Rystad Energy Analysis: Northern White Sand generates 39% higher BOE recoveries than Regional Brady Brown Sand in the Delaware Basin

Apr 14, 2020

On March 15, 2019 Rystad Energy released a report detailing that in-basin sand has no initial impact (i.e. the IPs show no material differences) on well productivity in the Permian Basin. In part due to this result, the group also surmises that the adoption rate of in-basin Permian dune sand has reached as high as 80% already in 2019. Infill Thinking reported similar market sentiment in February 2019 indicating:

-

that there is no evidence of reverse substitution back to Northern White Sand (“NWS”), local sand mines vs. rail transloads volumes are running 90:10 today;

-

the up-front well savings of local sand play well with new capital discipline shift and the mandate to live within cash flow; and,

-

frac sand prices & supply are no longer a concern.

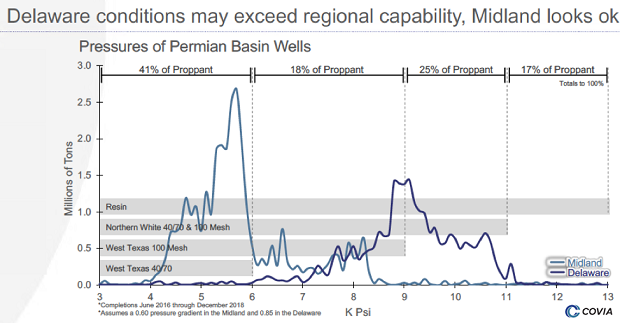

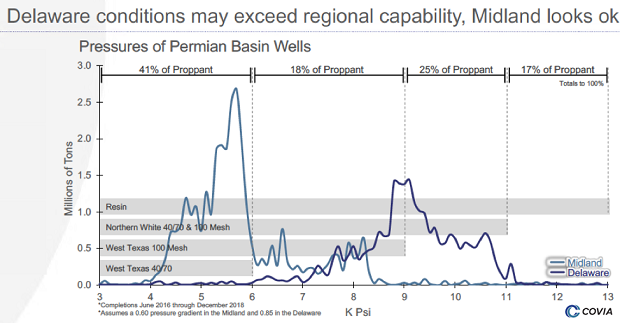

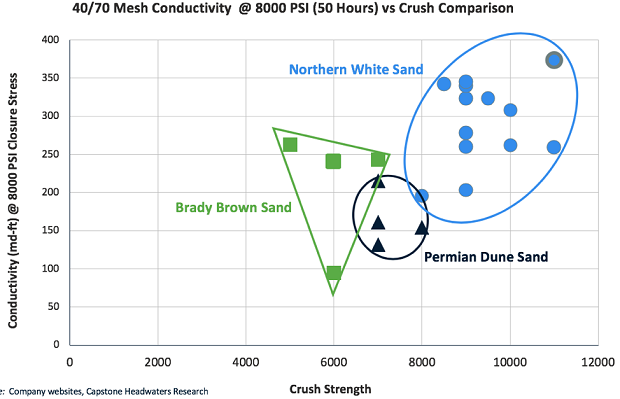

However, at the Petroleum Connection Update on Feb 6, 2019, Erik Nystrom of Covia presented the thesis that when the closure stress of in-basin sand is exceeded it may not be suitable for well completions. More specifically, in-basin Permian dune sand looks to be suitable for the shallow Midland Basin (i.e. requires sand <6000 PSI), but the majority of the deeper Delaware wells (i.e. requires sand 7000 – 11,000 PSI) appear to present closure stress in excess of in-basin sand capabilities.

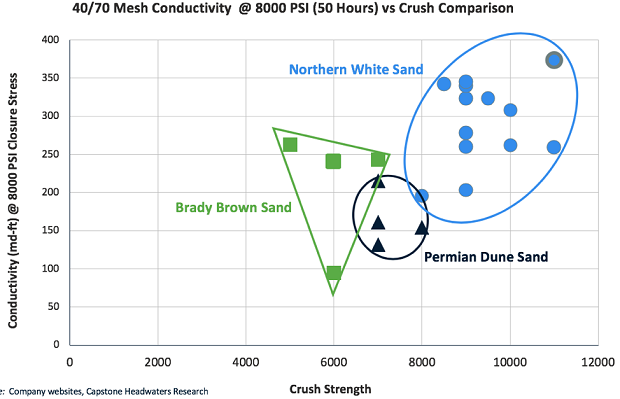

At the same conference, I presented publicly available data on conductivity tests that suggest Permian dune sands may have equal or lower conductivities than even Brady Brown Sands.

And now, data within the Rystad Energy report of March 15, 2019 corroborates the thesis presented by Covia; differences in sand proppant type versus well productivity were immaterial on the shallower Midland side of the Permian Basin, but impacted well productivity significantly on the higher pressure, Delaware side of the Permian Basin.

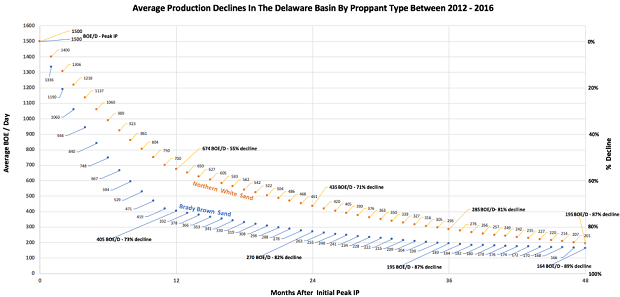

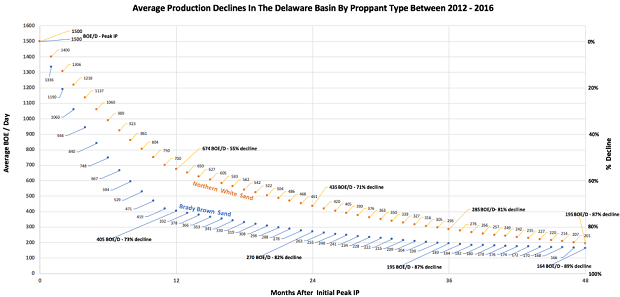

This was a very carefully constructed study: Rystad identified 289 horizontal wells in the Permian Basin, which were completed between 2012 and 2016, produced for more than two years, and were fracked with Brady Brown sand without NWS additions. They only included wells in the study where they were able to identify the proppant source with high confidence, and then located nearby offsets that used only NWS during the fracking process. The chart below recreates Figure 8 from Rystad Energy’s report using a linear interpolation between data points reported in bold:

To assess the sentiment that capital discipline for lower sand prices more than makes up for this difference in performance, I plugged in Rystad’s four-year average decline numbers for the Delaware Basin into a simple before-tax model for an “average” Delaware well, assuming the following:

-

$55 per barrel WTI price with no differentials;

-

78% NRI leasehold interest;

-

$6.5 million D&C costs (with Regional Sand);

-

8500 tons of sand to complete each well;

-

$15 per BOE total cash operating costs;

-

an initial peak IP of 1500 BOE per day (200 BOE/d per 1000 foot x 7500 average lateral length) irrespective of whether a well was fracked with Regional or NWS; and,

-

a $60/ton "premium" to replace the Regional Sand with NWS in the completion.

Following Rystad’s average Delaware Basin decline curves for just the first 48 months after the IP peak (shown above), BOE recoveries per well would be 558,000 BOE for those fracked with Brady Brown Sand in comparison to 776,000 BOE for those fracked with NWS.

Results from the financial analysis of these two cases indicate that financial decision metrics are all very favorable for NWS over Brady Brown - higher IRR’s, higher before-tax present value, a lower breakeven oil price, greater returns on money – due to the 39% increase in EUR over the 48 months of initial production. As Brady Brown test results display higher conductivity than Permian dune sand, it appears highly likely that financial performance of wells fracked in the Delaware Basin with Permian dune sand will be equal to or less than the Brady Brown comparison above.

To settle the debate and regain some investor confidence, E&Ps might want to consider a little more transparency and partake in a “sand challenge” mimicking the Rystad dataset with the following construct to verify well performance:

-

E&P operators in the Delaware Basin agree to complete 5 wells on pad with Permian dune sand, and 5 wells on the same pad with NWS.

-

Same completion techniques each well, same grain distributions, same volumes of sand.

-

E&P pays Permian dune sand price for those wells fracked with NWS provided that:

If the average NWS production is higher, then the NWS sand provider first recovers his investment from the incremental cash flow and the E&P and NWS sand provider split the incremental profit equally, or

If the average NWS production is lower, the E&P is obligated to make no further payments.

Source: http://ir.coviacorp.com/investor-news/press-release-details/2020/Covia-Announces-Actions-In-Response-To-COVID-19-Pandemic-And-Disruptions-In-The-Global-Oil-And-Gas-Markets/default.aspx