TORONTO, Dec. 15, 2020 (GLOBE NEWSWIRE) -- Wesdome Gold Mines Ltd. (TSX: WDO) (“Wesdome” or the “Company”) is pleased to announce an updated Mineral Resource Estimate (“MRE”) at its 100% owned Kiena Mine Complex, in Val d\'Or, Québec. This estimate shall form the basis on which the Kiena Prefeasibility Study (“PFS”) is founded. The company plans to complete the PFS in H1 of 2021, and contingent upon those results, decide on the potential next steps and timing of the Kiena Mine restart.

HIGHLIGHTS

-

Definition drilling increased Kiena Deep A Zones Indicated Resources by 77% from 405,100 ounces to 717,400 ounces of gold since 2019, at a similar cut-off grade of 3.0 g/t Au.

-

Inferred Resources in the Kiena Deep A Zones of 120,400 ounces.

-

Kiena Mine Complex Mineral Resources total 796,000 ounces of Indicated and 656,000 ounces of Inferred.

Mr. Duncan Middlemiss, President and CEO, commented, “We are pleased with our drilling efforts that have converted a large portion of the existing A Zones inferred resources to indicated resources in spite of the lower than planned drilling metres due to the operational disruptions attributed to the COVID-19 restrictions. Our focus changed to conversion of the A Zones inferred resources into indicated resources, as the timeliness of our restart decision is paramount to the company’s objective of adding another producing asset.

We are also pleased with the limited amount of exploration drilling that has extended the A Zones over 880 metres (“m”) down plunge. The A Zones remain open at depth and there exists additional potential to add ounces per vertical meter by exploring the adjacent VC and B Zones at depth as these would be accessible off the down ramp. Currently the deepest portion of the resource resides at the 1686m elevation and will be ramp accessible.

In addition to the update of the Kiena Deep and VC zones, all previous polygonal resources were converted to 3D block model during this MRE update in order to be consistent across the Kiena Mine Complex. This resulted in a small reduction of inferred ounces in some zones, but the total resources across the property are now more reflective of how these zones may be mined in the future.

We have restarted the Kiena mill to process the A Zone development material and assess the current resource estimate based on grade capping levels. The recent development and processing of the A Zone will be used to inform the ongoing prefeasibility study on aspects of the geological model, geomechanics, and milling parameters. The PFS is on schedule to be released in the first half of 2021.

With a large portion of the definition drilling completed, the underground drilling will continue with seven drills; however, the focus will be on near mine exploration and zone extensions, of which there are numerous targets. In addition, we are currently ramping up a large surface exploration program, with the aim of unlocking additional value on the Kiena property.”

Comparison of 2020 MRE vs 2019 MRE for Kiena Deep A Zones

HIGHLIGHTS OF MINERAL RESOURCE ESTIMATE (“MRE”) – December 15, 2020

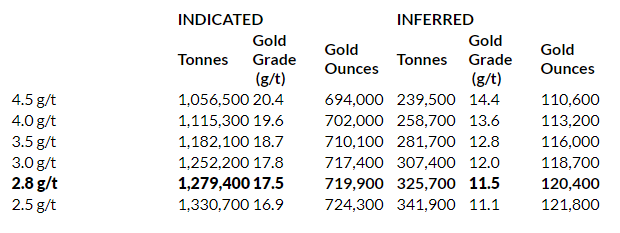

Kiena Deep A Zones Mineral Resource Estimate Sensitivity Table (namely zones ZA, ZA1, ZA2 and H1ZA)

Kiena Complex Mineral Resource Estimate by Area (2.8 g/t Au cut-off)

MINERAL RESOURCE UPDATE

The updated mineral resource estimate includes drill data as of September 18, 2020. It includes an additional 213 drill holes for a total of 60,865 m drilled since August 6, 2019 (close-out date for September 25, 2019 resource). Of which, an additional 122 new drill holes in Kiena Deep for a total of 35,280 m in the update of the Kiena Deep Zones. The drilling information was used to update the interpretation of the geologic model, geometry of the mineralized zones and domains resulting in a higher degree of confidence in the resource estimate.

The 2019 Preliminary Economic Assessment (“PEA”) has not been updated in light of the 2020 MRE. The 2020 MRE does not have a negative impact on or otherwise adversely affect the mineral resource inventory that formed the basis of the 2019 PEA.

Notes for Kiena Property Resource Estimate, October 31, 2020

(1) These mineral resources are not mineral reserves as they do not have demonstrated economic viability.

(2) The mineral resource estimate follows CIM definitions and guidelines for mineral resources.

(3) Results are presented in situ and undiluted and considered to have reasonable prospects for economic extraction, below a 100 m crown pillar.

(4) The resources include 46 zones with a minimum true thickness of 3.0 m (2.4 m for Wesdome zones) using the grade of the adjacent material when assayed or a value of zero when not assayed. High-grade capping varies from 20 to 265 g/t Au (when required) and was applied to composited assay grades for interpolation using an Ordinary Kriging interpolation method based on 1.0 m composite and block size of 5 m x 5 m x 5 m, with bulk density values of 2.8 (g/cm3). A three-step capping strategy was applied, where capping value decreased as interpolation search distance increased, in order to restrict high grade impact at greater distance. Indicated resources are manually defined and encloses areas where drill spacing is generally less than 30 m, blocks are informed by a minimum of three drill holes, and reasonable geological and grade continuity is shown.

(5) The estimate is reported for potential underground scenario at cut-off grades of 2.8 g/t Au (> 40 degree dip) and 3.6 g/t Au (< 40 degree dip, Wesdome zones only). The cut-off grades were calculated using a gold price of US$1,450 per ounce, a CAD:USD exchange rate of 1.32 (resulting in CAD$1,914 per ounce gold price); mining cost $100/t (>40 degree dip); $150/t (<40 degree dip); processing cost $40/t; G&A $25/t. The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rate, mining cost, etc.).

(6) The number of metric tonnes and ounces were rounded to the nearest hundred and the metal contents are presented in troy ounces (tonne x grade/31.10348).

(7) The QP is not aware of any known environmental, permitting, legal, title-related, taxation, socio-political or marketing issues, or any other relevant issue not reported in this Technical Report that could materially affect the mineral resource estimate.

ABOUT WESDOME

Wesdome has had over 30 years of continuous gold mining operations in Canada. The Company is 100% Canadian focused with a pipeline of projects in various stages of development. The Company’s strategy is to build Canada’s next intermediate gold producer, producing 200,000+ ounces from two mines in Ontario and Québec. The Eagle River Complex in Wawa, Ontario is currently producing gold from two mines, the Eagle River Underground Mine and the Mishi Open pit, from a central mill. Wesdome is actively exploring its brownfields asset, the Kiena Complex in Val d’Or, Québec. The Kiena Complex is a fully permitted former mine with a 930-metre shaft and 2,000 tonne-per-day mill. The Company has further upside at its Moss Lake gold deposit, located 100 kilometres west of Thunder Bay, Ontario. The Company has approximately 138.9 million shares issued and outstanding and trades on the Toronto Stock Exchange under the symbol “WDO”.