Brigus Gold

Projects

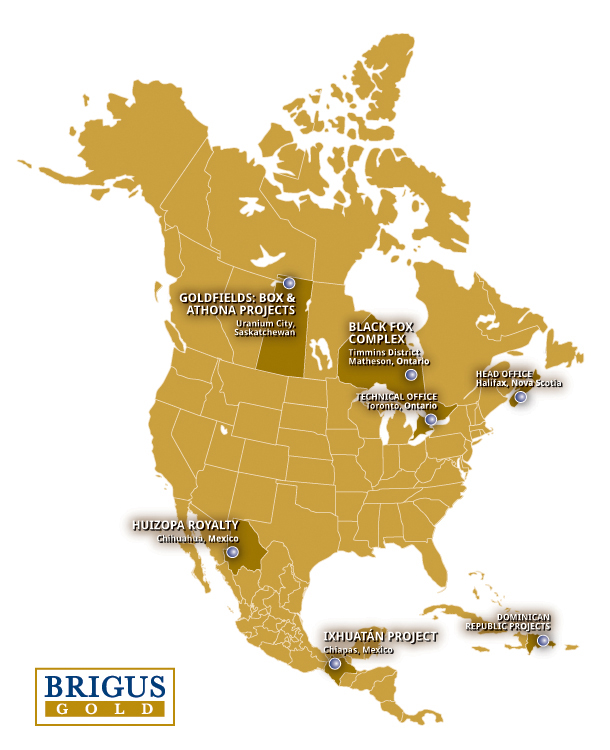

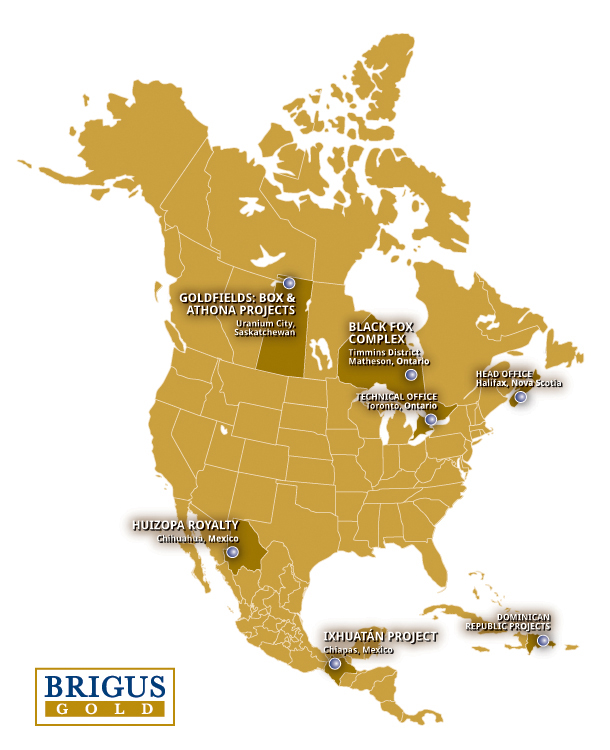

Brigus Gold operates the Black Fox Mine in Timmins, Ontario, located on the Black Fox Complex. This property also has tremendous exploration upside and is a proven source for new gold discoveries.

Brigus Gold's Goldfields property near Uranium City, Saskatchewan hosts an economic gold deposit and has reserves of approximately one million ounces.

Brigus Gold also holds interest in minerals projects in the Dominican Republic and Mexico.

Highlights:

Goldfields: Box & Athona Projects

Uranium City, Saskatchewan

The Goldfields property is wholly owned by Brigus Gold.

Highlights:

• Proposed annual gold production of 100,000 ounces over the first seven years with an average cash operating cost of $601 per ounce.

• Net present value (NPV) of $144.3 million at a 5% discount rate with an internal rate of return (IRR) of 19.6% and a payback period of five years, assuming a gold price of $1,250 per ounce.

• At $1,500 per ounce of gold, the NPV for the project increases to $300 million with an IRR of 32%.

• Exploration upside with potential resource additions below both deposits and from several drill-ready targets on the extensive property.

• Potential to increase known estimated reserves and resources to extend projected mine life or to increase production.

Good infrastructure in a mining-friendly province.

• The Environmental Impact Statement (EIS) has been submitted and approved. Therefore no permitting delays are anticipated.

Black Fox Complex

Timmins District, Matheson, Ontario

Brigus' wholly owned Black Fox Complex encompasses the Black Fox Mine and Mill, and adjoining Grey Fox property, all in the Township of Matheson, Ontario, Canada along the Destor-Porcupine Fault Zone. The Black Fox Mine has approximately 840, 000 gold ounces in reserves and is currently producing and on track for increased production in the upcoming years - generating steady cash flow for expansion.

Huizopa Project

Chihuahua, Mexico

Brigus has a 2% Net Smelter Royalty ("NSR") in the Huizopa gold-silver early stage exploration project, located in the Sierra Madre Occidental mountains in Chihuahua, Mexico. In December 2010, Brigus entered into a sale agreement, which was amended in December 2011, pursuant to which Brigus has sold its 100% interest in its Mexican subsidiary, Minera Sol de Oro, S.A. de C.V. and its joint venture in the Huizopa Project to the Cormack Capital Group, LLC for proceeds of US$3.0 million, payable over a eight-year term, while Brigus retains a 2% NSR over future production from the Huizopa Project.

Cormack can reduce Brigus' NSR to 1% by making a US$1.0 million payment to Brigus and may also elect to pay up to 50% of the purchase price through the issuance of common shares in a publicly traded company listed on a recognized U.S. or Canadian national stock exchange. In addition, Brigus will receive a production bonus payment of US$4.0 million within one year of the commencement of commercial production at the Huizopa Project.

Ixhuatán Project

Chiapas, Mexico

The Ixhuatan Project hosts the Campamento Gold Deposit as well as the Cerro La Mina Discovery, where impressive copper, gold and molybdenum mineralization has been recently intersected. The project is also host to numerous mineralized zones including Laguna Chica, Laguna Grande and the Western zone, as well as other numerous untested high-priority targets. The Project is located in the State of Chiapas in southern Mexico, two hours south of the city of Villahermosa, Tabasco and close to a major highway and power grid.

Ampliacion Pueblo Viejo, Loma El Mate & Loma Hueca Projects

Dominican Republic

Brigus has a purchase option agreement with Everton Resources whereby Everton has acquired the option to purchase Brigus' remaining 50% interest in the Ampliación Pueblo Viejo II ("APV"), Ponton and La Cueva concessions in the Dominican Republic ("the Concessions").

The binding agreement requires Everton to issue 15 million treasury common shares to Brigus to acquire the option. Pursuant to the option, Everton can acquire Brigus̢ۉ㢠remaining interest in the Concessions by paying Brigus CAD$500,000 cash and an additional CAD$500,000 in cash or common shares with a value of $500,000 by December 31, 2012.

Brigus will also receive a sliding scale net smelter return royalty on the Concessions equal to 1.0% when the price of gold is less than US$1,000 per ounce, 1.5% when the price of gold is between US$1,000 and US$1,400 per ounce, and 2% when the price of gold is above US$1,400 per ounce.

Everton will also issue Brigus a promissory note equal to the greater of CAD$5 million or 5,000,000 common shares of Everton. The promissory note will be subject to completion of a National Instrument 43-101.

Source: http://www.brigusgold.com/projects/

|