Toronto, Ontario--(Newsfile Corp. - May 3, 2021) - IAMGOLD Corporation (TSX: IMG) (NYSE: IAG) ("IAMGOLD" or the "Company") reports its consolidated financial and operating results for the first quarter ended March 31, 2021. Key highlights of operating performance and financial results include:

1 This is a non-GAAP measure. Refer to the non-GAAP performance measures section of the MD&A.

Gordon Stothart, President and CEO of IAMGOLD, commented, "In the first quarter 2021, the IAMGOLD team made good progress toward our operating and development goals. Our operations generated $89.5 million in mine-site free cash flow and we ended the quarter with approximately $1.5 billion in available liquidity. Production was strong at Essakane and as expected at Westwood's Grand Duc open pit, with Rosebel and satellite Saramacca impacted by unusually heavy seasonal rains and COVID-19 restrictions. We completed the CIL mill upgrade at Essakane and continue to expand camp capacity at Rosebel. At Côté, we started major earthworks ahead of schedule and have attained 18% completion of the project at March 31st. We continue to de-risk our Boto project by advancing essential infrastructure work including the access road and camp construction. And, we recently announced two important initiatives in further support of our host communities: a substantial donation to UNICEF's COVAX vaccination program and sponsorship of the Giants of Africa youth development program. With the normalization of operations and continuous improvement, we expect to see improved production levels and costs over the balance of the year and to continue to steadily advance our development projects and pipeline."

COMPANY UPDATES

Environmental, Social and Governance

-

DART2 and TRI2 incident frequency rates were 0.46 and 0.67, respectively, in the first quarter 2021, consistent with 2020. The Côté Gold Project had achieved 1.24 million hours without lost time as at March 31, 2021.

-

Maintained previously implemented COVID-19 protocols. At Rosebel, movement restrictions have impacted operations, with ongoing expansion of site accommodations expected to enable ramp up to full workforce levels in the second half of the year.

-

Ranked 10th out of 116 global mining companies on the Corporate Knights 2021 Global 100 Sustainability scorecard.

-

Included in the 2021 Bloomberg Gender Equality Index for the 3rd consecutive year, and recognized among 380 global companies that foster a more inclusive and equitable workplace.

-

Provided $400,000 from the Rosebel Community Fund, along with supplemental government contributions, for the installation of solar LED street lights, electrification and potable water supplies in local communities.

-

Completed Phase I of the Public-Private Partnership with Canada's government, One Drop Foundation, and Cowater on the Triangle d'Eau Project bringing potable water to 60,000 people near Essakane; advanced Phase II to bring potable water to an additional 75,000 people.

-

Contributed $250,000 to UNICEF to support the International ACT-A / COVAX Emergency Response.

-

Investing $950,000 in a 4-year Giants of Africa program, aimed at encouraging the development of youth through sports in Burkina Faso, Senegal and Mali.

-

Sponsored the Artemis Project, which aims to promote female business owners and entrepreneurs in the mining sector.

-

Received Mining Association of Canada's prestigious Towards Sustainable Mining® (TSM) Excellence Award in the Environmental category for innovative recycling of plastic at Essakane.

People and Governance

-

Daniella Dimitrov was appointed Executive Vice President & Chief Financial Officer, effective March 29, 2021. Ms. Dimitrov succeeds Carol Banducci, who retired on March 31, 2021.

-

Anne Marie Toutant and Deborah Starkman were appointed as independent directors of the Company, effective December 14, 2020.

-

John Caldwell stepped down from the Board, effective January 4, 2021, and Mahendra Naik and Sybil Veenman are not standing for re-election at the upcoming meeting of shareholders.

-

The Board has adopted board renewal and diversity guidelines. Following the annual general meeting on May 4, women will represent 29% of directors, or 33% of independent directors of the Board. The average tenure of the Board will be approximately 5.5 years (down from approximately 11 years).

FINANCIAL RESULTS AND FINANCIAL POSITION

-

Sold 153,000 ounces at an average realized gold price of $1,781 per ounce, resulting in gold margin of $729 per ounce.

-

Gross profit for the first quarter 2021 was $44.2 million, an increase of $12.3 million compared to the prior year quarter, primarily due to higher realized prices partially offset by lower sales volumes.

-

Net earnings for the first quarter 2021 were $19.5 million, or $0.04 per share, compared to net loss of $34.4 million, or $0.07 per share in the prior year quarter. The increase was primarily due to the gain on the sale of the Company's non-core royalties ($35.7 million) in March 2021, a decrease in loss on non-hedge derivatives and warrants and higher gross profit, partially offset by higher other expenses and higher income taxes.

-

Adjusted net earnings were $6.2 million, or $0.01 per share, compared to adjusted net loss in prior year quarter of $4.9 million, or $0.01 per share.

-

Net cash from operating activities in the first quarter 2021 was $101.7 million, up $57.7 million from the prior year quarter, primarily due to higher earnings, favourable movements in non-cash working capital items ($38.8 million) primarily resulting from receipts for value-added taxes and a decrease in inventory and non-current ore stockpiles. Mine-site free cash flow was $89.5 million for the first quarter 2021 compared to $14.1 million in the prior year quarter.

-

Cash, cash equivalents and short-term investments of $967.8 million at March 31, 2021.

-

Total available liquidity at March 31, 2021 of $1,466 million, providing appropriate headroom to finance the Company's ongoing development activities, with the maturity date of $490 million of the Company's largely undrawn $500 million credit facility extended to January 31, 2025.

-

Entered into gold sale prepayment arrangement for 50,000 gold ounces at an average price of $1,753 per ounce and at a cost of 4.44% per annum, for total prepayment to the Company of $80.3 million in 2022 with physical delivery by the Company of such ounces to the counterparties in 2024. This transaction effectively rolls one-third of the Company's 2019 prepay arrangement from 2022 to 2024, with the new gold deliveries occurring after the completion of the Côté Gold Project.

OPERATIONS AND PROJECTS

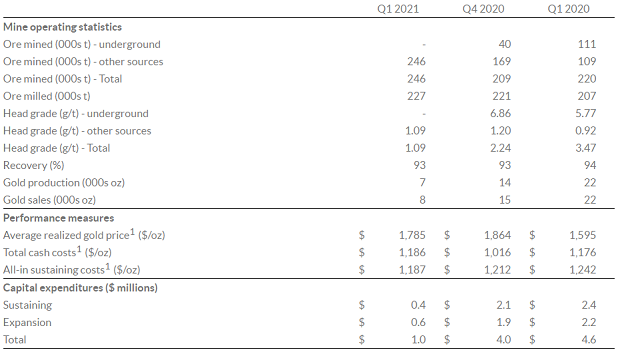

Abitibi District, Canada - Westwood Mine (IAMGOLD interest - 100%)

1 This is a non-GAAP measure. Refer to the non-GAAP performance measures section of the MD&A.

Following the seismic event in the fourth quarter 2020, the Company announced a temporary reduction in the underground workforce of approximately 70% and the Westwood underground operations were placed on care and maintenance. A business recovery plan has been in progress and rehabilitation work has been ongoing with a small crew. The Company announced on April 22, 2021 that it had started a staged recall of employees. Activities will be focused on training and rehabilitation work in the second quarter 2021. Mill feed in 2021 is being sourced from the lower grade Grand Duc open pit, located 3 kilometres from the Westwood mill complex.

Outlook

Rehabilitation activities are expected to ramp up following the workforce recall in the second quarter. The Company expects to make a decision in the second quarter with respect to a possible targeted safe restart, which would commence with the East Zone and progress to the other zones in a staged manner. The business continuity assessment in the West Zone will be ongoing. The production guidance range for the Westwood complex for 2021 remains 45,000 to 65,000 ounces assuming a restart of underground mining in the second half of the year. Mill feed will continue to be sourced from the Grand Duc open pit and would be supplemented with underground material when the Westwood mine restarts.

Exploration

Drilling to support the geotechnical study for the Fayolle property, acquired in 2020, commenced during the quarter. Permitting, environmental studies and sampling activities are ongoing.

During the first quarter 2021, the Company completed approximately 950 metres of diamond drilling focused on both geotechnical and expansion drilling on the Lac Gamble Zone at its optioned Rouyn Gold Project.

Côté Gold Project (IAMGOLD interest - 64.75%)

During the first quarter 2021, the earthwork contractors continued work on road widening and overburden stripping, and commenced work on the water management infrastructure for the tailings management facility. Temporary camps are now fully erected and commissioned. Construction of the permanent camp is underway, which will serve to supplement peak construction workforce requirements. Of the total number of rooms planned, approximately 50% have been installed to-date, meeting the current requirements of the site.

At March 31, 2021, detailed engineering reached 83% and overall the project was 18% complete. Procurement and expediting of major equipment contracts are progressing with the contract for the mining fleet being awarded in the first quarter.

The Company's share of total project costs (exclusive of sunk costs) from July 1, 2020, net of leasing, is in the range of $875 million to $925 million. The Company's share of leasing is expected to be approximately $120 million, assuming a go-forward USDCAD exchange rate of 1.30 (originally approximately $80 million at an exchange rate of 1.35). The Company had incurred and expended costs of $67.1 million and $49.5 million, respectively, for the first quarter 2021 and $142.8 million and $101.6 million, respectively, since July 1, 2020.

In line with company-wide COVID-19 safety protocols, additional steps have been taken to protect the health and safety of employees and contractors, including antigen testing at the Sudbury and Timmins bus terminals in order to detect COVID-19 cases before individuals reach the site. To date, the Company has not experienced impacts to schedule due to COVID-19.

Outlook

The work plan will continue to focus on earthwork construction, haul road construction and water management infrastructure around the pit site. A portion of the permanent camp will be commissioned during the second quarter 2021 to increase the current capacity on site, with the camp expected to be fully commissioned in the third quarter 2021. Civil works are underway at the plant site and concrete activities, as well as initial pre-stripping work in the pit, are expected to be initiated during the second quarter 2021 as planned.

The Company's share of the remaining total costs are expected to be expended as follows: 2021 - $319 million (including $307 million of capital expenditures), 2022 - $380 to $420 million and 2023 - $75 million to $85 million.

Exploration

During the first quarter 2021, the Company reported further assay results from its ongoing delineation drilling program at the Gosselin zone, centered 1.5 kilometres northeast of the Côté gold deposit. Drilling highlights included: 417.3 metres grading 0.95 g/t Au (including 197.3 metres grading 1.60 g/t Au), 353.0 metres grading 1.04 g/t Au (including 46.0 metres grading 3.39 g/t Au), 86.0 metres grading 5.57 g/t Au (including 30.35 metres grading 14.70 g/t Au) and 101.6 metres grading 1.86 g/t Au (see news releases dated January 21 and March 8, 2021).

The Company completed approximately 3,000 metres of diamond drilling and spent $0.9 million during the quarter, compared to $0.7 million in the fourth quarter 2020, primarily on continued delineation diamond drilling to support the completion of an initial resource estimate, expected in the second half of 2021. In 2021, the Company expects to spend $2.8 million on greenfield exploration related to the Côté property, including the Gosselin zone. This expenditure is not part of construction costs.

Chibougamau District, Canada

During the first quarter 2021, the Company commenced a ground induced polarization geophysical survey to help guide the targeting for future drilling programs at its 75%-owned Nelligan Gold Project. Approximately 8,000 to 10,000 metres of diamond drilling is planned for 2021 to support the completion of an updated resource estimate expected in the second half of 2021.

Conference Call

A conference call will be held on Tuesday, May 4, 2021 at 8:30 a.m. (Eastern Time) for a discussion with management regarding IAMGOLD's operating performance and financial results for the first quarter 2021. A webcast of the conference call will be available through IAMGOLD's website at www.iamgold.com.

Conference Call Information:

North America Toll-Free: 1-800-319-4610 or International number: 1-604-638-5340

A replay of this conference call will be available for one month following the call by dialing:

North America toll-free: 1-800-319-6413 or International number: 1-604-638-9010, passcode: 6571#.

About IAMGOLD

IAMGOLD is a mid-tier gold mining company operating in three regions globally: North America, South America and West Africa. Within these regions the Company is developing high potential mining districts that encompass operating mines, construction, development, and exploration projects. The Company's operating mines include Westwood in Canada, Rosebel (including Saramacca) in Suriname and Essakane in Burkina Faso. A solid base of strategic assets is complemented by the Côté Gold construction project in Canada, the Boto Gold development project in Senegal, as well as greenfield and brownfield exploration projects in various countries located in the Americas and West Africa.

IAMGOLD employs approximately 5,000 people. IAMGOLD is committed to maintaining its culture of accountable mining through high standards of Environmental, Social and Governance practices, including its commitment to Zero Harm®, in every aspect of its business. IAMGOLD (www.iamgold.com) is listed on the New York Stock Exchange (NYSE: IAG) and the Toronto Stock Exchange (TSX: IMG) and is one of the companies on the JSI index3.

For further information please contact:

Indi Gopinathan, VP, Investor Relations & Corporate Communications, IAMGOLD Corporation

Tel: (416) 360-4743 Mobile: (416) 388-6883

Philip Rabenok, Senior Analyst, Investor Relations, IAMGOLD Corporation

Tel: (416) 933-5783 Mobile: (647) 967-9942

Toll-free: 1-888-464-9999 info@iamgold.com