GoWest Gold Ltd.

North Timmins Gold Project

Overview

|

|

|

|

|

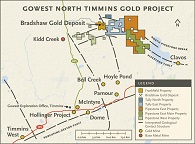

The project is located within the Abitibi Greenstone belt, historically known as Canada’s most prolific gold district. More than 172 million ounces of gold have been produced from this district, representing almost half of Canada’s total gold production. Much of the project area overlays or is adjacent to the Pipestone Fault or the North Pipestone Break, two highly prospective gold-bearing structures.

Gowest’s NTGP covers numerous unexplored or underexplored areas with gold potential. In recent years, the Company’s primary focus has been on the Frankfield Property, where gold mineralization was discovered in 1974 before Gowest obtained title to the property.

Timmins Gold Camp

It was in 1909 that two prospectors discovered the “Golden Staircase”, a rich vein of gold that led to the first major gold mine in the area, the Dome Mine. Within days, what became known as the Porcupine Gold Rush began and a huge mining camp formed at Porcupine Lake, a few kilometres east of modern Timmins. Lying 680 kilometres north of Toronto, the town of Timmins was founded by Noah Timmins in 1912 following several gold discoveries and the founding of the Hollinger, McIntyre, and Big Dome Mines, still known a century later as the “Big Three.”

The rail system, which began to operate around Timmins in 1911, accelerated the growth of the Timmins camp. However, just two days after the first train arrived, the entire camp was destroyed by fire. Due to the importance of the gold discoveries, very few people abandoned the camp and the area was rebuilt within two months. The discovery of base metals in the 1960’s increased the value of the industry and today the city continues to prosper because of numerous additional gold deposits and important zinc, copper, nickel, and silver finds in the area.

In 1973, the provincial government of Ontario amalgamated all of the municipal jurisdictions in the area to create the Corporation of the City of Timmins, which later adopted the nickname “The City with a Heart of Gold.”

In the 1990s, the City of Timmins became a regional service and distribution centre for Northeastern Ontario. In addition to its business based on natural resources, new areas of manufacturing, high technology and a labour-intensive service industry including forestry and manufacturing value-added wood products, metal fabrication, retail, service industries, and government have emerged. However, to this day, mining remains the dominant industry in the area.

Regional Geology

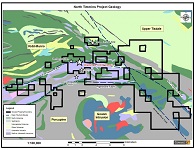

The Gowest NTGP, situated in the Abitibi Greenstone Belt, is underlain by Archean rocks of the Abitibi Sub province of the Canadian Shield. The belt contains a variety of geological terranes, including the Porcupine, Upper Tisdale and Kidd-Munro assemblages that are present in the project area. The eastern project area is cut by the regional northwest-trending Buskegau River Fault.

The Porcupine (sedimentary) assemblage (2696-2675 Ma) underlies the south and southwestern portions of the project area and unconformably overlies the Kidd-Munro (volcanic) assemblage (2719-2711 Ma). The Kidd-Munro underlies the central part of the project area and is in fault contact to the northwest with the upper Tisdale (volcanic) assemblage (2710- 2703 Ma). To the east of the Buskegau River Fault, the Kidd-Munro assemblage rocks underlie the southeast part of the project. Upper Tisdale assemblage rocks overlie the Kidd-Munro assemblage to the north, and possibly interfolded Porcupine assemblage rocks near the contact between these two tectonostratigraphic units. The project stratigraphy is interpreted to be cross cut by later north-south faults and northeast-southwest faults.

History

As with much of the Timmins camp, the area controlled by Gowest has had a long exploration history. The area was especially active during the Texas Gulf/Kidd Creek discovery period and still contains wide unexplored or underexplored areas.

Gowest has been exploring the Frankfield Property since 1983. A number of diamond drilling campaigns have been carried out on the property and semi-continuous diamond drilling has been carried out since 2004. Following a reorganization and change of the Company’s management team, Gowest has more than doubled the size of the original mineralized envelope at the Bradshaw Gold Deposit (formerly named Frankfield East) since 2010 when it contained an Inferred mineral resource of 510,000 ounces (oz.) of gold (Au) (2.4 million tonnes at 6.5 grams per tonne gold “g/t Au”).

In mid-2011, Gowest contracted a HELITEM electromagnetic and magnetic airborne geophysical survey (“the airborne survey”) covering what was then – before Gowest added more land to the project area – the entire NTGP to map the geology and structure of the area.

In June 2011, ACA Howe calculated a National Instrument (NI) 43-101 compliant resource at the Bradshaw Gold Deposit of 348,000 oz. Au in the Indicated category (1,621,000 t at a grade of 6.68 g/t Au) and 838,900 oz. Au in the Inferred category (4,342,000 t at a grade of 6.01 g/t Au). A positive Preliminary Economic Assessment Study was completed in 2011 that, using a gold price of US$1,200/oz., demonstrated a pre-tax net cash flow of $US 265 million and a 3.3 year payback period based on the 2011 resources with annual production rate averaging 95,000 oz. Au over a 10-year mine life.

In 2012, the Company completed the environmental baseline work for mine permitting, a First Nations Memorandum of Understanding agreement, a positive full-scale ore sorting optimization test and a drilling program focused on further resource expansion at the Bradshaw Gold Deposit and other regional exploration targets. Site reviews were carried out for the construction of an ore processing facility. The resource expansion drilling program confirmed gold mineralization to at least 1.4 km along strike and 1.1 km vertical depth (deposit remains open). Based on this drilling, an updated NI 43-101 compliant resource of approximately 945,600 oz. Au in the Indicated category (6.0 million t at a grade of 4.9 g/t Au) and 536,800 oz. Au in the Inferred category (3.7 million t at a grade of 4.2 g/t Au) was completed by Neil N. Gow, P. Geo., an independent Qualified Person, on November 15, 2012.

Highlights of PEA:

| Note: The PEA is preliminary in nature. It includes Indicated and Inferred mineral resources, which are not mineral reserves and do not have demonstrated economic viability; there is no certainty that the preliminary economic assessment will be realized. | ||

|---|---|---|

| Gold Price | $1,200 /oz | (versus 24 month average of $1348 / oz) |

| Initial Capital Cost | $167 million | (includes buyout of 2% NSR) |

| Life-of-Mine (LOM) Sustaining Capital | $86 million | |

| LOM Pre-tax Net Cash Flow (PNCF) | $265 million | (23% internal rate of return – IRR) |

| Average LOM Cash Costs | $660 /oz | (includes G&A) |

| Overall Gold Recovery | 95% | |

| Average Gold Production (10 years) | 95,000 oz / year | |

|

Mine Production Rate |

1,500 tonnes per day (tpd) |

|

In 2012, the Company completed the environmental baseline work for mine permitting, a First Nations Memorandum of Understanding agreement, a positive full-scale ore sorting optimization test and a drilling program focused on further resource expansion at the Bradshaw Gold Deposit and other regional exploration targets. Site reviews were carried out for the construction of an ore processing facility. The resource expansion drilling program confirmed gold mineralization to at least 1.4 km along strike and 1.1 km vertical depth (deposit remains open). Based on this drilling, an updated NI 43-101 compliant resource of approximately 945,600 oz. Au in the Indicated category (6.0 million t at a grade of 4.9 g/t Au) and 536,800 oz. Au in the Inferred category (3.7 million t at a grade of 4.2 g/t Au) was completed by Neil N. Gow, P. Geo., an independent Qualified Person, on November 15, 2012.

Gowest is currently conducting underground advanced exploration and mine development plans, carrying out permitting activities, and detail diamond drilling is ongoing for mine stope development at the Bradshaw Gold Deposit. The completion of mine site permitting is anticipated in late 2013 with bulk sampling and a feasibility study planned for 2014.

43-101 Technical Report

43-101 Technical Report

43-101 Technical Report

43-101 Technical ReportSource: http://www.gowestgold.com/index.php/north-timmins-gold-project/overview/

|