Avalon Advanced Materials Inc.

East Kemptville

Location, ownership and access

The 100% owned East Kemptville Tin-Indium Project is located approximately 45 km northeast of Yarmouth, Nova Scotia in the vicinity of the former East Kemptville Tin Mine.

The property consists of four contiguous exploration licenses and a Special License covering an aggregate of over 10,000 ac (4,000 ha) and 880 ac (356 ha) respectively and is easily accessible by a secondary highway. The Special License requires Avalon to secure permission from current landowners to access the closed East Kemptville mine site. Avalon has commenced the process toward converting this Special Licence into a mining lease, which the company anticipates completing in early 2020.

Project timeline

In May 2014, Avalon entered into an agreement with the surface rights holder to secure access to lands held under the Special Licence for a limited drilling program, to confirm historic estimates of tin-copper-zinc resources remaining in the ground after production ceased at the East Kemptville mine in 1992, and bring them into compliance with NI 43-101 for reporting purposes.

A second drilling program conducted in 2015 had the objective of upgrading inferred mineral resources in the Main and Baby Zones into the Indicated and Measured categories, as well as testing other known tin occurrences in the area. 22 drill holes totalling 4,514 metres were completed during the 2015 drilling program, on the Main, Baby and Duck Pond Zones. Results were in line with expectations and confirmed continuity of the mineralized zone to depth. Highlights include intersections of 0.46% tin (Sn), 25.2 ppm indium (In) and 0.63% zinc (Zn) over 82.3 metres (EKAV-15-10), 0.23% Sn, 15.6 ppm In and 0.33% Zn over 36.25 metres (EKAV-15-09) and 0.25% Sn, 29.4 ppm In and 0.64% Zn over 18.67 metres (EKAV-15-11).

Re-development model

In July 2018, Avalon finalized its Preliminary Economic Assessment (PEA) on the East Kemptville Project. The re-development model, as presently conceived, is an environmental remediation project that will be financed through the sale of tin concentrates recovered in large part from previously-mined mineralized material on the site. The PEA was prepared by independent consultants Micon International Limited, Toronto, Canada, with the finalized mine plan based on the updated mineral resource estimate disclosed in the new release dated June 28, 2018. The PEA is preliminary in nature, includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized.

The redevelopment model primarily involves processing the 5.87 million tonne stockpile of previously-mined oxidized low-grade mineralization, supplemented by selective mining of near-surface fresh higher-grade tin mineralization in the Main and Baby Zone deposits. The freshly mined tin mineralization will serve an important purpose in the site rehabilitation concept by allowing for the generation of clean tailings free of sulphide minerals. These clean tailings will be used to create a cover for the existing dry-stacked tailings, which will fully remediate the long term environmental liability associated with the tailings and facilitate its ultimate conversion into other long term beneficial uses, such as a solar power generation or agriculture. Avalon’s small-scale, re-development model utilizes existing infrastructure and previously-mined material, making the project a low energy, low green-house gas producer.

The development model utilized for the PEA contemplates a production schedule of approximately 1,300 tonnes per annum of a 55% tin concentrate for 19 years, with tin concentrates being sold and shipped for treatment in international markets. The PEA concludes that the small-scale re-development model for tin concentrate production at East Kemptville is economically viable at current tin prices in the range of US$20,000 to US$22,000/tonne. Assuming an average go-forward tin price of US$21,038/tonne (as forecast by the World Bank Commodity Price outlook for 2020), and an exchange rate of CAD 1.30/USD, the project has an indicated pre-tax IRR of 15.0% and an NPV of C$17.9 million at an 8% discount rate. The initial capital cost is estimated at C$31.5 million. Average annual revenues from sales are calculated as C$17.75 million vs. annual production costs of C$11.6 million.

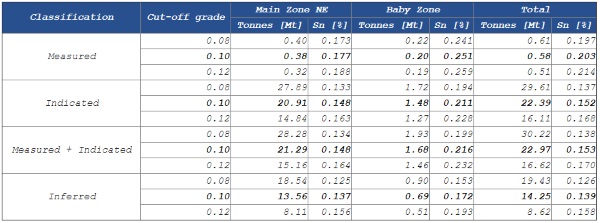

Based on Percentage Tin Cut-off Grade, as at May 7, 2018

Notes:

- CIM Definition Standards for Mineral Resources, 2014, were followed.

- The independent Qualified Person for this mineral resource estimate update is William Mercer, P. Geo., of Avalon Advanced Materials Inc.

- The mineral resource estimate is based on 194 drill holes totalling 21,456 m drilled between 1979 and 1991 by previous operators and 23 holes totalling 4,190 m drilled by Avalon in 2014 and 2015.

- Drill data were organized in Maxwell DataShed and for estimation purposes were transferred to the Geovia GEMS 6.8.1 software, wherein the block model was developed.

- Resources were estimated by interpolating composites within block models of 24 m by 24 m by 12 m blocks in the Main Zone and 6 m by 6 m by 6 m in the Baby Zone. Interpolation used the inverse Ordinary Kriging method.

- In the Main Zone, Measured material was defined as blocks interpolated with a search ellipse with radii of 40x20x15 m using 18-36 samples, corresponding to 3-6 drill holes, indicated material with a 120 x 40 x 18 m search ellipse and the same number of samples, and inferred material with a 315 x 85 x 18 m search ellipse using 12-24 samples corresponding to 2-4 drill holes. In the Baby Zone, Measured material was defined as blocks interpolated with a search ellipse with radii of 30 x 20 x 8 m using 6-12 samples, corresponding to 3-6 drill holes, Indicated material with a 48 x 33 x 12 m search ellipse and the same number of samples, and Inferred material with a 95 x 65 x 24 m search ellipse using 4-8 samples corresponding to 2-4 drill holes.

- Prior to compositing, the assays were capped at 1% Sn, which corresponds to the 99th percentile of the tin assay data, reducing the length-weighted mean of the tin assays by 9.4%.

- Mean density values of available data of 2.728 t/m3 and 2.784 t/m3 were used for the Main and Baby Zones, respectively.

- The resource estimate has been constrained using the Whittle pit described previously (Avalon News Release 15-02, February 25, 2015)

- Several possible cut-off grades are reported in this resource estimate. Based on past mining practice at East Kemptville, a cut-off grade of 0.1% Sn is reasonable and preliminary cost and revenue values at the time of estimation also suggest this is reasonable.

- Mineral resources do not have demonstrated economic viability and their value may be materially affected by environmental, permitting, legal, title, socio-political, marketing or other issues.

Current activities and future plans

While the results of the PEA indicate good economic potential, there are a number of opportunities to further improve project economics, including the potential to upgrade the feed material to the processing plant through ore-sorting. Results from an initial evaluation of ore-sorting technology (carried out in 2017) were very encouraging. Additional results, announced in September 2018, from a second evaluation using an alternative ore-sorting technology were also positive. By rejecting non-mineralized waste rock before feeding it into the concentrator, ore-sorting allows for a reduction in the size of the concentrator with attendant reductions in both capital and operating costs. It may also allow for economic recovery of tin from other mineralized materials stored on site that are presently not included in the re-development model. Lastly, ore-sorting technology will reduce the amount of fine tailings produced, creating opportunities to improve tailings deposition plans and sludge management with respect to pit dewatering.

In January 2019, Avalon extracted a bulk composite sample to begin a pilot-scale ore sorting plant. This testwork, combined with a confirmation drilling program on the stockpile, will be utilized to finalize the small-scale site re-development model to the Feasibility level of confidence.

Avalon is currently in commercial discussions with several parties interested in new sources of supply of tin concentrate or interested in tin development opportunities.

Environment, permitting and community

Avalon initiated the permitting and environmental assessment process for the proposed redevelopment of the East Kemptville site in June 2015, when a multi-ministry meeting with provincial and federal regulators was held in Halifax. Avalon selected a Nova Scotia-based consultant experienced in mine development and approvals to assist the company in the preparation of a comprehensive Environmental and Social Impact Assessment (ESIA). The ESIA will be integrated into the redevelopment plan to mitigate potential impacts, meet or exceed all regulatory requirements, address concerns about site development and guide the development of the site to ensure environmental best practices are employed.

Since then, the key regulators have been kept apprised of the evolution of the business model and how it can augment environmental protection. This includes an innovative redevelopment model that removes existing site environmental liabilities and ensures future wastes are managed in a sustainable manner such that there will be no long term environmental concerns post-closure.

Engagement with the local NGO Tusket River Environmental Protection Association and local politicians and businesses has continued. In addition, Avalon had early discussions with the local Acadia First Nation about the project and contracted a business owned by band members to manufacture and supply core boxes for the 2015 drilling program. Avalon is committed to maximizing employment opportunities for Nova Scotia residents.

Ore displayed at Avalon’s East Kemptville Tin-Indium property

Source: http://avalonadvancedmaterials.com/projects/east_kemptville/

|