MONCTON, New Brunswick (June 14, 2021) – Major Drilling Group International Inc. (TSX: MDI), a leading provider of specialized drilling services to the mining sector (“Major Drilling” or the “Company”), today reported results for the year and fourth quarter of fiscal 2021, ended April 30, 2021.

Highlights

• Highest annual revenue since 2013 at $432 million.

• Quarterly revenue of $128.1 million, an increase of 44% from Q4 2020, driven primarily by increased gold drilling activity.

• EBITDA(1) for the quarter was $12.0 million, an increase of 64% compared to same period last year, despite impact of heavy start-up costs.

• Net cash position(2) of $6.9 million.

• Completed the acquisition of McKay Drilling PTY Ltd. on June 1, 2021, providing established leading position in Australia market.

“Activity levels continue to improve as we reached our best quarterly and annual revenue since 2013. Most of the growth came from North America where we have now well surpassed pre-pandemic levels due to the ramp-up experienced this quarter. Gold projects were the main driver as we saw both seniors and juniors increase their activity this quarter. In South America and in Asia, our operations continued to be impacted by the effects of the pandemic, which has delayed several projects and continues to disrupt commercial and operational activities,” said Denis Larocque, President and CEO of Major Drilling. “Due to the strong growth experienced in North America, margins were impacted by ramp-up costs related to training, mobilization and setup costs to meet the pickup of activity, while other regions were impacted by delays and logistical challenges from the pandemic.”

“Availability of skilled labour continues to be challenging in busy markets. In North America, we have increased efforts across our training centers with goals to improve our retention rate for new hires and to qualify candidates for our drillertrainee programs. As well, we have had to increase wages in certain areas to retain and attract the most experienced drillers, which are key to high-quality customer service, as competition for drillers is heating up.”

“Our financial position remains strong and our balance sheet flexible, with net cash of $6.9 million at the end of the quarter,” said Ian Ross, CFO of Major Drilling. “We spent $10.7 million on capital expenditures this quarter, adding seven drill rigs and support equipment for existing rigs going out in the field, while disposing of nine older, less efficient rigs, bringing the total rig count to 588. Most of the rigs purchased will be working in North America this upcoming quarter. The Company expects to spend approximately $50 million in capital expenditures in fiscal 2022, with the intent of purchasing additional specialized and underground rigs to meet strong market demand.”

“Following the end of the quarter, on June 1st, the Company closed a transaction to acquire the shares of McKay Drilling PTY Ltd. The transaction was completed by payment of the cash portion of the purchase price of A$39.7 million (representing approximately $37.1 million in Canadian dollars) subject to post-closing debt, working capital adjustments and holdbacks, using Major Drilling’s current cash balance and debt facilities, as well as the issuance of 1,318,101 common shares of Major Drilling, valued on the closing of the transaction by the volume weighted average price of the shares on the TSX for the 10 trading days before the closing date. In addition, an earn-out of up to A$25 million will be payable in cash over the next three years, based on the achievements of certain milestones. In conjunction with this transaction, the Company has increased its credit facilities by $25 million effective June 7, 2021, to an aggregate of $105 million in order to maintain financial flexibility and capitalize on current market conditions.”

“Looking ahead to fiscal 2022, we continue to see a noticeable increase in inquiries from all categories of customers, and if their plans progress as advertised, we expect to see utilization rates continue to improve as crews become available.

Although the shortage of experienced drill crews will put temporary pressure on labour costs and productivity, especially in our most active markets, we expect the wider industry shortages and higher utilization rates to continue to drive a more positive pricing environment and expedite margin recovery as the cycle progresses. Further, as pandemic restrictions ease in South America, we expect to see an increase of activity as drilling programs resume in Chile and Argentina.” said Denis Larocque.

“With gold’s average mine life falling to a low of nearly 10 years due to the lack of exploration over the last 6 years, industry experts expect reserve replacement to be a top priority for gold companies for years to come. As well, although we have not seen much of an increase in activity from base metal players, copper prices have recently hit historical highs, which should also translate into more exploration activity in the near future as mining companies seek to replenish depleting reserves. At the same time, we have seen governments across the world unleashing significant stimulus programs targeting renewable energy and electric vehicles, which will require a huge volume of copper, as well as battery metals.”

(1) See “Non-IFRS Financial Measures”

(2) Net cash position (net of debt, excluding lease liabilities reported under IFRS16 Leases)

Fourth Quarter ended April 30, 2021

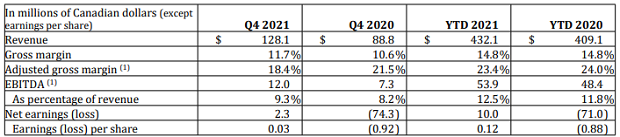

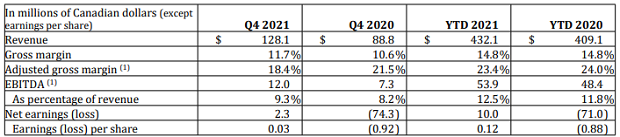

Total revenue for the quarter was $128.1 million, up 44% from revenue of $88.8 million recorded in the same quarter last year. The unfavourable foreign exchange translation impact on revenue for the quarter, when comparing to the effective rates for the same period last year, was approximately $8 million as the COVID-19 pandemic resulted in significant volatility in foreign exchange markets in the last quarter of the previous year. The impact on net earnings was minimal as expenditures in foreign jurisdictions tend to be in the same currency as revenue.

Revenue for the quarter from Canada - U.S. drilling operations increased by 80.5% to $74.2 million, compared to the same period last year. The strong growth was driven mainly by the Canadian operations as well as the U.S. underground division.

Demand for drilling services in Canada is the highest the Company has seen in eight years, primarily driven by gold projects.

South and Central American revenue increased by 46.8% to $32.6 million for the quarter, compared to the same quarter last year. Despite continued COVID-19 related challenges in some areas, the region’s growth was driven by increasing activity levels in Mexico.

Asian and African revenue decreased by 16.9% to $21.2 million, compared to the same period last year. Southern Africa and Mongolia faced challenges from COVID-19 that negatively impacted the region.

Gross margin percentage for the quarter was 11.7%, compared to 10.6% for the same period last year. Depreciation expense totaling $8.6 million is included in direct costs for the current quarter, versus $9.7 million in the same quarter last year.

Adjusted gross margin, which excludes depreciation expense, was 18.4% for the quarter, compared to 21.5% for the same period last year. Margins were impacted by increased training costs and significant ramp-up costs due to rapid growth in certain regions. There were also some COVID-19 related shutdowns in the quarter, which generated mobilization and demobilization costs, as well as additional standby labour costs to retain skilled drillers through the shutdown periods.

General and administrative costs were $12.5 million, an increase of $1.4 million compared to the same quarter last year. The increase relates to wage increases for the current year and, in the fourth quarter of the previous year, the Company recorded a benefit of $0.6 million related to the Canada Emergency Wage Subsidy program.

The income tax provision for the quarter was an expense of $0.3 million compared to an expense of $10.1 million for the prior year period. The significant decrease year-over-year was caused by the de-recognition of $10.0 million in deferred tax assets in the prior year quarter, as a result of the unknown impacts caused by COVID-19 at that time. The tax expense for the quarter was affected by the utilization of accelerated tax depreciation on the U.S. assets and U.S. tax losses carried back to years where the federal corporate tax rate was higher.

Net Income was $2.3 million or $0.03 per share ($0.03 per share diluted) for the quarter, compared to a net loss of $74.3 million or $0.92 per share ($0.92 per share diluted) for the prior year quarter. Net loss in the prior year quarter was affected by goodwill impairment, restructuring charge and deferred tax write-down totaling $71.2 million.

About Major Drilling

Major Drilling Group International Inc. is one of the world’s largest drilling services companies primarily serving the mining industry. Established in 1980, Major Drilling has over 1,000 years of combined experience and expertise within its management team alone. The Company maintains field operations and offices in Canada, the United States, Mexico, South America, Asia, Africa, and Australia. Major Drilling provides a complete suite of drilling services including surface and underground coring, directional, reverse circulation, sonic, geotechnical, environmental, water-well, coal-bed methane, shallow gas, underground percussive/longhole drilling, surface drill and blast, and a variety of mine services.

For further information:

Ian Ross, Chief Financial Officer

Tel: (506) 857-8636

Fax: (506) 857-9211

ir@majordrilling.com