Bold Ventures Inc.

Ring of Fire Exploration Project

Project Details – Ring of Fire

Bold’s Ring of Fire Project is comprised of claims held by Bold and claims held by Rencore Resources Ltd. (“Rencore”). Pursuant to a merger transaction concluded in February of 2012, Rencore became a wholly owned subsidiary of Bold Ventures.

Rencore holds 228 claim cells/boundary cells totalling approximately 10,910 acres or 4.415 hectares (the “Rencore Ring of Fire Claims”) covering airborne VTEM geophysical anomalies.

The Rencore Ring of Fire Claims are subject to an Option Agreement with a wholly owned subsidiary (2282726 Ontario Ltd.) of Dundee Corporation (“Dundee”) signed on May 31, 2011. Dundee will earn a 33.33% interest in Rencore’s Ring of Fire activities (“Rencore’s ROF Project”) by funding $2.5 million of exploration work. Upon completion of this option to earn-in, a joint venture will be formed between Dundee and Rencore giving Dundee the right to participate for up to 33.33% in Rencore’s ROF Project by funding its portion of the project’s budget (see Rencore Press Releases dated April 12, 2011 and May 31, 2011).

Bold holds 878 claim cells/boundary cells comprising approximately 16,789 hectares or approximately 41,486 acres (the “Bold Ring of Fire Claims”) covering airborne VTEM geophysical anomalies.

The Bold Ring of Fire Claims are subject to an Option Agreement with a wholly owned subsidiary (2282726 Ontario Ltd.) of Dundee Corporation (“Dundee”) signed on May 31, 2011. Dundee will earn a 33.33% interest in Bold’s Ring of Fire activities (“Bold’s ROF Project”) by funding $2.5 million of exploration work. Upon completion of this option to earn-in, a joint venture will be formed between Dundee and Bold giving Dundee the right to participate for up to 33.33% in Bold’s ROF Project by funding its portion of the project’s budget (see Bold Press Releases dated April 12, 2011 and May 31, 2011).

2282726 Ontario Limited has earned a 33 and 1/3 % interest in Bold’s Areas 55, 55E, 56 to 72 incl. A draft Joint Venture Agreement has been forwarded for review and execution.

Refer to Maps, Charts and Geology section (below) for the location map of our Ring of Fire claims.

It is Bold Ventures’ philosophy to systematically investigate underexplored areas using cutting edge technology in order to discover large size, economic mineral deposits. By getting to the drilling stage as rapidly as possible, the Company endeavours to maximize the opportunities for discovery on behalf of our shareholders.

Project Details – Koper Lake (Ring of Fire)

Property Description

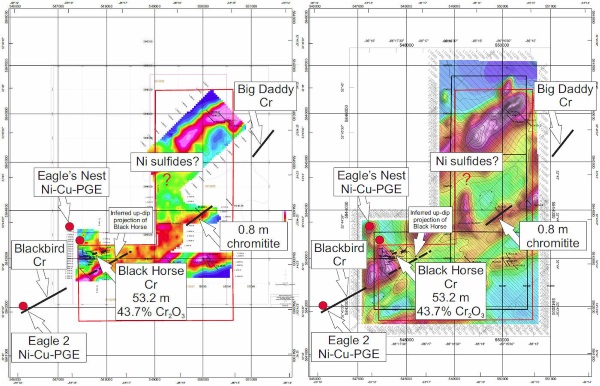

The Koper Lake Project consists of 4 claims totaling 64 units comprising approximately 1024 hectares or 2,529 acres hosting chromite and massive sulphide occurrences that have yet to be delineated. The Koper Lake Project is located centrally within the Ring of Fire and is described in an additional section of maps, charts and project details within this section of our website.

Option Agreement With Fancamp Exploration Ltd.

In May of 2012 Bold Ventures signed an option agreement with Fancamp Exploration Ltd. (“Fancamp”) to earn-in for up to 60% of the Fancamp Ring of Fire property (the “Koper Lake Project”). The Agreement calls for Bold Ventures to make option payments totalling $1,500,000 and to incur exploration expenditures on the property of at least $8,000,000 over a 3 year period. Upon fulfilling these optional terms, Bold Ventures will earn a 50% interest in the Koper Lake Project and a joint venture will be formed. A further 10% interest may be earned by Bold at any time by delivery of a positive feasibility study and by making a payment of $700,000 in cash and/or stock at the option of Bold Ventures.

Subsequently, in January of 2013 Bold signed an amendment agreement in order to allow it to earn up to a 100% working interest in the Koper Lake Project (the “Property”). The Amendment Agreement amends the terms of the Earn-In Option Agreement announced in the Company’s press release of May 7, 2012 to provide that once Bold has earned its 60% interest in the Koper Lake Project, it will then have two options for a period of 90 days following the date it earns its 60% interest. First, it can earn a further 20% interest in the Property by paying Fancamp $15,000,000 payable in equal instalments over three years with half of the amount payable in cash and the balance payable, at Bold’s option, through the issuance of common shares of Bold at the market price at the time the shares are issued with Fancamp retaining a carried interest (the “Carried Interest”) in the Koper Lake Project. If the first option is exercised, Bold would then have the additional option to acquire from Fancamp the Carried Interest in exchange for a Gross Metal Royalty (“GMR”) payable to Fancamp resulting in Bold holding a 100% interest in the Koper Lake Project. Fancamp would then be entitled to be paid 2% of the total revenue from the sale of all metals and mineral products from the Property from the commencement of Commercial Production. Once all of the capital costs to bring the Koper Lake Project to the production stage have been repaid entirely, the GMR may be scaled up to a maximum of 4% of the total revenue from the sale of all metals and mineral products from the Property depending upon the price of product sold from the Property.

Option Agreement With KWG Resources

In February of 2013 Bold announced the signing of a letter agreement (the “Agreement”) with KWG Resources Inc. (“KWG”). Under the terms of the Agreement, Bold acts as Operator of the exploration programs which are to be funded by KWG. KWG will also make the option payments due under the agreement with Fancamp Exploration Ltd. (“Fancamp”). Reference is made to the Press Releases dated May 7, 2012 and January 7, 2013 relating to the Koper Lake Project and the agreement with Fancamp (the “Fancamp Option”).

KWG can acquire up to 80% of Bold’s interest in chromite produced from the Koper Lake Project by funding 100% of the costs to a feasibility study leaving Bold and Bold’s Co‐Venturer with a 20% carried interest, pro rata. For nickel and other non‐chromite minerals identified during the exploration programs KWG would have a 20% participating interest and Bold and Bold’s Co‐Venturer would have an 80% participating interest, pro rata. KWG will have a right of first refusal to purchase all ores or concentrates produced by such joint venture whenever its interest in the joint venture exceeds 50%.

As Of October of 2016 Bold (and KWG) announced the successful completion of the first stage earn-in for 50% of the Koper Lake Project. Consequently, Bold has a 10% carried interest in the project and KWG, through it’s Option Agreement with Bold has acquired a 40% working interest in the property. KWG assumes the role of “Operator” for future programs related to the earn-in option.

Bold’s Co-Venturer

2282726 Ontario Limited (“Bold’s Co‐Venturer”), a subsidiary of Dundee Corporation, signed an Option Agreement with Bold to earn a 33‐1/3% interest in Bold’s Ring of Fire activities around the area of Bold’s Ring of Fire claims in Ontario (the “Bold ROF Project”) by funding $2.5 million of exploration work which has been completed. Reference is made to Bold’s Press Release dated May 31, 2011 for further particulars.

Once Bold’s Co‐Venturer earns its 33‐1/3% interest, a joint venture will be formed between Bold’s Co‐Venturer and Bold giving Bold’s Co‐Venturer the right to participate for up to 33‐1/3% in Bold’s ROF Project by funding its portion of the project’s budgets. The Koper Lake Project is within the Bold ROF Project.

The Project

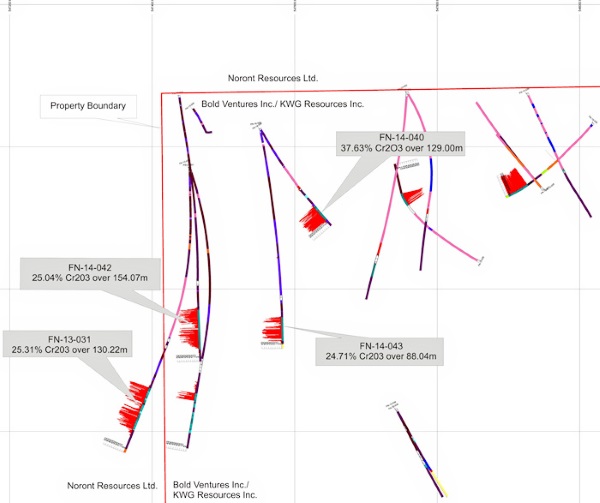

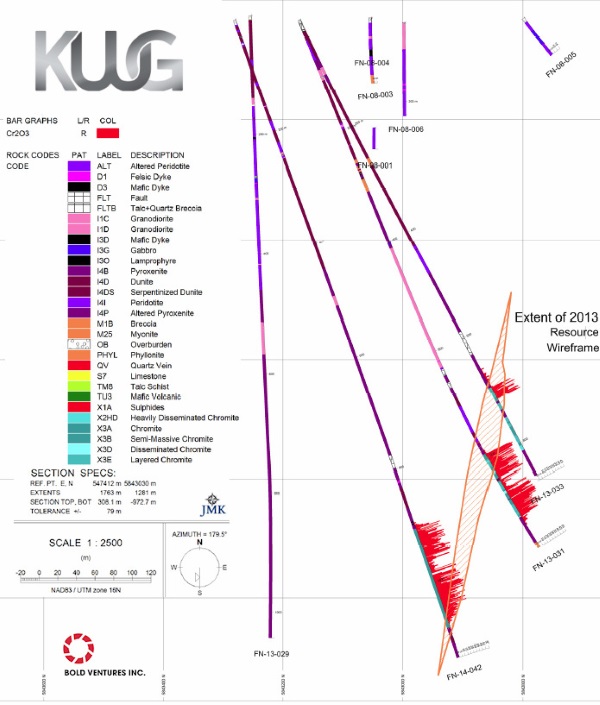

The joint venture property contains a known occurrence of massive chromite called the Black Horse occurrence. One drill hole intersected massive chromite interpreted to have a true thickness of approximately 35 to 55 m; the other intersected intercalated chromitite and peridotite beds followed by massive chromite over interpreted true thicknesses of 20 to 25 m and 20 m respectively (please refer to Fancamp press release dated December 27, 2011).

Composite samples taken at strictly regularly spaced intervals throughout the massive chromite intersections had average Cr2O3 grades of 43 and 45%, respectively. This occurrence was encountered at depths of approximately 850 m vertically below surface.

Diamond drilling in the spring of 2013 provided the basis for an initial 43-101 inferred resource of 85.9 million Tonnes of 34.5% Cr2O3 (see KWG news release dated July 20, 2015).

During 2015 and 2016 process tests and transportation studies were initiated by KWG with an eye towards carrying out a feasibility study of the Black Horse Chromite Resource.

Dr James E. Mungall, Ph.D., P.Eng., a professional geologist, has reviewed and approved the technical content of the information in this project description and qualifies under the definition of “Qualified Person” set out in National Instrument 43-101.

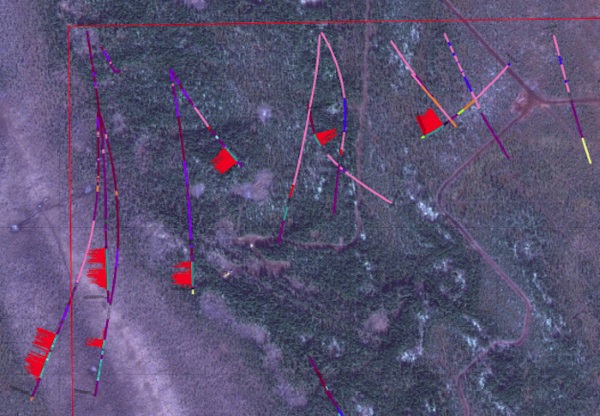

Maps, Charts and Geology

Source: https://www.boldventuresinc.com/exploration-projects/ring-of-fire-ontario/