Rubicon Ready for First Production at Phoenix Gold Red Lake Project

Rubicon Minerals Corporation announced that the construction of the Phoenix Gold Project in Red Lake, Ontario, Canada continues on schedule and the company fully expects initial production to begin by mid-2015.

Rubicon Minerals Corporation announced that the construction of the Phoenix Gold Project in Red Lake, Ontario, Canada continues on schedule and the company fully expects initial production to begin by mid-2015.

Underground development rates have improved significantly in October and November, to the point where Rubicon has begun stockpiling of mineralized development material from the first planned stopes.

"We are pleased to announce that underground development rates have significantly improved since September and we are realizing better productivity and cost savings," stated Michael A. Lalonde, President and Chief Executive Officer for Rubicon. "Our operations team began stockpiling mineralized material from underground stope development last week, ahead of schedule.”

One of the stopes being developed is a trial stope located between the 305- and 244-metre levels, which will utilize the Alimak longhole method. This trial stope will provide Rubicon with valuable information with regard to dilution, recovery, and productivity as they march forward to projected initial production in mid-2015. Several new underground stopes will be developed in January

Construction of Mill, Concentrator and Refinery

Mill construction at the Phoenix Gold site is on budget and on schedule. Rubicon expects that the mill will be fully commissioned in the second quarter of 2015. The drive train for the ball mill has been installed and aligned and the drive train for the SAG mill is currently being installed.

The Knelson concentrators, which recover gold via gravity, are currently being installed. All structural steel in the mill, with the exception of the installation of the stairwells has been completed. The carbon-in-leach ("CIL") tank shells have been welded and the top rings and platforms are being installed. The paste plant filters and vacuum receivers have been placed and are ready to be installed. The construction of the refinery, mill thickener and cyanide destruction circuits are progressing as planned.

Rubicon has approximately C$27 million (as at November 30, 2014) of mill capital expenditures remaining to projected initial production.

Stockpiling, Underground Development and Construction

The Company began to stockpile mineralized material on surface from underground stope development on the 244- and 305-metre levels. Some of the stockpiled material will be fed to the mill during the commissioning phase and the remainder will be used for the projected production phase.

Underground development rates have improved month-over-month since September at an accelerated pace. The Company surpassed its monthly development target for November. Rubicon crews have exceeded productivity levels achieved by previous contractors, as they develop the 122-, 183- and 244-metre levels. The new contractors have also outperformed previous contractors, as they develop 305- and 610-metre levels, the 685-metre loading pocket and the vertical raises.

Alimak Longhole Method

The trial stope will utilize the Alimak longhole method (horizontal holes), as recommended by SRK Consulting in the Preliminary Economic Assessment. This method does not require sublevel development between main levels, which the Company believes will reduce overall underground development requirements from the original plan. The Alimak longhole method also has the potential to increase productivity, reduce costs and speed up stope cycle time. See Figure 1 for a diagram of the Alimak longhole method.

As of November 30, 2014, Rubicon has completed 3,586 m of the planned 8,023 m (or 45%) of total underground development (lateral and vertical) at the 685-metre level and above. Overall underground development has tracked behind the original schedule by 948 m. Management believes it has identified approximately 430 m of off-ramp development that can be eliminated from the development plan. This, combined with the accelerated pace of development, is expected to bring the underground development back on schedule in the first quarter of 2015. Summary of the total underground development is displayed in Figure 2. There is approximately C$29 million (as at November 30, 2014) of total underground development capital remaining to the start of projected initial production.

Surface Infrastructure and On-Site Construction

The construction of the crushed ore bin, with a design capacity of 2,500 tonnes, has been completed. The tailings management facility ("TMF") is ready to receive tailings for up to a year of potential production and will have the capacity to handle two years of potential production in early 2015. Rubicon has approximately C$19 million (as at November 30, 2014) of on-site construction remaining to completion.

See Figure 3 for pictures of the construction and development progress of the Project. For more up to date pictures of the construction and development progress, please visit our website at http://www.rubiconminerals.com/Investors/Photo-Galleries/default.aspx.

Project Capital and Timeline to Projected Initial Production

As of November 30, 2014, Rubicon estimates that capital expenditures to projected initial production is C$85 million (which includes C$14 million of contingency). A breakdown of the capital expenditures remaining can be seen in Table 1. Rubicon has approximately C$140 million in cash and cash equivalents (C$110 million in working capital) on its balance sheet as of November 30, 2014 and expects to receive an additional US$12 million from the Royal Gold streaming transaction in early 2015, as spending on construction and development approaches completion. The Phoenix Gold Project remains well-funded to complete construction and remains on schedule for projected initial production in mid-2015.

As of November 30, 2014, Rubicon estimates that capital expenditures to projected initial production is C$85 million (which includes C$14 million of contingency). A breakdown of the capital expenditures remaining can be seen in Table 1. Rubicon has approximately C$140 million in cash and cash equivalents (C$110 million in working capital) on its balance sheet as of November 30, 2014 and expects to receive an additional US$12 million from the Royal Gold streaming transaction in early 2015, as spending on construction and development approaches completion. The Phoenix Gold Project remains well-funded to complete construction and remains on schedule for projected initial production in mid-2015.

Table 1: Capital Expenditures to Projected Initial Production - as at November 30, 2014

|

Project capex spent, October 1, 2011 to November 30, 2014 |

~C$299 million |

|

|

Remaining capex to projected initial production |

||

|

Mill |

~C$27 million |

|

|

Underground development |

~C$29 million |

|

|

On-site construction |

~C$19 million |

|

|

Indirects & definition drilling |

~C$10 million |

|

|

Total remaining capex to projected production (with contingency) |

~C$85 million |

|

Credit Facility

As Rubicon approaches the completion of the construction phase of the Project, the Company is evaluating its working capital requirements beyond projected production. In this regard, the Company is currently evaluating debt alternatives for approximately C$50 million.

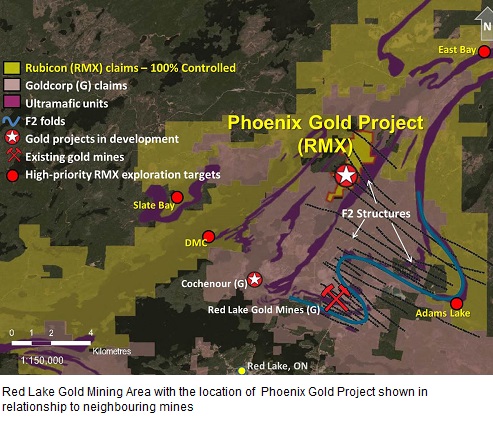

About Rubicon Minerals Corporation

Rubicon Minerals Corporation is an advanced stage gold development company. The Company is focused on responsible and environmentally sustainable development of its Phoenix Gold Project in Red Lake, Ontario. The start of potential gold production is projected in mid-2015, based on current forecasts. The Phoenix Gold Project is fully permitted for initial production at 1,250 tonnes per day. In addition, Rubicon controls over 100 square miles of prime exploration ground in the prolific Red Lake gold district which hosts Goldcorp's high-grade, world class Red Lake Mine. Rubicon's shares are listed on the NYSE MKT (RBY) and the Toronto Stock Exchange (RMX).

Photos and Illustrations

To view "Figure 1: Conceptual Diagram of the Alimak Longhole Stoping Method" please visit: http://media3.marketwire.com/docs/984742fig1.png.

To view "Figure 2: Cumulative Underground Development Advancement (as of November 30, 2014)" please visit: http://media3.marketwire.com/docs/984742fig2.png.

To view "Figure 3: Pictures of Project Mill and On-Site Construction" please visit the following links:

Panoramic view inside the mill building: http://media3.marketwire.com/docs/984742fig3.1.jpg.

SAG and ball mill installation: http://media3.marketwire.com/docs/984742fig3.2.png.

Knelson concentrators installation: http://media3.marketwire.com/docs/984742fig3.3.png.

CIL tank construction: http://media3.marketwire.com/docs/984742fig3.4.jpg.

Mill thickener: http://media3.marketwire.com/docs/984742fig3.5.png.

Crushed ore bin: http://media3.marketwire.com/docs/984742fig3.6.jpg.

Contact Information

-

Rubicon Minerals Corporation

Allan Candelario

Director of Investor Relations

+1 (866) 365-4706

ir@rubiconminerals.com

www.rubiconminerals.com

|