. (“Harte Gold” or the “Company”) (TSX: HRT / OTC: HRTFF / Frankfurt: H4O) announced today its results for the three months ended March 31, 2021.

The Company’s unaudited annual financial results for the three months ended March 31, 2021 (“Q1 2021”), together with its Management’s Discussion and Analysis (“MD&A”) for the corresponding period, can be accessed under the Company’s profile on www.sedar.com and on the Company’s website at www.hartegold.com. All currency references in this press release are in Canadian dollars except as otherwise indicated.

Q1 2021 Operational Highlights:

- Gold production: Total production of 11,776 oz Au for Q1 2021, a 9% increase over the previous quarter. Average monthly production totaled 3,925 oz Au for the quarter.

- Mine capital development: Averaged 14.0 metres per day, an increase of 23% over Q4 2020.

- Ore tonnes processed: Average throughput rate of 716 tonnes per day (“tpd”) for the quarter, an increase of 42% over Q4 2020.

- Head Grade: 6.1 g/t Au, within 10% of target for the quarter.

Q1 2021 Financial Highlights:

- Revenues: $27.4 million in revenue from 12,349 ounces sold in Q1 2021 ($15.7 million and 7,637 ounces respectively, in Q1 2020).

- Net Income: $5.8 million in Q1 2021 (loss of $16.1 million in Q1 2020).

- Mine Operating Cash Flow: $9.2 million in Q1 2021 ($3.9 million in Q1 2020).

- Gold hedge impact: Incurred a $4.3 million expense in Q1 2021 ($1.1 million in Q1 2020) for the settlement of 8,341.3 ounces hedged. Average Realized Gold Price1 after hedge in Q1 2021 was US$1,491/oz (US$1,447 in Q1 2020).

- EBITDA: $1.6 million in Q1 2021 ($0.3 million in Q1 2020).

- Cash Cost: US$1,183/oz in Q1 2021, (US$1,178/oz in Q1 2020).

- AISC: US$1,916/oz in Q1 2021, (US$2,231/oz in Q1 2020).

- Mine Capital development: $6.3 million invested in Q1 2021 ($6.0 million in Q1 2020).

- Enhanced Shareholder Base: On March 24, 2021, the Company closed an investment by New Gold Inc. (“New Gold”) for net proceeds of $23.7 million.

- Liquidity position: Cash on hand at March 31, 2021 was $21.1 million ($8.2 million at December 31, 2020). Based on the Company’s updated outlook and guidance for 2021, the Company will require additional funding within the next few months. The Company’s liquidity position is further discussed below under “Liquidity and Capital Resources”.

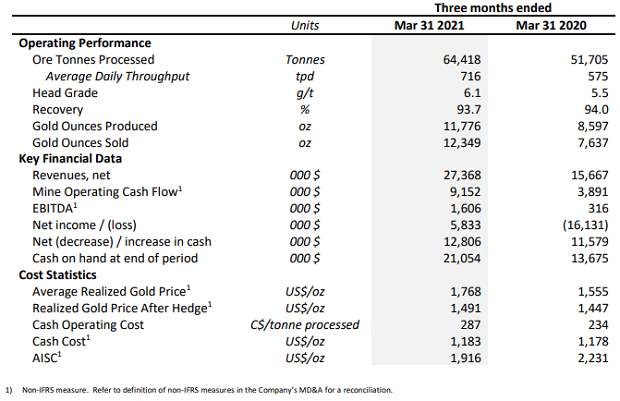

Operating and Financial Summary for Q1 2021 and 2020:

The following table compares operating and financial performance for Q1 2021 relative to the preceding year-on-year

quarter.

Revised 2021 Outlook and Guidance

While positive production advances experienced over the prior two quarters continued in Q1 2021, based on an analysis of recent learnings and the continued operational challenges faced as well as the additional mitigative measures being implemented (as discussed below), the Company is now forecasting that quarterly growth will occur at a lower rate than what was previously planned for 2021. This increased timing expected to achieve stabilization at 800 tpd has negatively impacted 2021 guidance.

Achieving a steady-state ore mine production rate of 800 tpd, representing approximately 5,200 ounces per month, continues to be the Company’s main priority to stabilize the operation and provide the launching platform to the subsequent expansion to 1,200 tpd in 2023. The Company’s updated view, assuming the acceleration of some life-of-mine capital, is that the targeted ore mine production rate of 800 tpd will only be achieved in late Q4 2021.

The Company has revised its guidance for 2021 as outlined in the following table

The above guidance on AISC reflects the Company’s current best estimate but remains subject to ongoing analysis, especially with respect to the costs associated with the mitigation measures discussed below. The Company is continuing to review its prior guidance for Mine Development ($26 million), Other Capital ($13 million) and Regional Exploration ($5 million) and will provide updated guidance to the market when available.

Recent Insights:

In late 2020, a system for tracking key operational metrics was established to provide us with the ability to better monitor and analyze operational performance. During Q1 2021, this data was continually evaluated although the trends were not evident until more recently. Our key findings include:

o significantly higher than planned labour workforce shortfalls (approximately 20%) and a much longer than anticipated timeline to filling vacancies;

o ongoing definition drilling completed to date, critical to increasing the understanding of the orebody, has, in some areas, resulted in changes to portions of the 2021 mine plan grade and tonnage assumptions and, in other areas, the identification of new economic mineralization outside of the planned reserves;

o the negative impact the condition of our mobile equipment is having on production; and

o much longer than planned lead time to obtain critical components.

Over the course of the past two weeks, we have been working on translating what these challenges mean for 2021.

Ultimately, we have determined that achieving 800 tpd of ore at near mineral reserve grade will only occur later in the year.

The impact of a shortfall of approximately 10,000 recovered gold ounces in 2021 (resulting from the change in production guidance to 50,000 to 55,000 ounces from 60,000 to 65,000 ounces) creates a revenue shortfall of approximately $22 million. The impact on the Company’s liquidity due to the loss of this revenue is compounded by a mostly fixed operating cost base, ongoing sustaining capital deployment, the commencement of some expansion capital and a debt repayment of US$3.3 million to BNP scheduled for June 30, 2021.

Despite the Company’s current capital constraints, the 1,200 tpd expansion, which would generate an average annual gold production of close to 100,000 ounces, continues to be the ultimate objective for 2023.

Mitigation Measures:

To mitigate factors currently impacting the previous 2021 guidance and the subsequent 1,200tpd expansion, the Company is taking the following steps to de-risk planning, significantly increase mine flexibility and unlock potential additional ore tonnes.

• Bolster mine workforce: Significant competition to attract and retain employees, primarily in underground mining and, partially, in mobile maintenance, has prevented the Company from achieving its budgeted workforce complement which is currently approximately 20% below plan. While the Company continues to focus on hiring and retention strategies to expand its labour complement and expects these strategies to have a positive impact on the medium to long-term, the Company anticipates this labour shortage to continue to be a challenge throughout 2021. The Company is also seeking temporary additional support from specialist contracted mining operators to assist in designated areas of the mine for specific activities such as ore sill development and Alimak mining.

• Accelerate definition drilling: The Company plans to accelerate its definition drilling from 30,000 metres initially planned for the year to approximately 40,000 metres for the year. Adding more diamond drill coverage across the orebody on a tighter space pattern from the original 50-metre mineral resource spacing will allow for more efficient future budgeting, forecasting and mining by increasing the understanding of the orebody, especially the grade and tonnage profile of current reserves and the potential to better clarify economic material recently identified but not within the reserves.

• Accelerate mine capital development: To increase mine production flexibility and access, the Company plans to accelerate capital development from an average of 14.0 metres per day (Q1 2021) to 18.0 metres per day by Q4 2021, with increased focus on decline ramp development as compared to horizontal capital. Expanded horizontal and ramp development remains the most critical indicator for operational success as it provides access to more ore haulage horizons and additional stope faces.

• Reinforce underground equipment: Equipment availability targets above 80% have not been met for some of the highest utilization gear due to the condition of some of the underground fleet, supply chain delays on certain critical spares, outstanding key maintenance hires, and the new larger capacity workshop not yet completed. The Company plans to pursue options to either acquire, lease or rent some selected additional mobile gear and to conduct time motion study analyses. This equipment is expected to further improve availability constraints and can also be leveraged as the Company prepares for the 1,200 tpd expansion. In addition, critical data tracking of key metrics, such as mean time between failure, and progressing planned maintenance practices, will help clarify critical spares for lead orders while only moderately increasing inventory holdings.

Frazer Bourchier, President and CEO commented:

“Although we have continued to make good progress over the past three quarters, we also continue to face challenges that are preventing us from achieving our previous targets and stated guidance. Data tracking mechanisms that I implemented in late 2020, and continued to enhance in Q1 2021, began to reveal more recently our critical constraints. I believe these challenges can be overcome and I know we have a team committed to doing so. What I see as the exceptional long-term value potential of the Sugar Zone mine and vast exploration potential of the surrounding property remains intact. Ultimately, however, I believe this value may only be unlocked in the context of a stronger balance sheet, which is why we are evaluating all alternatives.”

Liquidity and Capital Resources:

In Q1 2021, the Company completed a private placement offering of 154,940,153 common shares to New Gold at a price of $0.16 per common share for gross proceeds of $24,790,424 (the “Strategic Investment”).

In exchange for waiving its(i) right to receive up to 35% of the net proceeds of the Strategic Investment for debt repayment under the August 28, 2020 Facility Agreement (the “Appian Debt Facility”); and (ii) participation right under the November 23, 2016 Subscription Agreement, Appian was granted a deferred participation warrant that allows Appian to acquire up to 55,802,812 common shares of Harte Gold at $0.18 per share for a period of 15 months following the closing of the Strategic Investment (the “Appian Deferred Participation Warrant”). The Appian Deferred Participation Warrant is not exercisable by Appian, subject to certain exceptions, until March 24, 2022. New Gold was also granted a warrant (the “New Gold Warrant”) which provides New Gold with the right, subject to Appian exercising the Appian Deferred Participation Warrant, to acquire up to 8,314,619 additional common shares of Harte Gold at $0.18 per common share in order to maintain its pro rata interest in the Company.

In Q1 2021, the Company also received a non-binding indicative proposal (the “BNP Refinancing Proposal”) from BNP Paribas (“BNP”) to reschedule principal debt payments under the Company’s senior debt facility with BNP comprised of a US$46.9 million term loan and US$20 million revolving credit facility (the “BNP Debt Facilities”). The BNP Refinancing Proposal provided for the deferral of certain principal debt payments and an extension of the maturity dates of the revolving credit facility and term loan.

The BNP Refinancing Proposal was subject to certain conditions including: (i) obtaining final internal BNP approvals; (ii) the extension of the maturity of the Appian Debt Facility from June 2023 to June 2025; (iii) negotiation of definitive documentation with BNP and Appian; and (iv) shareholder approval being obtained for the extension of the maturity of Appian Debt Facility.

In light of the updated guidance announced today, seeking shareholder approval of the extension to the maturity date of the Appian Debt Facility is being deferred until such time as the Company can confirm what changes to the terms of the BNP Refinancing Proposal are required. The Company is now targeting to obtain shareholder approval of the extension to the maturity date of the Appian Debt Facility in Q3 2021.

Due to the deferral of the proposed BNP refinancing, the Company does not expect to be in compliance with the current financial covenants of the BNP Debt Facilities on June 30, 2021, which would constitute an event of default under the BNP Debt Facilities and the Appian Debt Facility. In addition, there is a US$3.3 million principal repayment on the BNP term loan due June 30, 2021. The Company intends to seek a waiver of the anticipated financial covenant breaches and a deferral of the US$3.3 million principal payment due June 30, 2021, but there can be no assurance that such waivers or deferral will be granted by BNP.

The Company does not expect that it will generate sufficient cash from operations to fully fund planned investment activities and debt service obligations (including the US$3.3 million principal repayment to BNP due on June 30, 2021) due to the estimated cash flow based on the reduction in expected gold production for 2021.

Strategic Review Process:

The Company plans to initiate a strategic process to explore, review and evaluate a broad range of alternatives focused on ensuring financial liquidity and to fund accelerated life-of-mine capital. This includes the restructuring of its long-term debt and reviewing other potential strategic alternatives.

There can be no assurance that the strategic review will result in any transaction or that the Company will be able to continue as a going concern.

Conference Call and Webcast:

Date: Friday, May 14, 2021, 9:00 am EST

Webcast access: Via Harte Gold’s website at www.hartegold.com (details on home page) or the following link:

https://produceredition.webcasts.com/starthere.jsp?ei=1459877&tp_key=0247fa630d

Telephone access:

Toronto local and international: 647-427-7450

Toll-free (North America): 1-888-231-8191

Conference ID 9278235

A replay of the conference call and webcast will be available until 11:59 pm EST on May 21, 2021. A link to a replay of the webcast will be provided on the Company’s website, www.hartegold.com, and a replay of the call can be accessed using the following dial-in number:

About Harte Gold Corp.

Harte Gold holds a 100% interest in the Sugar Zone mine located in White River, Canada. The Sugar Zone Mine entered commercial production in 2019. The Company hasfurther potential through exploration atthe Sugar Zone Property, which encompasses 81,287 hectares covering a significant greenstone belt. Harte Gold trades on the TSX under the symbol “HRT”, on the OTC under the symbol “HRTFF” and on the Frankfurt Exchange under the symbol “H4O”.

For further information, please visit www.hartegold.com or contact:

Shawn Howarth

Vice President, Corporate Development and Investor Relations

Tel: 416-368-0999

E-mail: sh@hartegold.com

Source: https://www.hartegold.com/news/harte-gold-reports-first-quarter-2021-results-provides-updated-guidance-for-2021-and-initiates-strategic-review/

|

Underground Miners

The successful candidates will have a high focus on safety and environmental protection in all aspects of the job reporting to the Underground Miner Supervisor.

Heavy Duty Mechanic

The successful candidates will have a high focus on safety and environmental protection in all aspects of the job reporting to the Mechanical Supervisor.