Moneta Porcupine Mines Inc.

MONETA FILES NI 43-101 TECHNICAL REPORT ON THE PRELIMINARY ECONOMIC ASSESSMENT STUDY OF THE SOUTH WEST DEPOSIT, GOLDEN HIGHWAY PROJECT

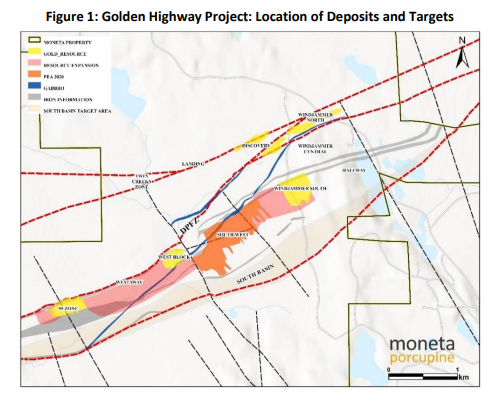

Toronto, Ontario – October 22, 2020 - Moneta Porcupine Mines Inc. (TSX:ME) (OTC:MPUCF) (XETRA:MOP) (“Moneta” or the “Company”) is pleased to announce the filing of the technical report covering the Preliminary Economic Assessment “PEA” study on the South West deposit located in the Golden Highway Project, 110 km east of Timmins, Ontario.

“We are pleased to have filed the Technical Report which supports the positive results from the preliminary economic assessment of the South West deposit and its robust project economics including an NPV5% of C$236 million and IRR of 30% at US$1,500 ounce gold,” commented Moneta CEO, Gary O’Connor. “The PEA study assumed underground extraction at only our South West deposit and has shown the potential to produce up to 85,700 ounces per annum at a cash cost of US$590 per ounce, with low initial capital of C$144 million repaid over 3.4 years with annual after tax cash flow of C$49 million.

The excellent economics are afforded by the project’s location in Canada’s most prolific gold mining camp, Timmins Ontario, with extensive existing infrastructure and experienced and available services and workforce. We are now focussing on expanding the adjacent deposits and discovering new zones of gold mineralization with the start of our new 20,000 m drill program designed to continue to add value to the Golden Highway Project with a growing resource base. In addition to following up the three new discoveries from earlier this year, Moneta is currently updating the Windjammer South, 55 and new Westway resource estimates, expected to be released before the end of 2020.”

The Technical Report dated October 21, 2020 was prepared in accordance with National Instrument 43-101 standards for Disclosure for Mineral Projects (“NI 43-101”) and has been filed on both SEDAR and the Company’s website (www.monetaporcupine.com) and is now available for review.

The Report was prepared by Mr. B. Terrence Hennessey, P.Geo., Mr. Richard M. Gowans, P.Eng., Mr.Barnard Foo, P.Eng., Mr. Christopher Jacobs, MIMMM, Mr. David Makepeace, P.Eng., and Mr. Nigel Fung, P.Eng., of Micon International Ltd. of Toronto, Canada, who are considered “Qualified Persons” under NI 43-101. The new technical report covers and supports the technical and scientific disclosure as contained in the new PEA study reported in Moneta’s press release dated September 09, 2020 entitled “Moneta announces positive results from Preliminary Economic Assessment study on South West Deposit.”

About Moneta

The Company holds a 100% interest in 6 core gold projects strategically located along the Destor-Porcupine Fault Zone in the Timmins Gold Camp with over 85 million ounces of past gold production. The main Golden Highway Project covers 12 km of prospective ground along the DPFZ of which 2 km hosts the current 43-101 mineral resource estimate comprised of an indicated resource of 676,900 ounces gold contained within 5.11 Mt @ 4.12 g/t Au and a total of 1,386,600 ounces gold contained within 10.78 Mt @ 4.00 g/t Au in the inferred category at a 2.60 g/t Au at South West and 3.00 g/t Au cut-off for the other deposits. A PEA study completed on the South West Deposit, one of 6 deposits located on the Golden Highway project, highlighted an 11-year mine life with an after-tax NPV5% of C$236MM, IRR of 30% and a 3.4 year payback, generating C$371MM LOM after-tax free cash flow. The project envisaged underground mining producing 76,000 oz/pa at a cash cost of US$590/oz.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Gary V. O’Connor, CEO

416-357-3319

Linda Armstrong, Investor Relations

647-456-9223

Source: https://www.monetaporcupine.com/uploads/ME-PR-23-2020.pdf

|