Moneta Porcupine Mines Inc.

MONETA ANNOUNCES POSITIVE RESULTS FROM PRELIMINARY ECONOMIC ASSESSMENT STUDY ON SOUTH WEST DEPOSIT

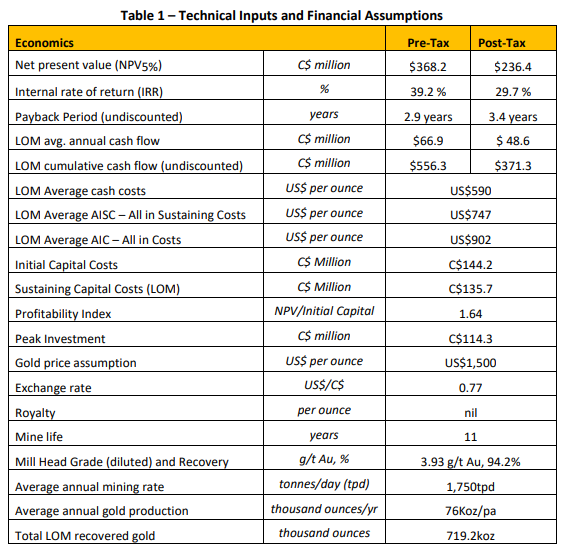

Toronto, Ontario – September 09, 2020 - Moneta Porcupine Mines Inc. (TSX:ME) (OTC:MPUCF) (XETRA:MOP) (“Moneta” or the “Company”) is pleased to announce the excellent results from the Company’s Preliminary Economic Assessment (“PEA”) of the South West deposit at its 100% owned Golden Highway Project located in Timmins, Ontario. The PEA study demonstrates robust economics and is based on a stand-alone, owner-operated mine and mill with an 11-year mine life which produced an after-tax Net Present Value (“NPV”) of C$236 million using a 5% discount rate. The financial model shows an after-tax Internal Rate of Return (“IRR”) of 30% and a capital payback period of 3.4 years. All amounts are shown in Canadian dollars unless otherwise stated.

South West Deposit PEA Highlights

• After Tax Net Present Value at a 5% discount rate (“NPV5%”) of C$236 million and after-tax Internal Rate of Return (“IRR”) of 30% at US$1,500/oz gold and exchange rate of US$0.77/C$

• C$371 million after tax cash flow over the life of mine

• 75,700 ounces annual production during full production for 719,000 ounces total gold production

• Peak gold production of 85,700 ounces per annum

• Cash cost of US$590 per ounce and all in sustaining cost of US$747 per ounce gold

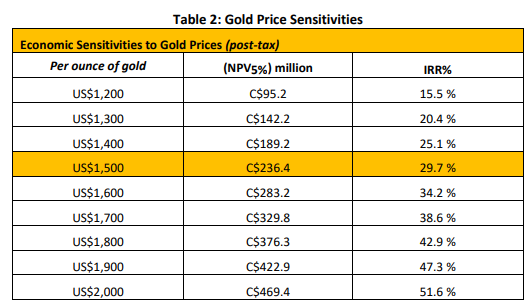

• Highly leveraged to the gold price with after tax NPV5% of C$423 million and 47% IRR at US$1,900 per ounce gold

• Initial capital of C$144 million, and sustaining capital of C$136 million

• After-tax discounted pay-back of 3.4 years, with an 11 year mine life

• Attractive alternative Toll Milling development option with after-tax NPV5% of C$197 million and IRR of 44% at US$1,500 gold with initial capital costs of C$65 million

• Potential to expand production from additional deposits located on the Golden Highway Project

“We are extremely pleased with the positive results from this preliminary economic assessment of the South West deposit and its robust project economics including an NPV of C$236 million and IRR of 30% at US$1,500 ounce gold and a 5% discount rate,” commented Gary O’Connor, CEO. “The PEA study which assumed underground extraction of our South West deposit only has shown the potential to produce up to 85,700 ounces per annum for a total of 719,000 ounces life of mine at an attractive cash cost of US$590 per ounce, with low initial capital of C$144 million repaid over 3.4 years. The excellent economics are afforded by the project’s location in Canada’s most prolific gold mining camp, Timmins Ontario, with extensive existing infrastructure and experienced and available services and workforce. The South West deposit would generate C$371 million after tax cash flow over the life of mine. We will now be able to focus on expanding the adjacent deposits and discovering new zones of gold mineralization to continue to add value to the Golden Highway Project with a growing resource base. In addition to our base case development plan, we also have a highly attractive development option which involves minor initial capital expenditure, shorter development time line and negates the need to permit and build our own processing plant and associated infrastructure assuming Toll Milling of the ore.”

Mr. O’Connor commented, “In addition to the highly successful PEA on our South West deposit, we have 5 additional gold deposits on the Golden Highway project and have discovered three new mineralized areas, Westaway, Halfway and South Basin in 2020, of which a maiden resource for Westaway is planned for this year. During 2020 we have doubled the footprint of continuous mineralization from 2 kilometres to 4 kilometres at Golden Highway. In addition, we have discovered regional scale potential with gold mineralization discovered over 1.2 km on the southern margins of the South Basin with a potential strike length of 12 km.”

PEA: TECHNICAL INPUT AND FINANCIAL RESULTS SUMMARY

The average annual mining rate and gold production is calculated for years 3 to 11 of mining when mining is at full production rates. All other parameters are measured for life of mine (LOM) and include the 2 year ramp up period. No royalties or encumbrances are attributed to any of the South West deposit. The PEA was prepared in accordance with National Instrument 43-101 (“NI 43-101”) by Micon International Limited (“Micon”) of Toronto, Canada with an effective date of September 09, 2020. The Company will file the PEA on SEDAR at www.sedar.com in accordance with NI 43-101 within 45 days. This preliminary economic assessment is preliminary in nature; it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized.

GOLD PRICE SENSITIVITIES

The following table demonstrates the post-tax sensitivities of NPV and IRR to gold price per ounce. The base case, highlighted in the table below, assumes US$1,500 per ounce of gold and an exchange rate of 0.77 (US$/C$):

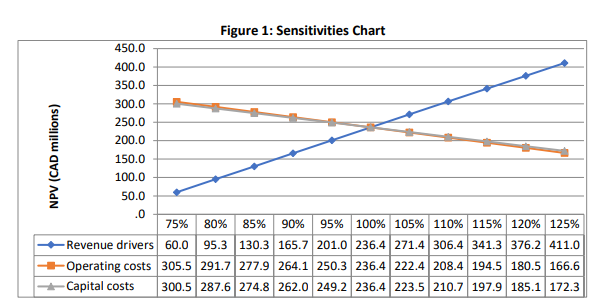

The Project economics are most sensitive to revenue drivers (gold prices, gold grade and recovery). Operating and capital cost sensitivities are similar and are also presented in Figure 1.

OPPORTUNITIES

The PEA outlined several initiatives that may enhance the Project including:

• Potential to mine additional ounces from the current resource estimate from the developed underground infrastructure with more selective mining

• Opportunity to drill out additional gold mineralization from underground not currently in the mineral resource estimate

• Include lower grade gold mineralized haloes and veins systems not currently in the resource model which will lower the amount of dilution

• With modelling of lower grade veins and haloes, development through these areas could potentially be processed through the mill. Current mine plan assumes the development in these areas carries no grade

• Optimize the metallurgical recoveries with more test work to potentially increase the overall gold recoveries

• The possibility of increasing the tonnes mined per year with longer/additional mining shifts

• Additional mineral resources located adjacent to South West and currently the focus of ongoing exploration and resource updates by Moneta are not covered in this PEA. Additional resources and mine plans have the potential to significantly increase production from the project

• Optimization of the mine plan and mine production schedule to potentially decrease costs and increase production

NEXT STEPS

• The South West resource requires additional infill drilling to upgrade inferred resources to measured and indicated categories

• Continue and expand the current environmental base line studies and data collection

• Drill known open extensions of the resource to expand the potential size of the South West deposit

• Additional metallurgical recovery and environmental test work is required to better define the process flow sheet

• Drill out adjacent gold deposits to enable additional resources to be considered in any further development plans

• Drill test exploration targets to continue to grow the resource base

• Hydrological and geotechnical studies will be required

• Commence pre-feasibility level mine engineering and development studies upon completion of resource expansion and infill drill programs

About Moneta

The Company holds a 100% interest in 6 core gold projects strategically located along the DestorPorcupine Fault Zone in the Timmins Gold Camp with over 85 million ounces of past gold production. The projects consist of the Golden Highway, North Tisdale, Nighthawk Lake, DeSantis East, Kayorum and Denton projects. The Golden Highway Project covers 12 kilometres of prospective ground along the DPFZ of which 4 km hosts the current 43-101 mineral resource estimate comprised of an indicated resource of 676,900 ounces gold contained within 5.11 Mt @ 4.12 g/t Au and a total of 1,386,600 ounces gold contained within 10.78 Mt @ 4.00 g/t Au in the inferred category at a 2.60 g/t Au at South West and 3.00 g/t Au cut-off for the other deposits.

Source: https://www.monetaporcupine.com/uploads/ME-PR-20-2020-.pdf

|