New Gold Reports Second Quarter Financial Results

- The Company is providing its updated operational outlook for 2020 that incorporates the impact of COVID-19. Annual guidance was withdrawn on April 15, 2020 while the Company evaluated the impact on operations over the balance of the year.

- Total production for the second quarter was 98,079 gold equivalent (gold eq.) ounces (64,294 ounces of gold, 134,282 ounces of silver and 16.9 million pounds of copper). For the six-month period, production was 201,514 gold eq. ounces (131,084 ounces of gold, 265,699 ounces of silver and 35.4 million pounds of copper).

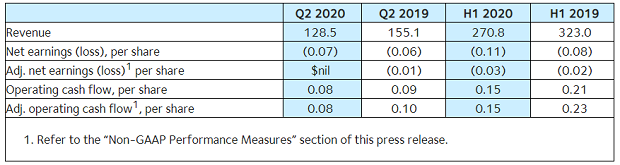

- Revenues for the quarter were $129 million and $271 million for the six-month period.

- Operating expense for the quarter was $726 per gold eq. ounce and $799 per gold eq. ounce for the six-month period.

- Total cash costs1,2 for the quarter were $773 per gold eq. ounce and $849 per gold eq. ounce for the six-month period.

- All-in sustaining costs (AISC)1,2 for the quarter were $1,283 per gold eq. ounce and $1,370 per gold eq. ounce for the six-month period.

- Net loss from operations for the quarter was $46 million ($0.07 per share) and $74 million ($0.11 per share) for the six-month period.

- Adjusted net loss2 for the quarter was $3.3 million ($nil per share) and $21.1 million ($0.03 per share) for the six-month period.

- Cash generated from operations for the quarter was $53 million ($0.08 per share) and $104 million ($0.15 per share) for the six-month period. Operating cash flow generated from operations for the quarter, before non-cash changes in working capital2, was $52 million ($0.08 per share) and was $99 million ($0.15 per share) for the six-month period.

- During the quarter, the Company announced that it entered into a definitive agreement with Artemis Gold Inc. to divest its Blackwater Project for C$190 million in cash, an 8% gold stream and a C$20 million equity stake in Artemis (refer to the Company's June 9, 2020 news release for further information).

- During the quarter, the Company completed a $400 million senior notes offering yielding 7.50% due in 2027 that was used, along with cash on hand, to fund the full redemption of its outstanding 6.25% senior notes due in 2022 completed on July 10, 2020 (refer to the Company's June 24, 2020 and July 10, 2020 news releases for further information).

- The Company's 2019 Sustainability Report, including the updated Tailings Fact Sheet is now available and can be accessed via the following link: www.2019sustainabilityreport.newgold.com.

- Revenues for the quarter were $129 million and $271 million for the six-month period, a decrease compared to the prior year quarter due to a decrease in gold and copper sales volumes and a decrease in copper prices, partially offset by an increase in gold prices.

- Operating expenses for the quarter and six-month period were lower than the prior-year period due to lower production. Additionally, for the three months ended June 30, 2020, operating expenses were positively impacted by the receipt of the Canada Emergency Wage Subsidy.

- Net loss for the quarter was $46 million ($0.07 per share) and $74 million ($0.11 per share) for the six-month period, an increase in loss over the prior year quarter primarily due to lower other gains and losses. Other gains and losses for the quarter and six-month period includes a $38 million impairment loss on the reclassification of Blackwater as held for sale.

- Adjusted net loss for the quarter was $3.3 million ($nil per share) and $21.1 million ($0.03 per share) for the six-month period, which is a decrease in loss over the prior year quarter, primarily due to lower operating expenses and lower depreciation and depletion, partially offset by lower revenue.

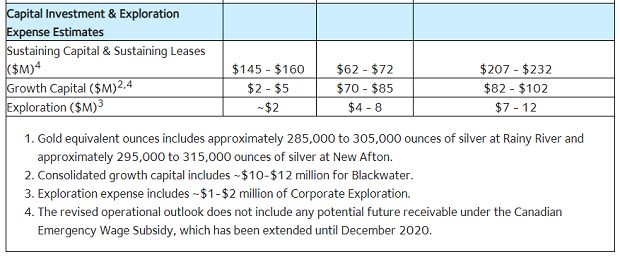

- Production estimates for the year have been lowered, primarily related to the impact of COVID-19 in the first half of the year, resulting in lower tonnes and slightly lower grades milled for the full year.

- Cash costs and operating expense per gold eq. ounce for the year have been slightly increased primarily due to lower sales.

- Total capital for the year has increased by less than $10 million due to a portion of the Tailings Management Area construction that was originally scheduled for completion in 2021, now planned for completion in 2020.

- Gold and copper production estimates for year have been lowered, primarily due to lower than planned gold and copper grades.

- Cash costs and operating expense per gold eq. ounce for the year are expected to increase, primarily due to lower sales.

- Total capital estimates remain consistent with original estimates, and it is expected that planned capital projects will be completed in the second half of the year.

Source: https://www.newgold.com/investors/news-releases/news-details/2020/New-Gold-Reports-Second-Quarter-Financial-Results/default.aspx

|

As an integral part of New Gold’s Project Procurement team, the Project Buyer will provide support to the Capital Projects group.

The role of the Major Material Warehouse Technician is responsible for the managing of all the major materials (fuel, oils, mill reagents, tires, drilling materials etc.) to support the mine operations.

The Senior Inventory Management Analyst leads the management of Rainy River Mine Inventory to sustain site operations.

The role of Warehouse Technician is to ensure the efficient operation of all warehouse activities.

As a member of the New Gold Rainy River team, the Lead Environmental Technician demonstrates commitment and compliance with company Health & Safety, Environment and Social Responsibility policies and procedures.

The role of Mine operations Superintendent is to oversee the safe and efficient extraction of ore through the supervision and control of mining department activities such as budgeting, planning staffing and cost control.

The Senior Mine Engineer will provide clarity and focus for the engineering group to achieve and surpass the mine’s safety and production targets and to add value to the operation.

The Engineering & Construction Superintendent is expected to be a safety leader on site and thus will be required to demonstrate experience in executing work with a safety focus and an emphasis on human performance.

Groundwater monitoring, management and modeling is a critical component in Environmental management at New Afton.

Red Seal Industrial Mechanic (Millwright) provides skilled expertise, executing world class maintenance practices and lubrication techniques.