VANCOUVER, BC, Nov. 4, 2020 /CNW/ - Pan American Silver Corp. (NASDAQ: PAAS) (TSX: PAAS) ("Pan American" or the "Company") today reported unaudited results for the third quarter ended September 30, 2020 ("Q3 2020"). Pan American's unaudited condensed interim consolidated financial statements and notes ("financial statements"), as well as Pan American's management's discussion and analysis ("MD&A") for the three and nine months ended September 30, 2020, are available on Pan American's website at panamericansilver.com and on SEDAR at www.sedar.com.

"Low operating costs and strong precious metal prices contributed to robust mine operating earnings of $124.6 million in Q3," said Michael Steinmann, President and Chief Executive Officer. "All operations are running and projects are proceeding. We have replenished the heap leach inventories drawn down during the mine suspensions in Q2 of this year, are nearing completion of the first of two ventilation raises at La Colorada, which will re-open access to the high-grade area of the mine, and have started processing the high grade ore from the COSE mine at our Manantial Espejo plant."

Added Mr. Steinmann: "We have generated strong operating cash flow year-to-date of approximately $292 million. In line with our capital allocation priorities, we have substantially reduced debt, with only $60 million drawn on our Credit Facility, as of today. We are aiming to have no bank debt by the end of the year. We are also increasing the dividend for the second time this year, raising the quarterly dividend by 40% to $0.07 per common share."

Operations Review and Impact of COVID-19

During Q3 2020, seven of Pan American's nine operations were operating with limited workforce levels in order to accommodate COVID-19 related protocols. Two of the Company's operations, Huaron and Morococha in Peru, were suspended for most of Q3 2020, having previously been returned to care and maintenance on July 20, 2020, because of an increase in workers testing positive for COVID-19. The Company began gradually redeploying its workforce at these mines over the last two weeks of September after intensive health screenings and testing. Huaron and Morococha resumed operations at the end of Q3 2020. Pan American continues to enforce protocols to help protect the health and safety of our workforce during the COVID-19 pandemic.

Pan American is engaging with its communities to better understand the effects of the COVID-19 pandemic on its residents and how we can support them during this time. In Q3 2020, Pan American entered into a $1.5 million partnership commitment with UNICEF Canada to provide health and education to vulnerable children in Latin America affected by the pandemic. In addition, our Shahuindo mine donated an oxygen plant to the Province of Cajabamba in Peru, as part of Pan American's commitment to support its local communities.

Q3 2020 Highlights:

-

Revenue was $300.4 million, primarily reflecting lower quantities of metal sold, partially offset by strong realized precious metal prices. The Company recorded a $79.8 million increase in inventories during Q3 2020, of which approximately $25.0 million was in the form of dore and finished inventories. Revenue associated with these dore inventories were not recorded in Q3 2020 due to timing of shipments, and will be reflected in revenue in the normal course. The remaining increase in inventories largely resulted from the replenishment of the heap leach operations at Dolores, Shahuindo and La Arena, where inventories were drawn down during the mine suspensions earlier in 2020; these inventories, equivalent to about 30,000 ounces of gold and 0.5 million ounces of silver, were replenished during Q3 2020.

-

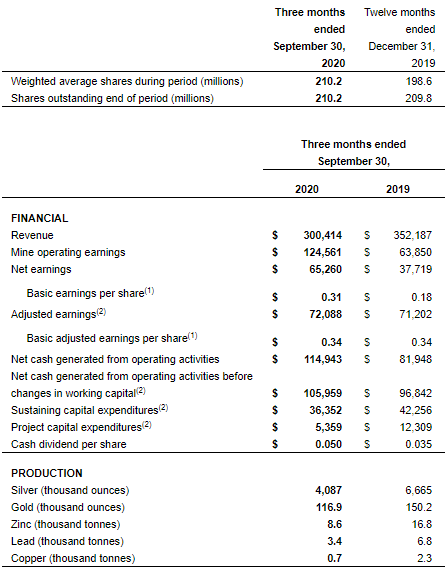

Net income was $65.3 million ($0.31 basic income per share). Net income includes $13.1 million of investment income and $27.1 million of mine care and maintenance costs, largely incurred from the suspensions of Huaron and Morococha, which restarted operations at the end of Q3 2020.

-

Adjusted earnings of $72.1 million ($0.34 basic adjusted earnings per share) excludes the $20.5 million of mine care and maintenance costs related primarily to the Huaron and Morococha suspensions.

-

Net cash generated from operations was $114.9 million and includes $9.0 million source of cash from working capital changes.

-

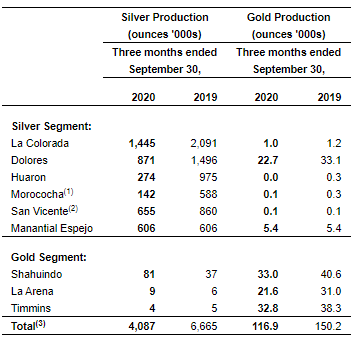

Consolidated silver production was 4.1 million ounces. Silver production was impacted by the COVID-19 related suspensions of Huaron and Morococha, lack of access to high-grade ore at La Colorada due to the delay in completing a ventilation project, in-process inventory build-up on the Dolores pads following draw downs of those inventories in Q2 2020, and reduced operating capacities at the other mines on account of adopting stringent COVID-19 protocols. Those factors also affected base metal production.

-

Consolidated gold production was 116.9 thousand ounces, primarily reflecting the expected replenishment of in-process inventories at the heap leach operations following the draw down of inventories that occurred during the COVID-19 related suspensions earlier in 2020. In addition, reduced operating capacities on account of COVID-19 protocols and adjustments being made to the mining methods at the Timmins Bell Creek mine reduced gold production.

-

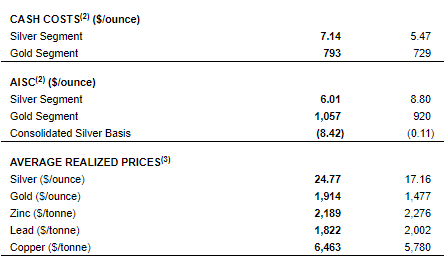

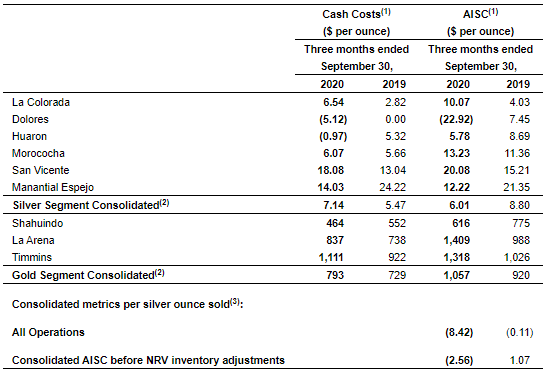

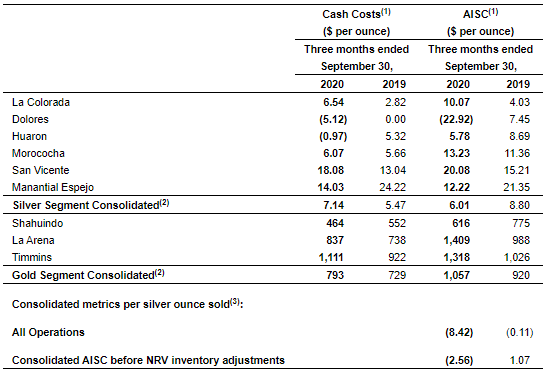

Silver Segment Cash Costs and All-in Sustaining Costs ("AISC") were $7.14 and $6.01 per silver ounce sold, respectively. Net realizable value ("NRV") inventory adjustments reduced Silver Segment AISC by $5.96 per ounce.

-

Gold Segment Cash Costs and AISC were $793 and $1,057 per gold ounce sold, respectively.

-

Consolidated AISC, including gold by-product credits from the Gold Segment mines, were $(8.42) per silver ounce sold.

-

Capital expenditures totaled $41.7 million, comprised of $36.4 million of sustaining capital and $5.4 million of project capital.

-

During Q3, Pan American repaid $110.0 million on its four-year, $500.0 million revolving Credit Facility (the "Credit Facility"). At September 30, 2020, the Company had $90.0 million drawn on its Credit Facility, cash and short-term investment balances of $231.6 million and working capital of $465.6 million. Total debt was $129.8 million, including $34.3 million of lease liabilities and $5.6 million of loans in Peru. In October 2020, the Company repaid an additional $30.0 million on the Credit Facility and plans to repay the remaining balance of $60.0 million by the end of 2020.

-

The Board of Directors has approved an increase in the quarterly cash dividend from $0.05 to $0.07 per common share, or approximately $14.7 million in aggregate cash dividends per quarter, payable on or about November 27, 2020, to holders of record of Pan American's common shares as of the close on November 16, 2020. Pan American's dividends are designated as eligible dividends for the purposes of the Income Tax Act (Canada). As is standard practice, the amounts and specific distribution dates of any future dividends will be evaluated and determined by the Board of Directors on an ongoing basis.

-

Relative to the guidance provided on August 5, 2020, management has maintained its 2020 Guidance for gold and base metal production, silver segment and gold segment Cash Costs and AISC, and consolidated silver basis AISC, while revising its estimates for 2020 silver production and capital expenditures; see the "Guidance" section of this news release for further information.

Cash Costs, AISC, adjusted earnings, basic adjusted earnings per share, sustaining capital, project capital, working capital, total debt, and total available liquidity are not generally accepted accounting principle ("non-GAAP") financial measures. Please refer to the "Alternative Performance (non-GAAP) Measures" section of this news release for further information on these measures.

CONSOLIDATED RESULTS

(1) Per share amounts are based on basic weighted average common shares.

(2) Non- GAAP measures: adjusted earnings, basic adjusted earnings per share, and net cash generated from operating activities before changes in working capital are non-GAAP financial measures. Please refer to the "Alternative Performance (non-GAAP) Measures" section of this news release for further information on these measures.

(3) Metal prices stated are inclusive of final settlement adjustments on concentrate sales.

INDIVIDUAL MINE OPERATING PERFORMANCE

(1) Morococha data represents Pan American 92.3% interest in the mine's production.

(2) San Vicente data represents Pan American 95.0% interest in the mine's production.

(3) Totals may not add due to rounding.

(1) Cash Costs and AISC are non-GAAP measures. Please refer to the section "Alternative Performance (Non-GAAP) Measures" of the MD&A for the period ended September 30, 2020 for a detailed description of these measures and where appropriate a reconciliation of the measure to the Q3 2020 financial statements.

(2) Silver segment Cash Costs and AISC are calculated net of credits for realized revenues from all metals other than silver and are calculated per ounce of silver sold. Gold segment Cash Costs and AISC are calculated net of credits for realized silver revenues and are calculated per ounce of gold sold. Consolidated AISC is based on total silver ounces sold and are net of by-product credits from all metals other than silver.

(3) Consolidated silver basis total is calculated per silver ounce sold with total gold revenues included within by-product credits. G&A costs are included in the consolidated AISC, but not allocated in calculating AISC for each operation.

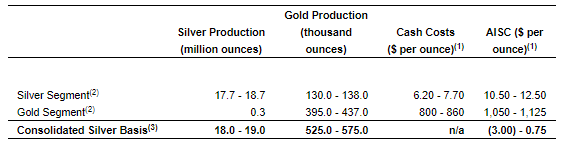

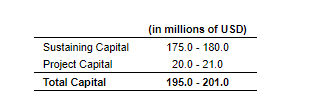

2020 GUIDANCE

The following table provides management's guidance for 2020, as at November 4, 2020. Relative to the guidance provided on August 5, 2020, management has maintained its guidance for gold and base metal production, silver segment and gold segment Cash Costs and AISC, and consolidated silver basis AISC. Management has reduced its estimate for 2020 silver production from 19.0 to 22.0 million ounces to 18.0 to 19.0 million ounces, as a result of an inability to access high-grade ore at La Colorada due to the delay in completing the first ventilation raise, and reduced underground mining rates at our Manantial Espejo operation; both related to the impact of COVID-19 protocols.

These estimates are forward-looking statements and information that are subject to the cautionary note associated with forward-looking statements and information at the end of this news release.

Annual Production, Cash Costs and AISC Guidance

(1) Cash Costs and AISC are non-GAAP measures. Please refer to the section "Alternative Performance (Non-GAAP) Measures" of the MD&A for the period ended September 30, 2020, for a detailed description of these calculations and a reconciliation of these measures to the Q3 2020 financial statements. The Cash Costs and AISC forecasts assume the realized prices and exchange rates provided in the MD&A for the period ended June 30, 2020.

(2) As shown in the detailed quantification of consolidated AISC, included in the "Alternative Performance (Non-GAAP) Measures" section of the MD&A for the period ended September 30, 2020, corporate general and administrative expense, and exploration and project development expense are included in consolidated (silver basis) AISC, but are not allocated amongst the operations and thus are not included in either the silver or gold segment totals.

(3) Consolidated total is calculated per silver ounce sold with gold revenues included in the by-product credits.

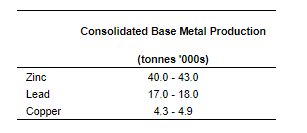

Management's guidance for zinc, lead and copper production is unchanged, as provided in the following table:

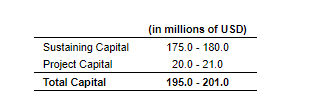

Capital Expenditures Guidance

Based on capital expenditures to date, which reflect COVID-19 related delays, and those expected for the remainder of 2020, Management is reducing the forecast annual expenditures by approximately $15.0 million. These reductions reflect the deferral of certain capital investments.

Third Quarter 2020 Unaudited Results Conference Call and Webcast

Date: November 5, 2020

Time: 11:00 am ET (8:00 am PT)

Dial-in numbers: 1-800-319-4610 (toll-free in Canada and the U.S.)

+1-604-638-5340 (international participants)

Webcast: panamericansilver.com

Callers should dial in 5 to 10 minutes prior to the scheduled start time. The live webcast and presentation slides will be available on the Company's website at panamericansilver.com. An archive of the webcast will also be available for three months.

About Pan American Silver

Pan American owns and operates silver and gold mines located in Mexico, Peru, Canada, Argentina and Bolivia. We also own the Escobal mine in Guatemala that is currently not operating. As the world's second largest primary silver producer with the largest silver reserve base globally, we provide enhanced exposure to silver in addition to a diversified portfolio of gold producing assets. Pan American has a 26-year history of operating in Latin America, earning an industry-leading reputation for corporate social responsibility, operational excellence and prudent financial management. We are headquartered in Vancouver, B.C. and our shares trade on NASDAQ and the Toronto Stock Exchange under the symbol "PAAS".

Learn more at panamericansilver.com.