New Gold Reports 2021 First Quarter Results

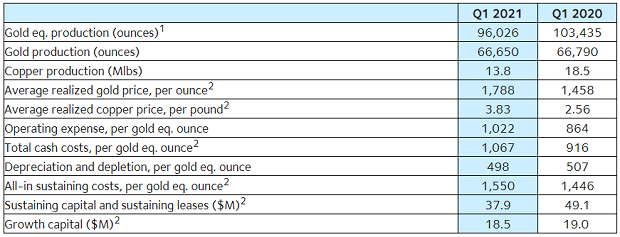

- Total production for the first quarter was 96,026 gold equivalent1 ("gold eq.") ounces (66,650 ounces of gold, 187,224 ounces of silver and 13.8 million pounds of copper).

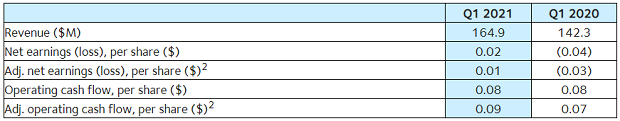

- Revenues for the quarter were $165 million.

- Operating expense for the quarter was $1,022 per gold eq. ounce.

- Total cash costs2 for the quarter were $1,067 per gold eq. ounce.

- All-in sustaining costs2 for the quarter were $1,550 per gold eq. ounce.

- Average realized gold price2 of $1,788 per ounce.

- Net earnings for the quarter were $15 million($0.02 per share).

- Adjusted net earnings2 for the quarter were $8 million ($0.01 per share).

- Cash generated from operations for the quarter $53 million ($0.08 per share). Cash generated from operations for the quarter, before changes in non-cash operating working capital2, was $64 million($0.09 per share).

- At the end of the quarter, the Company had a cash position of $131 million and a strong liquidity position of $435 million.

- Revenues for the quarter were $165 million, an increase compared to the prior-year period due to higher gold and copper prices, which was partially offset by lower sales volume as underground operations at New Afton continued to ramp-up during the quarter following the tragic mud-rush incident in February.

- Operating expenses for the quarter were higher than the prior-year period due to the strengthening of the Canadian dollar and costs related to the continued ramp-up of operations at New Afton.

- Net earnings for the quarter were $15 million ($0.02 per share), an increase compared to the prior-year period primarily due to higher revenue, lower depreciation and depletion and a gain on the revaluation of the Rainy River gold stream obligation and the New Afton free cash flow obligation to the Ontario Teacher's Pension Plan as a result of an increase in discount rates.

- Adjusted net earnings2 for the quarter were $8 million ($0.01 per share), an increase compared to the prior-year period primarily due to higher revenue and lower depreciation and depletion.

- Rainy River has implemented measures to mitigate and limit the spread of COVID-19 and to protect the well-being of its employees, contractors, their families, local communities, and other stakeholders. Measures include on-site testing and the use of contact tracing by the site team and through Public Health to isolate any infected individuals and limit further exposure. There are currently two active cases at the Rainy River Mine. All prior cases (including the ten individuals referenced in the April 21 news release, all of whom were confirmed as COVID-positive by the Northwestern Health Unit) have recovered following the applicable quarantine period. Further information on the Company’s response to COVID-19 is available via the following link: https://newgold.com/covid-19/.

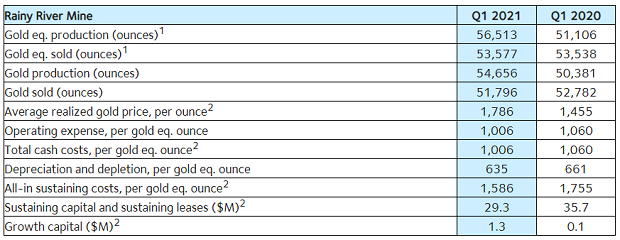

- First quarter gold eq.1 production was 56,513 ounces (54,656 ounces of gold and 133,730 ounces of silver). Lower grades were expected during the quarter as mining operations were focused on Phase 3 stripping to bring pit walls to the final pit limit. During the second half of the year, grades are expected to increase as the mine returns to Phase 2 area of the pit. The increase compared to the prior-year period is due to higher throughput.

- Operating expense and total cash costs2 were $1,006 per gold eq. ounce for the quarter, a decrease over the prior-year period primarily due to improved operational performance, partially offset by the strengthening of the Canadian dollar.

- Sustaining capital and sustaining lease2 payments for the quarter were $29 million, including $13 million of capitalized mining costs. The decrease compared to the prior-year period is mainly due to deferred construction capital programs completed in 2020. Sustaining capital spend during the quarter primarily included advancement of the planned annual tailings dam raise and capital maintenance.

- All-in sustaining costs2 were $1,586 per gold eq. ounce for the quarter, a decrease over the prior-year period primarily due to lower sustaining capital spend.

- Growth capital2 for the quarter $1 million, relating to the development of the underground Intrepid zone. At the end of the quarter, development of the decline towards the Intrepid underground ore zone had advanced 650 metres. The first ore level was accessed and approximately 155 metres of development in ore was completed with tonnes and grades mined reconciling with the block model and approximately 16,000 tonnes of development ore at 1.20 grams per tonne has been stockpiled.

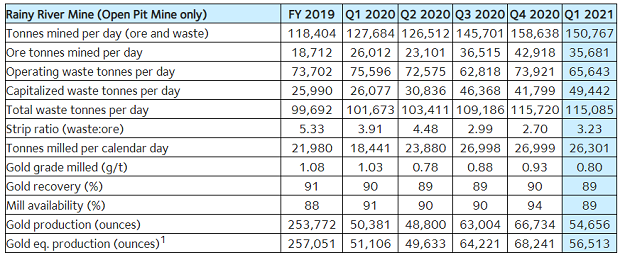

- During the quarter, the open pit mine achieved 150,767 tonnes per day, a decrease over the prior quarter, due to lower drilling rates as a result of extreme winter weather conditions, but in-line with the 2021 target of ~151,000 tonnes per day. Approximately 3.2 million ore tonnes and 10.4 million waste tonnes (including 4.4 million capitalized waste tonnes) were mined from the open pit at an average strip ratio of 3.23:1. During the second half of the year, the strip ratio is expected to decrease as operations return to Phase 2 area of the pit.

- The mill processed 26,301 tonnes per day for the quarter, slightly above plan and higher than the prior-year period. The mill continued to process ore directly supplied by the open pit combined with ore from the medium grade stockpile and processed an average grade of 0.80 grams per tonne at a gold recovery of 89%. Mill availability for the quarter averaged 89%, lower than the prior quarter due to planned maintenance activities.

- New Afton has implemented measures to mitigate and limit the spread of COVID-19 and to protect the well-being of its employees, contractors, their families, local communities, and other stakeholders. There are currently no active cases at the New Afton Mine. Further information on the Company’s response to COVID-19 is available via the following link: https://newgold.com/covid-19/.

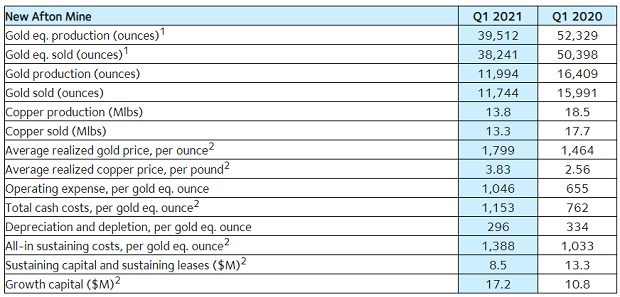

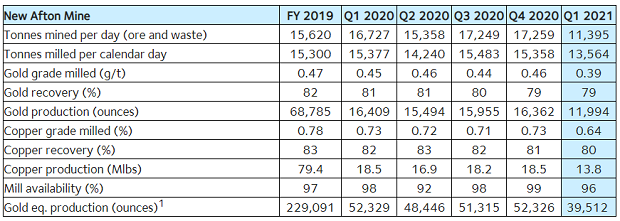

- First quarter gold eq.1 production was 39,512 ounces (11,994 ounces of gold, and 13.8 million pounds of copper). The decrease compared to the prior-year period is due to lower grades and lower throughput as a result of the mud rush incident.

- Operating expense and total cash costs2 for the quarter were $1,046 and $1,153 per gold eq. ounce, respectively. Operating expense and total cash costs2 per gold eq. ounce have increased compared to the prior-year period as operations were impacted due to the tragic mud rush incident that occurred in February and the strengthening of the Canadian dollar.

- Sustaining capital and sustaining lease2 payments for the quarter were $8 million, primarily related to B3 mine development and the advancement of the planned tailings dam raise.

- All-in sustaining costs2 were $1,388 per gold eq. ounce for the quarter, an increase over the prior-year period due to lower gold and copper sales volumes and higher total cash costs.

- Growth capital2 was $17 million for the quarter, primarily related to C-Zone development and the TAT project.

- During the quarter, C-Zone development advanced by approximately 820 metres and the project remains on track.

- The C-Zone permit process was initiated with the pre-application package submitted during the first quarter.

- The underground mine averaged 11,395 tonnes per day for the quarter, lower than previous quarters as underground operations continued to ramp-up during the quarter following the tragic mud-rush incident in February. Mining rates increased in March, averaging approximately 16,200 tonnes per day, near pre-incident mining rates.

- Upon the receipt of the Mines Act permit, which is expected later this quarter, B3 production will commence and ramp-up over the year as more draw points become accessible.

- During the quarter, the mill averaged 13,564 tonnes per day, and is currently incorporating the current surface stockpiles to supplement the overall lower tonnes mined. The mill processed lower than average gold and copper grades of 0.39 grams per tonne gold and 0.64% copper, respectively, with gold and copper recoveries of 79% and 80%, respectively.

- Participants may listen to the webcast by registering on our website at www.newgold.com or via the following link https://onlinexperiences.com/Launch/QReg/ShowUUID=86F834BF-D9B7-4993-A7DA-B27454E7FA65

- Participants may also listen to the conference call by calling toll free 1-833-350-1329, or 1-236-389-2426 outside of the U.S. and Canada, passcode 2491156

- A recorded playback of the conference call will be available until June 5, 2021 by calling toll free 1-800-585-8367, or 1-416-621-4642 outside of the U.S. and Canada, passcode 2491156. An archived webcast will also be available until June 5, 2021 at www.newgold.com

Source: https://www.newgold.com/investors/news-releases/news-details/2021/New-Gold-Reports-2021-First-Quarter-Results/default.aspx

|

As an integral part of New Gold’s Project Procurement team, the Project Buyer will provide support to the Capital Projects group.

The role of the Major Material Warehouse Technician is responsible for the managing of all the major materials (fuel, oils, mill reagents, tires, drilling materials etc.) to support the mine operations.

The Senior Inventory Management Analyst leads the management of Rainy River Mine Inventory to sustain site operations.

The role of Warehouse Technician is to ensure the efficient operation of all warehouse activities.

As a member of the New Gold Rainy River team, the Lead Environmental Technician demonstrates commitment and compliance with company Health & Safety, Environment and Social Responsibility policies and procedures.

The role of Mine operations Superintendent is to oversee the safe and efficient extraction of ore through the supervision and control of mining department activities such as budgeting, planning staffing and cost control.

The Senior Mine Engineer will provide clarity and focus for the engineering group to achieve and surpass the mine’s safety and production targets and to add value to the operation.

The Engineering & Construction Superintendent is expected to be a safety leader on site and thus will be required to demonstrate experience in executing work with a safety focus and an emphasis on human performance.

Groundwater monitoring, management and modeling is a critical component in Environmental management at New Afton.

Red Seal Industrial Mechanic (Millwright) provides skilled expertise, executing world class maintenance practices and lubrication techniques.