DENVER--(BUSINESS WIRE)-- Newmont Corporation (NYSE: NEM, TSX: NGT) reported gold Mineral Reserves (reserves) of 94.2 million attributable ounces for 2020 as compared to the Company’s adjusted1 95.7 million ounces at the end of 2019. Newmont exceeded its 2020 conversion target by replacing 80 percent of all depletion and maintaining its industry-leading position with the largest gold reserves.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210210005297/en/

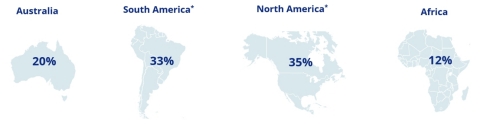

PERCENTAGE OF GOLD RESERVES BY JURISDICTION (North America includes 38.5 percent interest in Nevada Gold Mines; South America includes Newmont's 40 percent interest in Pueblo Viejo.)

“As the world’s leading gold company, Newmont has an exceptional history of exploration success and a track record of consistently delivering on our commitments,” said Tom Palmer, President and Chief Executive Officer. “In 2020, we added 6 million ounces of gold reserves overcoming the challenges of an unprecedented year. Newmont’s ability to replace reserves is underpinned by our disciplined operating model and world-class portfolio which will support stable production for decades to come.”

KEY HIGHLIGHTS AND DIFFERENTIATORS:

-

Industry’s largest gold Mineral Reserves of 94.2 million ounces

-

Over 90 percent of gold reserves in top-tier jurisdictions

-

Addition of 6 million ounces in 2020, approximately 5 million ounces added through drilling

-

Gold reserve life at operating sites of >10 years underpinned by a strong base at Boddington, Tanami, Ahafo, Yanacocha, Peñasquito, and Nevada Gold Mines (NGM), and further enhanced from our seven other operating mines and equity ownership in Pueblo Viejo

-

Significant gold reserves per share with 117 ounces per 1,000 shares, highest in the industry

-

Measured & Indicated gold Mineral Resources of 69.6 million ounces; Inferred of 31.6 million ounces

-

Significant exposure to copper with 6.9 million tonnes in reserves, 8.0 million tonnes in Measured & Indicated resources and 3.9 million tonnes in Inferred resources

-

Additional exposure to silver, zinc, and lead mainly at Peñasquito

PERCENTAGE OF GOLD RESERVES BY JURISDICTION

Newmont’s reserve base is a key differentiator with over 90 percent of gold reserves located in top-tier jurisdictions, an operating reserve life of more than 10 years and average reserve grade of 1.03 grams per tonne. In addition, Newmont has substantial exposure to other metals, with nearly 65 million gold equivalent ounces2 from copper, silver, zinc, lead and molybdenum.

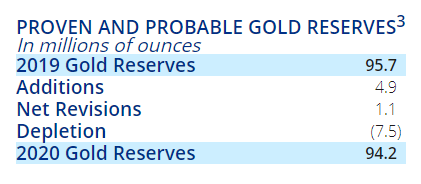

For 2020, Newmont reported 94.2 million ounces of gold Mineral Reserves slightly lower than prior year total of 95.7 million ounces after adjusting for the KCGM and Red Lake divestments. Depletion of 7.5 million ounces was largely replaced by additions before revisions of 4.9 million ounces and net revisions of 1.1 million ounces primarily from mine plan improvements.

Additions before revisions of 4.9 million ounces through exploration met the Company’s target despite challenges created by the pandemic with travel restrictions and additional safety protocols. Notable reserve additions for the year from Newmont’s operating sites included:

-

Ahafo added 0.8 million ounces primarily from drilling at Subika Underground

-

Tanami added 0.6 million ounces from additional drilling at Auron and Federation

-

Merian added 0.6 million equity ounces primarily through drilling at the Merian 2 Open Pit

-

Nevada Gold Mines added 0.8 million equity ounces and Pueblo Viejo added 0.7 million equity ounces

Favorable net revisions include 1.7 million ounces at Boddington due to the conversion of a layback in the North Open Pit from resource to reserve, partially offset by net negative revision at NGM of 0.4 million ounces and revisions at Ahafo, Cripple Creek & Victor (CC&V), and Musselwhite from mine model and design updates.

Newmont has continued to make progress at recently acquired sites, demonstrating the Company’s ability to improve operational performance and position operations for future growth through its proven operating model and disciplined technical standards. Highlights from select sites in 2020 net of revisions included:

-

Éléonore replaced depletion with reserves of 1.3 million ounces, as a result of positive drilling results along with cost improvements from Newmont’s Full Potential program

-

Porcupine more than offset depletion, with reserves of 3 million ounces largely due to progressing study work at the Pamour pit and nearly replacing depletion at the Borden Underground

-

Cerro Negro replaced depletion with reserves of 2.6 million ounces by advancing infill drilling at underground mines

Newmont’s 38.5 percent interest in NGM represented 17.4 million equity ounces of gold reserves at year end, as compared to 18.6 million equity ounces at the end of 2019. PV represented 4.1 million equity ounces in gold reserves at year end as compared to 3.8 million equity ounces at the end of 2019, representing Newmont’s 40 percent interest.

Gold reserve grade held constant at 1.03 grams per tonne compared to the prior year.

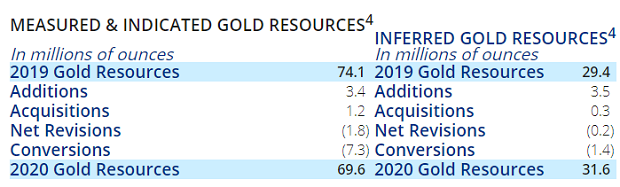

In 2020, Newmont reported Measured and Indicated gold Mineral Resources of 69.6 million ounces as compared to 74.1 million ounces in the prior year. Inferred gold Mineral Resources totaled 31.6 million ounces as compared to 29.4 million ounces in 2019. The impact from the pandemic required Newmont to prioritize drilling programs in existing operations due to travel restrictions and impacted our ability to progress greenfield resources.

Measured and Indicated Gold Mineral Resources added through exploration programs were 3.4 million ounces and included notable additions before revisions at Yanacocha of 0.5 million equity ounces and 0.3 million ounces at Ahafo South, Porcupine and Éléonore. Additionally, NGM added 0.9 million equity ounces.

Measured and Indicated Gold Mineral Resources reported negative revisions of 1.8 million ounces mainly driven by Porcupine of 2.4 million ounces primarily due to updated study work at the Dome and Pamour West Open Pits partially offset by positive revisions in North and South America.

Inferred Gold Mineral Resources added through exploration programs were 3.5 million ounces and included notable additions at Tanami of 1.4 million ounces, Merian of 0.5 million equity ounces, Cerro Negro of 0.5 million ounces and Ahafo South of 0.4 million ounces. Inferred Gold Mineral Resources had negative net revisions of 0.2 million ounces.

The formation of the MARA project at Agua Rica increased Measured and Indicated gold Mineral Resources by 1.2 million ounces and Inferred Gold Resources by 0.4 million ounces.

Newmont’s Measured and Indicated gold Mineral Resource grade decreased to 0.65 grams per tonne compared to 0.70 grams per tonne in the prior year largely from higher grade being converted to reserves. Inferred gold Mineral Resource grade of 0.65 grams per tonne increased compared with 0.63 grams per tonne from 2019.

OTHER METALS

Newmont’s base metal reserves were largely stable from 2019. Copper reserves increased slightly to 6.9 million tonnes from 6.8 million tonnes in 2019. Copper resources increased to 8.0 million tonnes of Measured & Indicated and 3.9 million tonnes of Inferred from 6.8 million tonnes of Measured and Indicated and 3.5 million tonnes of Inferred due to additions at Newmont’s Nueva Union joint venture and the formation of the Agua Rica joint venture.

Silver reserves decreased from 652 million ounces to 613 million ounces, largely due to depletion and the temporary suspension of exploration activities at Peñasquito from COVID-19 restrictions. Measured and Indicated silver resources were 482 million ounces and Inferred were 204 million ounces with revisions at Peñasquito, offsetting additions from Nueva Union and the MARA project at Agua Rica.

Lead reserves decreased to 1.3 million tonnes from 1.5 million, zinc reserves also decreased to 3.1 million tonnes from 3.4 million tonnes. In both cases the reduction was primarily due to depletion and the suspension of exploration activities at Peñasquito from COVID-19 restrictions. Measured & Indicated zinc resources decreased to 1.7 million tonnes from 1.9 million tonnes and Inferred zinc resources decreased to 0.8 million tonnes from 1.0 million tonnes. Measured & Indicated lead resources remained consistent at 0.8 million tonnes and Inferred lead resources decreased to 0.4 million tonnes from 0.5 million tonnes.

EXPLORATION OUTLOOK

Newmont’s total exploration expenditure is expected to be approximately $215 million in 2021 with 80 percent of total exploration investment dedicated to near-mine expansion programs and the remaining 20 percent allocated to the advancement of greenfield projects and innovation programs.

Additionally, Newmont’s share of exploration investment for its non-managed joint ventures will total approximately $35 million.

Geographically, the Company expects to invest approximately 28 percent in North America, 25 percent in South America, 20 percent in Australia and the remainder in Africa and other locations.

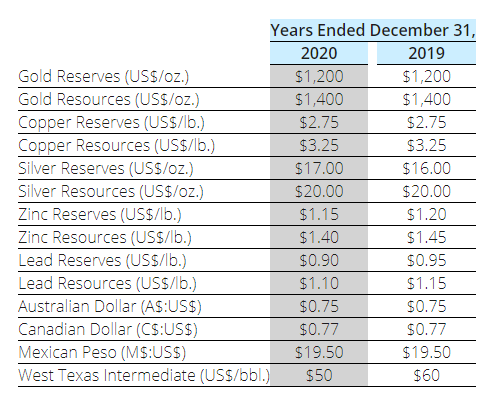

GOLD RESERVE SENSITIVITY

A $100 increase in gold price would result in an approximate four percent increase in gold reserves while a $100 decrease in gold price would result in an approximate seven percent decrease in gold reserves. These sensitivities assume an oil price of $50 per barrel (WTI), Australian dollar exchange rate of $0.75 and Canadian dollar exchange rate of $0.77.

For additional details on Newmont’s reported Gold, Copper, Silver, Zinc, Lead and Molybdenum Mineral Reserves and Mineral Resources, please refer to the tables at the end of this release.

KEY RESERVE AND RESOURCE ASSUMPTIONS:

About Newmont

Newmont is the world’s leading gold company and a producer of copper, silver, zinc and lead. The Company’s world-class portfolio of assets, prospects and talent is anchored in favorable mining jurisdictions in North America, South America, Australia and Africa. Newmont is the only gold producer listed in the S&P 500 Index and is widely recognized for its principled environmental, social and governance practices. The Company is an industry leader in value creation, supported by robust safety standards, superior execution and technical expertise. Newmont was founded in 1921 and has been publicly traded since 1925.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210210005297/en/

Media Contact

Courtney Boone, 303.837.5159

courtney.boone@newmont.com

Investor Contact

Eric Colby, 303.837.5724

eric.colby@newmont.com