Platinum group metals (PGMs) are rare precious metals with unique physical properties that are used in diverse industrial applications and in jewellery. Palladium, like gold, silver and platinum, is a precious metal, as well as one of the six PGMs, which also include platinum, rhodium, ruthenium, iridium and osmium.

The unique physical characteristics of PGMs include:

• Strong catalytic properties;

• Excellent conductivity and ductility;

• High level of resistance to corrosion;

• Strength and durability; and

• A high melting point.

Demand for palladium is diversified by geography and end market. Palladium is primarily used in the manufacture of catalytic converters in the automotive industry, as well as in the manufacture of jewellery and electronics, and in dental and chemical applications. As a precious metal, there is also investment demand for palladium in the form of doré bars, generally held as physical inventory by exchange traded funds (ETFs) and institutional investors.

Palladium is typically produced as a by-product metal from either platinum mines in South Africa (approximately 38% of world mine production) or Norilsk Nickel’s mines in Russia (approximately 41% of world mine production). North America contributes approximately 14% to the world’s supply of palladium, where the Company’s LDI mine is one of only two primary producers of palladium in the world.

Palladium is currently trading at the highest levels since 2001 and is projected to remain strong through 2017 as the supply deficit is expected to persist in the future. The outlook for palladium over the next ten years predicts a return to historically high prices, strong fabrication and investment demand, and constrained supply. Accordingly, the Company believes that its plans to optimize and expand its palladium operations are well timed in the commodity’s cycle.

Supply

The two main sources of palladium supply are mine production and secondary recovery. In 2012, approximately 8.7 million ounces of palladium were supplied to the market, of which approximately 6.3 million ounces came from mine supply, and 2.4 million ounces from secondary recovery.

As a rare precious metal, there are very few palladium producing regions worldwide and few known economically viable ore bodies. Russia and South Africa, which are known to be higher-risk jurisdictions, account for almost 80% of global mine palladium production.

Growth in mine supply is constrained, largely owing to:

• Political, infrastructure and cost issues in South Africa;

• Declining palladium production in Russia; and

• There is limited number of new projects on the horizon in the near term.

In particular, South African production is challenged by deeper mines, power and water limitations, higher operating costs, geopolitical risks, shortage of skilled labour, and the strengthening of currencies. There do not appear to be any near-term solutions in place, and the South African PGM mining industry has already started to contract with over 250,000 ounces of palladium lost in 2012 directly resulting from shutting down operations due to labour unrest. These problems are expected to continue to affect PGM miners, and coupled with rising mining cash costs, will likely limit palladium supply from South Africa.

Secondary supply is derived from recycling (which is estimated to have contributed approximately 2.2 million ounces in 2012), and from a Russian government stockpile. There has been considerable speculation about the current holdings of the Russian government’s palladium stockpile, which historically has been an overhang on the market. While this remains a state secret, credible forecasters have recently indicated the state stockpile has declined to relatively low levels and will no longer be a significant contributor to the palladium market going forward. This has resulted in a substantial deficit.

Demand

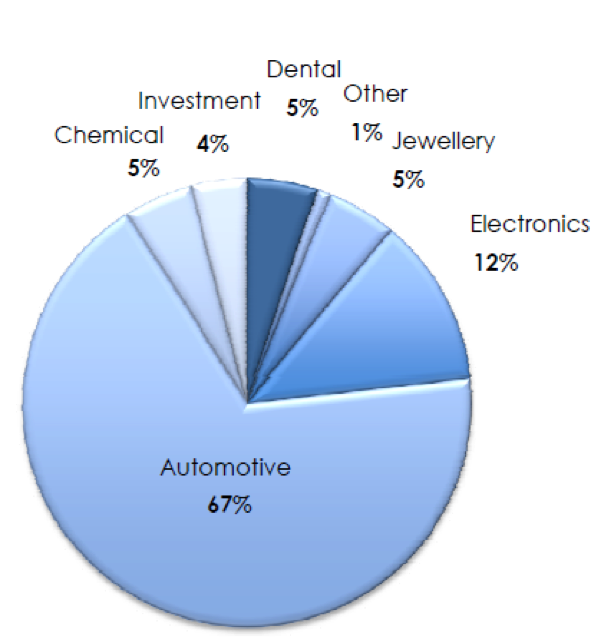

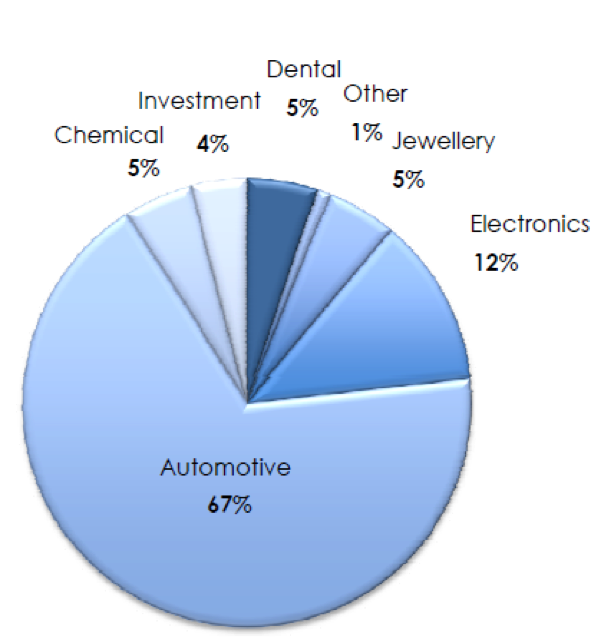

Demand for palladium continues to grow, driven primarily by the automotive sector which consumes approximately 67% of world palladium supply for the manufacture of catalytic converters (also referred to as mufflers) in cars which help reduce toxic emissions into the environment.

The demand for palladium in the automotive industry has more than doubled in the last ten years due to an increase in global automotive production and the tightening of emissions standards worldwide, resulting in steady growth in the use of catalytic converters.

The primary driver of growth in the automotive sector is from the emerging economies – China, India, Brazil, and Russia (“BRIC”) – where there is emerging affluence, very low penetration of vehicles per capita, and the affordability factor is high due to low interest rates and leasing programs.

Key factors affecting demand include:

• Increasing vehicle production: Light global vehicle production is forecasted to increase at a compound annual growth rate of 4% to over 100 million units by 2017, with most of that growth driven by the BRIC economies – which are forecasted to lead the growth in the automobile market.

• Stricter emission controls that mandate the use of catalytic converters;

• Technological advancements for palladium’s use in diesel catalytic converters, which can now substitute about 30% of its platinum content with palladium; and

• The recent growth in palladium exchange traded funds (ETFs) which have significantly contributed to the increased investment demand.