Half-Year Production Report 2020

- “Glencore has delivered an overall strong first-half operating performance amid the unprecedented challenges presented by Covid-19, reflecting both the ability and dedication of our teams to adapt to these difficult conditions. As a responsible operator, our top priority has been to protect the health and safety of our people and the communities that host our businesses.

- “Although some of our industrial operations were temporarily suspended in line with national and regional guidance, or where our risk assessment determined a suspension was appropriate, the majority of our assets continued to operate relatively normally. I am particularly pleased to report a strong operational performance at Katanga, with its ramp-up on track to achieve design capacity by the end of the year.

- “Our Marketing business has also risen to the challenge, delivering robust counter-cyclical earnings. A very strong first-half performance allows us to now raise our full year 2020 EBIT expectations to the top end of our $2.2-$3.2 billion guidance range.

- “In the near-term, we remain alert to the continuing challenges that Covid-19 presents. While we expect our operating cash flow to remain solid, we are ready to adapt to changing market conditions.”

- The average spot Newcastle coal price for the period was $62/t. After applying a portfolio mix adjustment (component of our regular coal cash flow modelling guidance) of $1.70/t to reflect, amongst other factors, movements in pricing of non-NEWC quality coals, an average price of $60.30/t was realised across all coal sales volumes.

- While the majority of our assets continued to operate through Q2 with minimal disruption, certain operations were temporarily suspended, on account of mandatory governmental lockdown provisions, or otherwise where a risk assessment determined such action appropriate.

- Marketing performance in H1 2020 was very strong, with full year EBIT expectations now raised to the top end of our long-term $2.2-$3.2 billion range. Contributing towards H1 2020’s EBIT performance was a sizeable increase in carried inventory (“Carry Trades”) transactions / quantities (although the overall dollar value of inventories was somewhat lower than December 2019, due to lower commodity prices) and also a build in non-RMI net working capital on account of the varying terms of trade in our respective business units. In particular, our oil department, which in recent years has managed its receivables portfolio days on hand to around 20 days and accounts payable around 45 days, saw a significant reduction in its net payables position (payables less receivables) via the sharp reduction in oil prices, as well as lower sales volumes due to weaker product demand in H1 2020. Together with the initial cash margining required to give effect to the additional Carry Trades, this has led to an increase in our Net Debt as at 30 June 2020.

- Mopani notified the Zambian government of its intention to place the mining operations on care and maintenance to preserve value and maintain the option to deliver its various growth projects when conditions further improve. Mopani was notified by the relevant authorities that its proposal was rejected. Mopani has appealed this decision. Mining operations will continue pending the outcome of the appeal and Mopani continues to engage with the relevant authorities.

- The outlook for Prodeco’s business remains challenging due to ongoing weakness in the Atlantic coal market, exacerbated by the impact of Covid-19. Prodeco is in the process of optimising its mine plans to account for the current market environment. This process requires consultation and approval by a number of external parties. An application has been made to the authorities for Prodeco to remain on care and maintenance, which will help preserve the value of the assets and the option to implement the revised plans when the appropriate approvals have been obtained and market conditions have improved.

- Due to Covid-19 related disruptions to international mobility, transportation and supply chains, the Chad oil fields were placed on care and maintenance in April. These disruptions and prevailing market conditions are being monitored to determine when some restart of operations would be appropriate.

- The Ferroalloys business has for some time experienced a structurally worsening competitive environment across the South African ferrochrome industry, including via substantial electricity price increases. In January 2020, a consultation process was initiated on the future of the Rustenburg smelter, and in June 2020, a further process commenced across the entire business, to seek a more competitive operating cost structure. This is an ongoing process with all alternatives being considered.

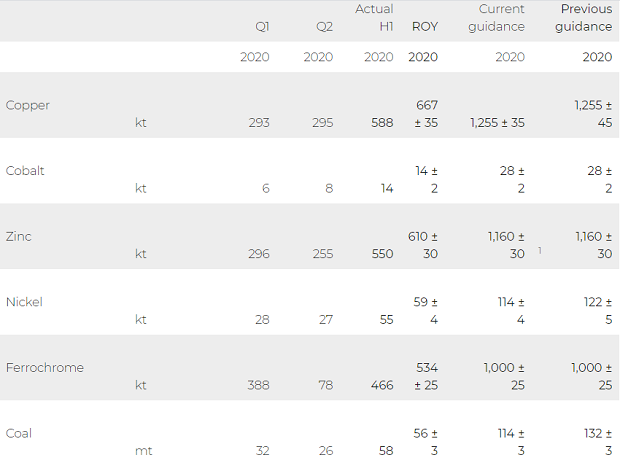

- Full year 2020 production guidance, including accounting for the latest expected business interruptions due to Covid-19 noted above, is set out below:

- Industrial Assets unit cost guidance updated for changes to production and current producer currency levels, energy costs and by-product pricing, is as follows:

- Own sourced copper production of 588,100 tonnes was 74,900 tonnes (11%) lower than H1 2019, mainly reflecting Mutanda being on care and maintenance in the current period, expected lower grades at Antapaccay and the short-term impact of Antamina’s Covid-19 related demobilisation/remobilisation, partly offset by stronger milling throughput at Collahuasi.

- Own sourced zinc production of 550,100 tonnes was in line with H1 2019, reflecting stronger grades at the Canadian mines and the various temporary Covid-19 related suspensions at Antamina and other South American operations.

- Own sourced nickel production of 55,200 tonnes was in line with H1 2019, reflecting a strong period of operations at Murrin offsetting the delayed delivery of matte from the Sudbury smelter to the Nikkelverk refinery.

- Attributable ferrochrome production of 466,000 tonnes was 333,000 tonnes (42%) lower than H1 2019, mainly reflecting the South African Covid-19 national lockdown during March/April. Smelting operations partly resumed on 1 May, with further capacity expected to be restarted towards the end of Q3.

- Coal production of 58.1 million tonnes was 10.1 million tonnes (15%) lower than H1 2019, mainly reflecting the Covid-19 related asset suspensions in Colombia.

- Entitlement interest production of 2.6 million barrels was 0.4 million barrels (17%) higher than H1 2019, due to new wells drilled in Equatorial Guinea and Cameroon, which helped to offset the Covid-19 related suspension of the Chad assets.

Source: https://www.glencore.com/media-and-insights/news/2020-half-year-production-report

|

Sous la supervision du contremaître d’entretien électrique et instrumentation, le titulaire évoluera dans un environnement multi-métiers dans lequel il sera appelé à effectuer les tâches de technicien en électricité et en instrumentation.

Relevant du Spécialiste senior, Gestion de talent et rémunération, vous serez basé à Montréal pour supporter le recrutement pour le groupe Zinc au Canada (Services techniques Zinc, Groupe commercial, opérations et installations Zinc).

Reporting directly to Head HSEC Excellence, the HSEC Excellence Specialist provides support to HSEC Excellence Management Team.

Working at our Sudbury Operations, the successful candidate must adhere to our core values on safety performance in the workplace.

We are currently seeking a sales administrator to support our metal trading team in their daily activities. This is a full-time permanent position based in our downtown office in Toronto.

Reporting to the General Manager, the Metallurgist is responsible for developing and executing a lineup of activities aimed at improving and optimizing metallurgical processes and drafting the related procedures in order to meet company objectives and support the production department in ensuring consistency in product quality.

Reporting to the Operations General Foreman - Logistics, the Logistics Supervisor is accountable for the supervision of an underground Cage, Crusher, Tramming, material movement crew so that safety and production targets are met or exceeded.

Reporting to the Electrical Supervisor - Surface Services, you will perform the preventive maintenance and execute corrective maintenance, including the diagnosis, troubleshooting and repairs.

- Safe and efficient installation, maintenance, troubleshooting, inspection, and repair of a range of industrial machinery, electrical systems, controls and ancillary equipment;

- Supporting the operation in preventative, corrective and reactive maintenance work processes and providing feedback to optimize plant reliability

- Safe and efficient maintenance, troubleshooting, inspection, and repair of a range of traditional and sophisticated mining equipment.;

- Supporting the operation in preventative, corrective and reactive maintenance work processes and providing feedback to optimize reliability